Church & Dwight's Q2 2025 Earnings: What to Expect

Ewing, New Jersey-based Church & Dwight Co., Inc. (CHD) develops, manufactures, and markets household, personal care, and specialty products. Valued at $23.9 billion by market cap, the company offers contraceptive products, laundry and dishwashing detergents, toothbrushes, shampoos, vitamins, pregnancy test kits, and hair removers. The leading U.S. producer of sodium bicarbonate is expected to announce its fiscal second-quarter earnings for 2025 before the market opens on Friday, Aug. 1.

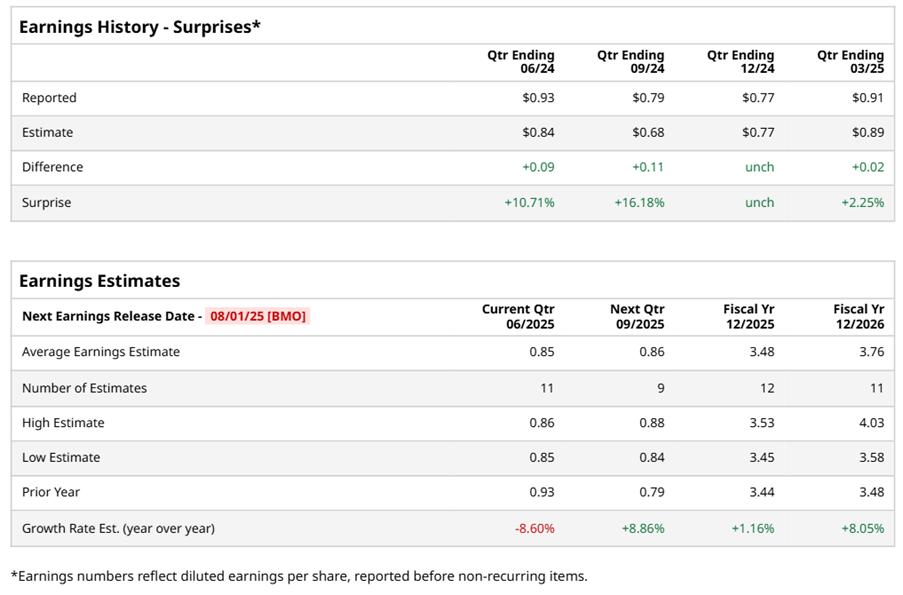

Ahead of the event, analysts expect CHD to report a profit of $0.85 per share on a diluted basis, down 8.6% from $0.93 per share in the year-ago quarter. The company has met or surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CHD to report EPS of $3.48, up 1.2% from $3.44 in fiscal 2024. Similarly, its EPS is expected to rise 8.1% year over year to $3.76 in fiscal 2026.

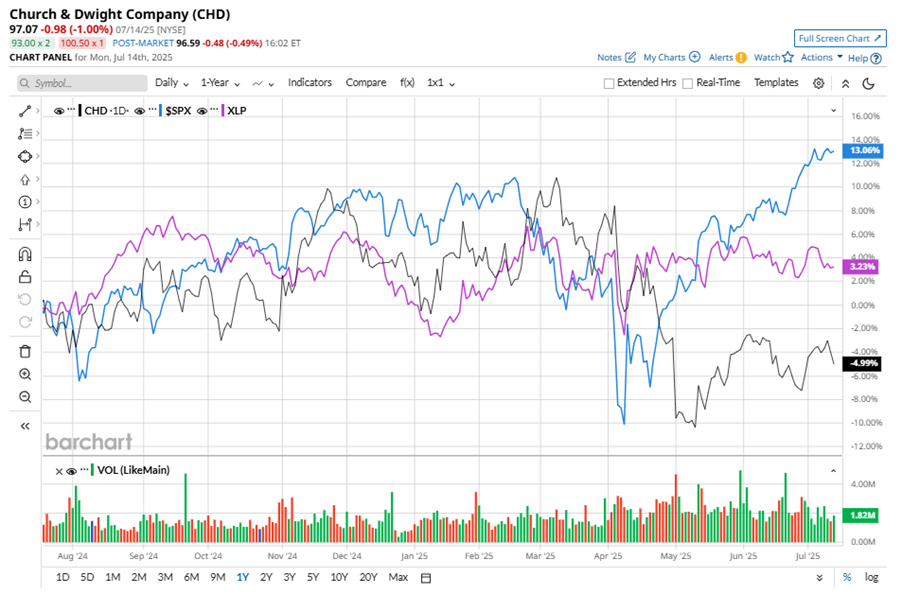

CHD stock has underperformed the S&P 500 Index’s ($SPX) 11.6% gains over the past 52 weeks, with shares down 6.8% during this period. Similarly, it underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.4% gains over the same time frame.

On May 1, CHD shares closed down more than 7% after reporting its Q1 results. Its adjusted EPS of $0.91 topped Wall Street expectations of $0.89. The company’s revenue was $1.47 billion, missing Wall Street forecasts of $1.51 billion. For Q2, CHD expects its adjusted EPS to be $0.85.

Analysts’ consensus opinion on CHD stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 21 analysts covering the stock, nine advise a “Strong Buy” rating, one suggests a “Moderate Buy,” eight give a “Hold,” and three recommend a “Strong Sell.” CHD’s average analyst price target is $104.39, indicating a potential upside of 7.5% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English