Here's What to Expect From McDonald's Next Earnings Report

Chicago, Illinois-based McDonald's Corporation (MCD) owns, operates, and franchises restaurants under the McDonald's brand in the United States and internationally. With a market cap of $215.9 billion, the company is one of the biggest fast-food chains in the world. The fast-food titan is expected to announce its fiscal Q2 2025 results before the market opens on Wednesday, Aug. 6.

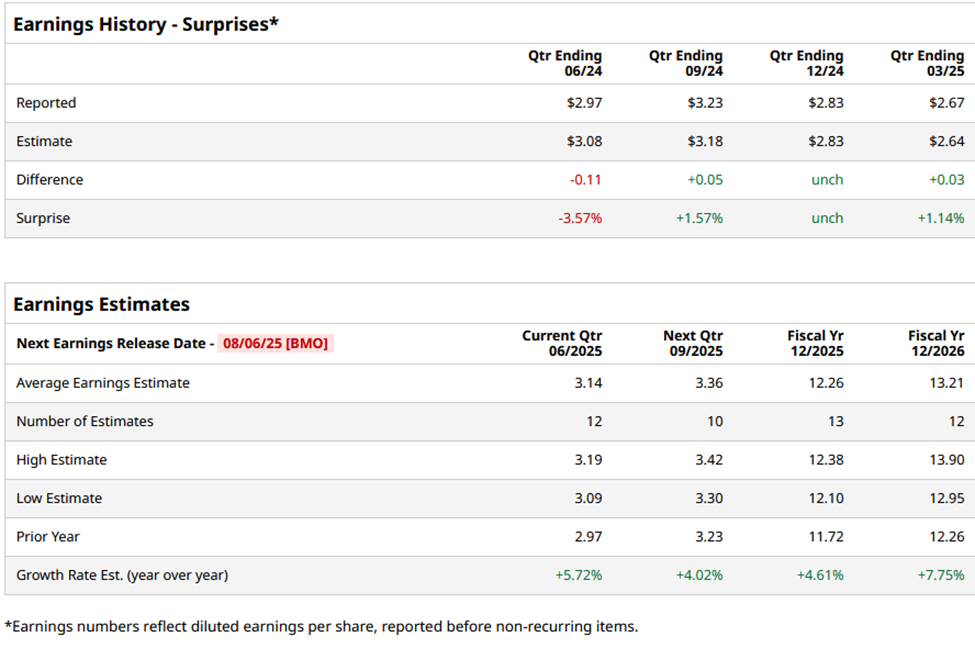

Ahead of the event, analysts expect MCD to report an adjusted EPS of $3.14, up 5.7% from $2.97 in the year-ago quarter. The company beat or matched the consensus estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect MCD to report adjusted EPS of $12.26, an increase of 4.6% from $11.72 in fiscal 2024. Moreover, its adjusted EPS is expected to rise 7.8% year-over-year to $13.21 in fiscal 2026.

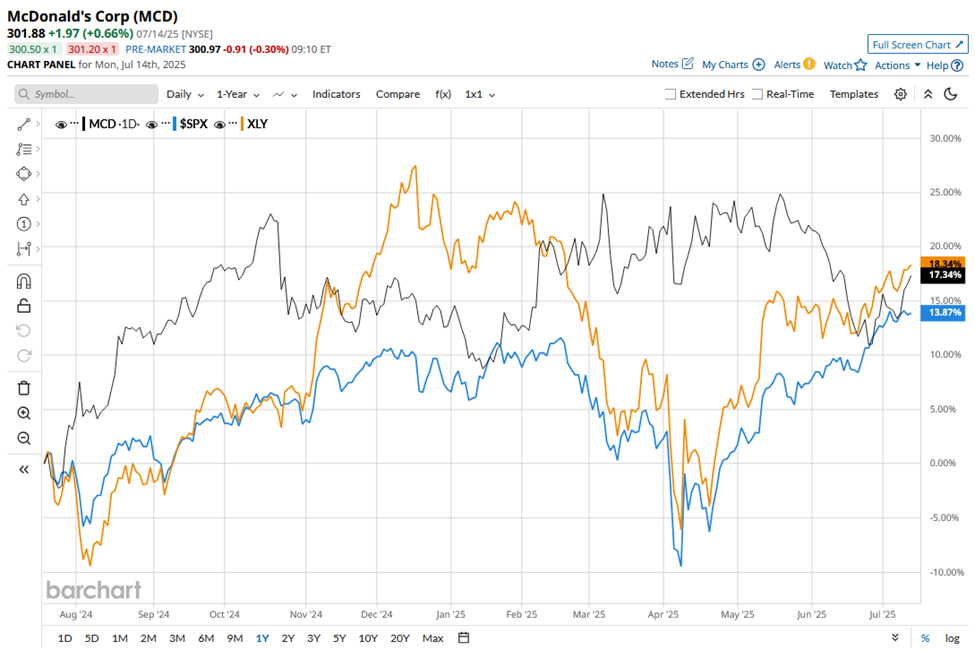

Over the past year, MCD shares have surged 19.7%, outperforming the S&P 500’s ($SPX) 11.6% rise and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 16.2% gain over the same time frame.

MCD shares fell 1.9% following the release of its Q1 2025 earnings on May 1. The world's biggest hamburger chain posted revenue of $5.96 billion in the period, falling short of Street forecasts. However, the company reported adjusted EPS of $2.67, beating the consensus estimate by 1.1%.

Analysts’ consensus opinion on MCD stock is moderately optimistic, with an overall “Moderate Buy” rating. Out of 33 analysts covering the stock, 14 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 17 suggest a “Hold,” and one recommends a “Strong Sell.”

The stock’s average analyst price target is $333.25, indicating a 10.4% potential upside from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English