BRO Outperforms Industry, Trades at Premium: How to Play the Stock

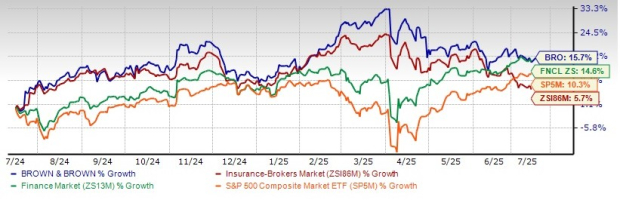

Shares of Brown & Brown, Inc. BRO have gained 15.7% in the past year, outperforming its industry, the Finance sector and the Zacks S&P 500 composite’s return.

The insurer has a market capitalization of $35.61 billion. The average volume of shares traded in the last three months was 3.1 million.

Image Source: Zacks Investment Research

Earnings have grown 21.5% in the past five years, better than the industry average of 15.2%. Brown & Brown's bottom line outpaced estimates in three of the trailing four quarters and missed in one, the average surprise being 6.35%.

BRO Shares are Expensive

BRO shares are trading at a premium to the industry. Its price-to-forward 12-months earnings of 24.53X is higher than the industry average of 21.24X. Shares of other insurers like Arthur J. Gallagher & Co. AJG and Marsh & McLennan Companies, Inc. MMC are trading at a multiple higher than the industry average, while shares of Willis Towers Watson Public Limited Company WTW are trading at a discount to the industry average.

Image Source: Zacks Investment Research

BRO’s Encouraging Growth Projection

The Zacks Consensus Estimate for Brown & Brown’s 2025 earnings per share indicates a year-over-year increase of 8.8%. The consensus estimate for revenues is pegged at $5.20 billion, implying a year-over-year improvement of 8.1%. The consensus estimate for 2026 earnings per share and revenues indicates an increase of 9.9% and 7.9%, respectively, from the corresponding 2025 estimates.

The Zacks Consensus Estimate for 2025 and 2026 moved 0.2% and 1.3% north, respectively, in the last 30 days.

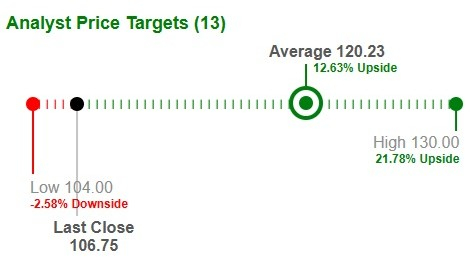

Average Target Price for BRO Suggests Upside

Based on short-term price targets offered by 13 analysts, the Zacks average price target is $120.23 per share. The average suggests a potential 12.6% upside from the last closing price.

Image Source: Zacks Investment Research

Factors Impacting BRO

Commissions and fees, the main component of the top line, benefit from increasing new business, strong retention and continued rate increases for most lines of coverage. The company met its intermediate annual revenue goal of $4 billion, doubling in the last five years.

The insurance broker continually makes investments in boosting organic growth and margin expansion. It has an industry-leading adjusted EBITDAC margin.

Brown & Brown’s strategic buyouts help it capitalize on growing market opportunities, strengthen its compelling products and service portfolio, expand global reach and accelerate its growth rate. The insurance broker completed 32 acquisitions during the year ended Dec. 31, 2024, and continued to build relationships with many other companies. From 1993 through the first quarter of 2025, Brown & Brown acquired 687 insurance intermediary operations. The Quintes buyout was the largest transaction in 2024.

Banking on operational expertise, BRO boasts a strong liquidity position with an improving leverage ratio. The strength of its operating model and diversity of businesses ensures strong cash conversion. The company effectively deploys cash into acquisitions, capital expenditure and wealth distribution for shareholders via dividend increases.

BRO has an impressive dividend history. The strong capital position enables Brown & Brown to distribute wealth to shareholders via dividend increases. For dividend payments, the company has increased dividends for the last 30 years at a five-year (2019-2024) CAGR of 8.7%.

End Notes

New business, strong retention, rate increases, strategic buyouts and impressive dividend history poise the company well for growth. Favorable growth estimates and positive analyst sentiment are other positives. A robust capital position over the years reflects its financial flexibility.

However, given its premium valuation, it is better to wait for some more time before taking a call on this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC): Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English