Alexandria Secures Lease at Its Megacampus in San Diego

Alexandria Real Estate Equities, Inc. ARE secured the largest life science lease in its 31 years of history by signing a 16-year lease agreement with a longtime multi-national pharmaceutical tenant. The lease for this build-to-suit research hub spans over 466,598 rentable square feet (RSF) of space located at Campus Point by Alexandria Megacampus in the University Town Center submarket of San Diego.

This lease highlights the demand for Alexandria's premier location for life science innovation in San Diego.

The construction of this development project, aimed at achieving 100% electrification along with LEED Gold Core & Shell and Fitwel certifications, is set to begin in 2026, with an expected completion in 2028. This high-performance laboratory facility emphasizes energy efficiency and minimizes water consumption, alongside focusing on the health and wellness of its occupants. Its distinctive design incorporates natural light, optimizes shared spaces to encourage connectivity and includes a spacious terrace that functions as a central gathering area, seamlessly integrating indoor and outdoor spaces.

In 1994, Alexandria took the lead in life science real estate with its founding and first acquisition in San Diego. Since the acquisition of its first Campus Point property in 2010, the company has been carefully aggregating, designing, entitling, developing and transforming assets to create an irreplicable Megacampus ecosystem featuring a solid and diverse tenant base, which drives high-quality long-term cash flows.

As of June 30, 2025, Campus Point comprises 1.3 million RSF in operation and is 98.8% occupied. With nearly 1.3 million RSF of additional future development and redevelopment opportunities, this Megacampus could potentially expand to about 2.6 million RSF, reflecting 420% growth in its scale from the initial acquisition.

The campus is well-positioned to provide tenants with crucial expansion space and an enhanced amenity experience, which aids in recruiting and retaining mission-critical talent to foster next-generation innovations.

Alexandria in a Snapshot

Alexandria is the preeminent, longest-tenured and pioneering owner, operator and developer of collaborative Megacampus ecosystems in AAA life science innovation cluster locations, including Greater Boston, the San Francisco Bay Area, San Diego, Seattle, Maryland, Research Triangle and New York City.

Alexandria caters to a diversified tenant base comprising high-quality companies ranging from multinational pharmaceutical companies, public and private biotechnology companies, manufacturers of complex medicines and top-tier investment-grade companies and institutions as well as technology entities. However, with a substantial concentration of companies belonging to the life science and technology industries, Alexandria’s performance remains susceptible to any changes within these industries.

The company’s substantial active development and redevelopment pipeline, although encouraging for long-term growth, exposes it to the risk of rising construction costs and lease-up concerns amid macroeconomic uncertainty.

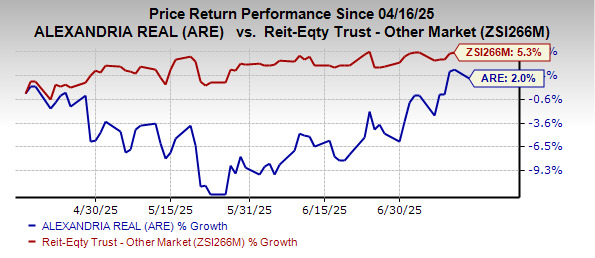

In the past three months, shares of this Zacks Rank #5 (Sell) company have gained 2% compared with the industry's rise of 5.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector include SBA Communications SBAC and American Tower AMT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for SBAC’s 2025 FFO per share has moved 3 cents northward to $12.74 over the past two months.

The Zacks Consensus Estimate for AMT’s 2025 FFO per share has moved 2 cents northward to $10.55 over the past week.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Tower Corporation (AMT): Free Stock Analysis Report

SBA Communications Corporation (SBAC): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English