What You Need to Know Ahead of Chevron's Earnings Release

Chevron Corporation (CVX), headquartered in Houston, Texas, integrates energy and chemicals operations. With a market cap of $271.2 billion, the company produces and transports crude oil and natural gas, as well as refines, markets, and distributes fuels worldwide. The oil giant is expected to announce its fiscal second-quarter earnings for 2025 before the market opens on Friday, Aug. 1.

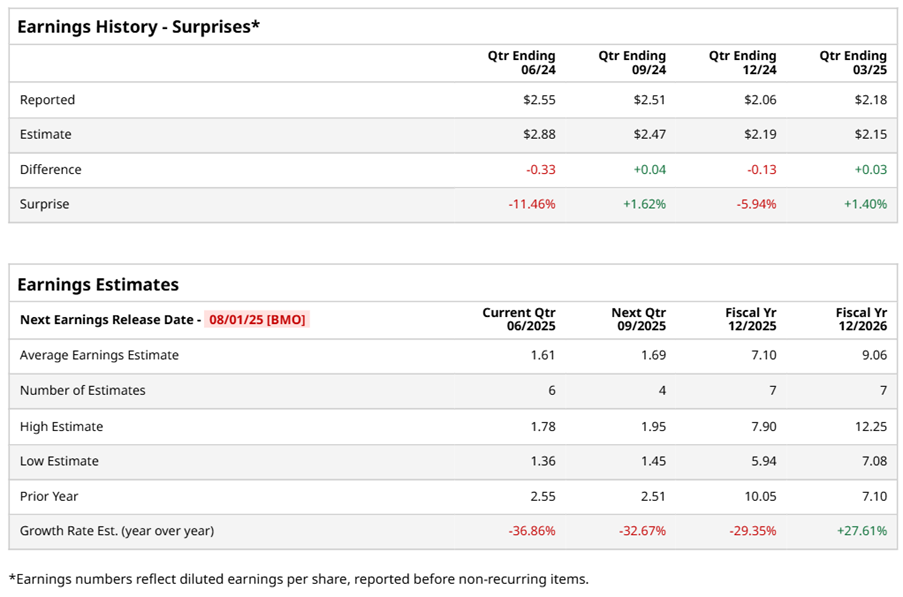

Ahead of the event, analysts expect CVX to report a profit of $1.61 per share on a diluted basis, down 36.9% from $2.55 per share in the year-ago quarter. The company surpassed the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect CVX to report EPS of $7.10, down 29.4% from $10.05 in fiscal 2024. However, its EPS is expected to rise 27.6% year-over-year to $9.06 in fiscal 2026.

CVX stock has underperformed the S&P 500 Index’s ($SPX) 11.6% gains over the past 52 weeks, with shares down 2.5% during this period. However, it slightly outperformed the Energy Select Sector SPDR Fund’s (XLE) 2.6% decline over the same time frame.

Chevron's struggles can be attributed to a combination of factors, including operational restrictions in Venezuela, fluctuating crude oil prices, geopolitical uncertainties, regulatory restrictions, and cost pressures. Additionally, ongoing disputes with Exxon Mobil Corporation (XOM) over a potential merger with Hess Corporation’s (HES) Guyana project have further complicated the situation, ultimately impacting the company's earnings and profitability.

On May 2, CVX shares closed up more than 1% after reporting its Q1 results. Its adjusted EPS of $2.18 beat Wall Street expectations of $2.15. The company’s revenue was $47.6 billion, falling short of Wall Street forecasts of $48.7 billion.

Analysts’ consensus opinion on CVX stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 22 analysts covering the stock, 11 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” six give a “Hold,” and two recommend a “Strong Sell.” CVX’s average analyst price target is $160.86, indicating a potential upside of 6.1% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English