Here's What to Expect From SBA Communications' Next Earnings Report

With a market cap of around $25 billion, SBA Communications Corporation (SBAC), based in Boca Raton, Florida, is a leading independent owner and operator of wireless communications infrastructure, including towers, buildings, rooftops, distributed antenna systems (DAS), and small cells.

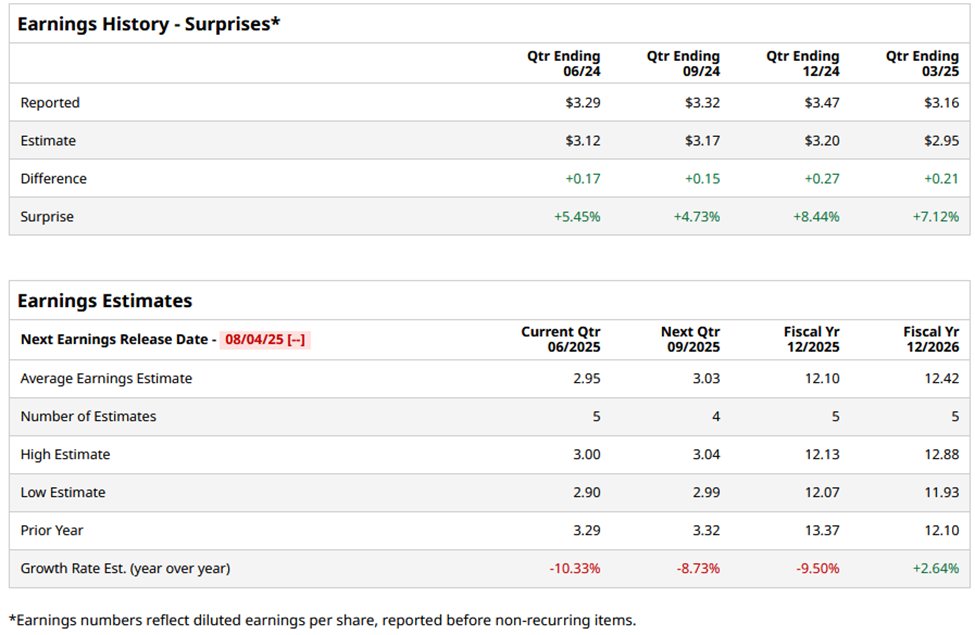

SBAC is scheduled to report its Q2 earnings on Monday, Aug. 4. Ahead of the event, analysts expect the company to report an AFFO of $2.95 per share, down 10.3% from $3.29 per share in the same quarter of the previous year. The company has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts expect SBAC to report an AFFO of $12.10 per share, down 9.5% from $13.37 in fiscal 2024. However, the AFFO is expected to rise 2.6% year-over-year to $12.42 per share in fiscal 2026.

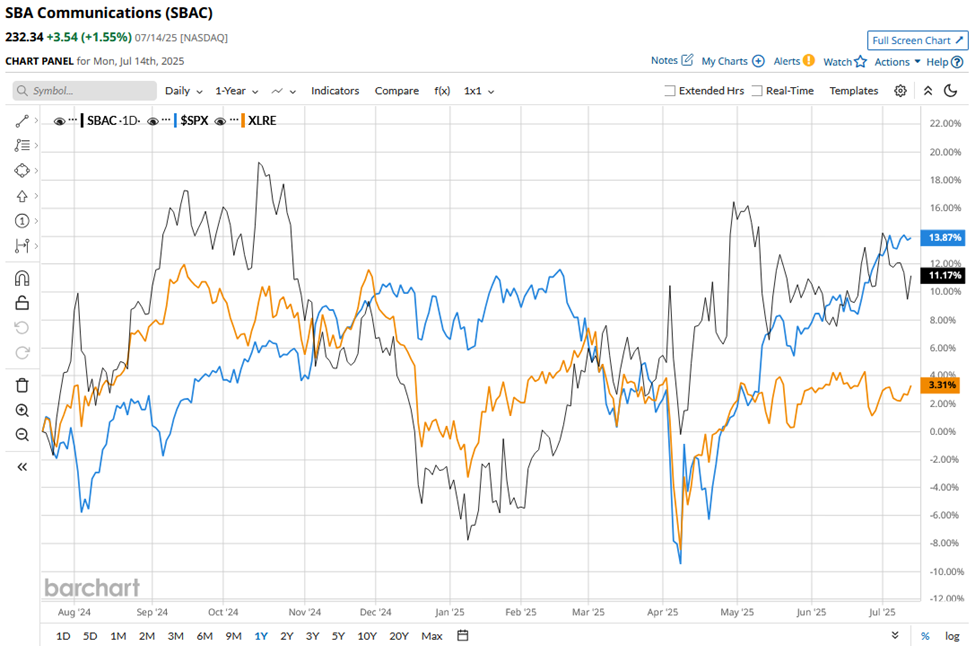

SBAC stock has risen 9.2% over the past 52 weeks, outperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 4.1% surge. Nevertheless, the stock has lagged behind the S&P 500 Index’s ($SPX) 11.6% return during the same time frame.

On Apr. 28, SBAC shares rose marginally following the release of its Q1 earnings. The company reported steady performance with revenue rising 1% year-over-year to $664.2 million, slightly beating the Street’s estimates. Its AFFO per share was $3.18, down from $3.29 last year, but it successfully beat the Street’s expectations by 7.1%.

Wall Street analysts are cautiously optimsitic about SBAC’s stock, with an overall "Moderate Buy" rating. Among 19 analysts covering the stock, nine recommend "Strong Buy," one suggests a “Moderate Buy,” and nine suggest a “Hold.” As of writing, the stock is trading below the average analyst price target of $253.28.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English