What to Expect From Hologic's Q3 2025 Earnings Report

Marlborough, Massachusetts-based Hologic, Inc. (HOLX) develops, manufactures, and supplies diagnostics products, medical imaging systems, and surgical products for women's health, focusing on early detection and treatment worldwide. With a market cap of $14.4 billion, the company operates through four segments: Diagnostics, Breast Health, GYN Surgical, and Skeletal Health.

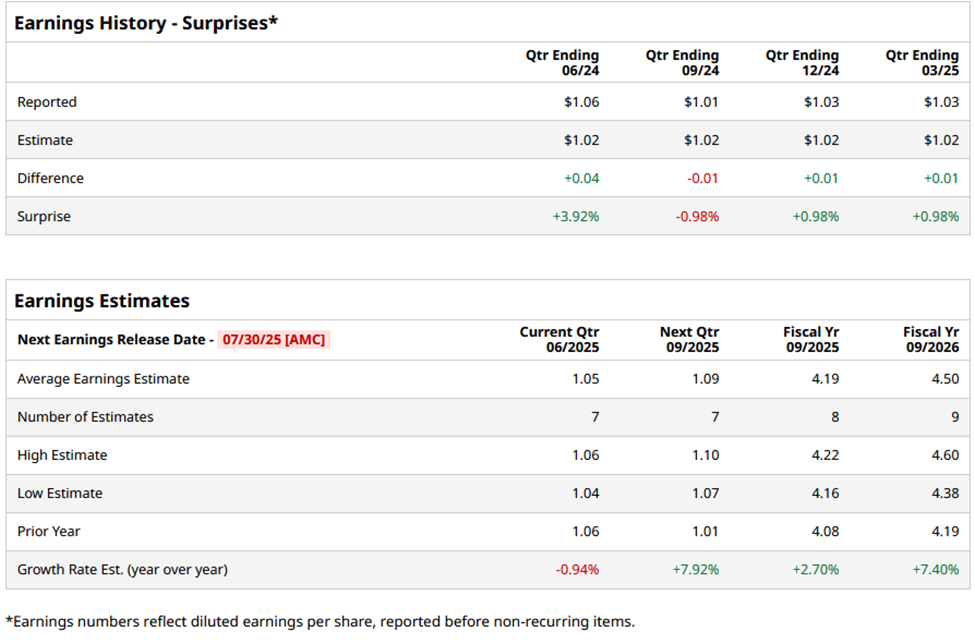

HOLX is all geared up for its fiscal Q3 2025 results after the market closes on Wednesday, Jul. 30. Before this event, analysts project this company to report an adjusted EPS of $1.05, down marginally from $1.06 in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in three of the last four quarters, while falling short in one quarter.

For fiscal 2025, analysts expect HOLX to report an adjusted EPS of $4.19, representing a 2.7% year-over-year increase from $4.08 in fiscal 2024. Moreover, in fiscal 2026, the company’s adjusted EPS is expected to increase 7.4% year-over-year to $4.50.

HOLX stock has declined 16.8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 11.6% gain and the Health Care Select Sector SPDR Fund’s (XLV) 8.6% decline over the same time frame.

On May 1, HOLX stock dropped 1.6% following the release of its Q2 2025 results. The company’s revenue declined 1.2% year-over-year, primarily due to a decrease in breast health revenue resulting from lower sales of mammography capital equipment. Moreover, its adjusted EPS for the quarter came in at $1.03, surpassing the consensus estimates marginally.

Analysts are moderately optimistic about HOLX’s stock, with an overall "Moderate Buy" rating. Among 19 analysts covering the stock, six recommend "Strong Buy," one suggests a “Moderate Buy,” and 12 advise “Hold.” The mean price target of $68.67 indicates a 6.3% potential upside from HOLX’s current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English