Eaton (ETN) Partners With NVIDIA To Revolutionize AI Data Center Power Infrastructure

Eaton (ETN) recently established a partnership with NVIDIA to enhance AI data centers, focusing on HVDC power infrastructure. This collaboration underscores Eaton's strategic alignment with advancing technology infrastructure and power solutions. Over the last quarter, Eaton’s stock price surged by 30%, supported by strong earnings results, which showcased increased sales and income alongside positive corporate guidance. The company’s proactive approach, reflected in its market and product developments, resonated amid a robust tech sector environment, as seen in Nvidia's impact on tech stocks, potentially adding weight to Eaton's stock price performance amid broader market movements.

Every company has risks, and we've spotted 2 risks for Eaton you should know about.

The recent collaboration between Eaton and NVIDIA to enhance AI data centers could significantly influence Eaton’s narrative around expanding its data center market footprint. The partnership aligns with Eaton's acquisition of Fibrebond to capitalize on data center growth, reinforcing its strategy in power infrastructure innovation. This move may drive sustained revenue increments, supported by emerging market strategies and an increased construction backlog, particularly in Electrical Americas.

Over the past five years, Eaton's shares have delivered a very large total return of 326.13%, marking a robust performance trajectory for stakeholders. However, Eaton underperformed the broader US Electrical industry, which saw a return of 31.6% over the last year. The strong returns over a longer term suggest a solid foundation, although recent comparative performance indicates areas of potential improvement amidst competitive sector challenges.

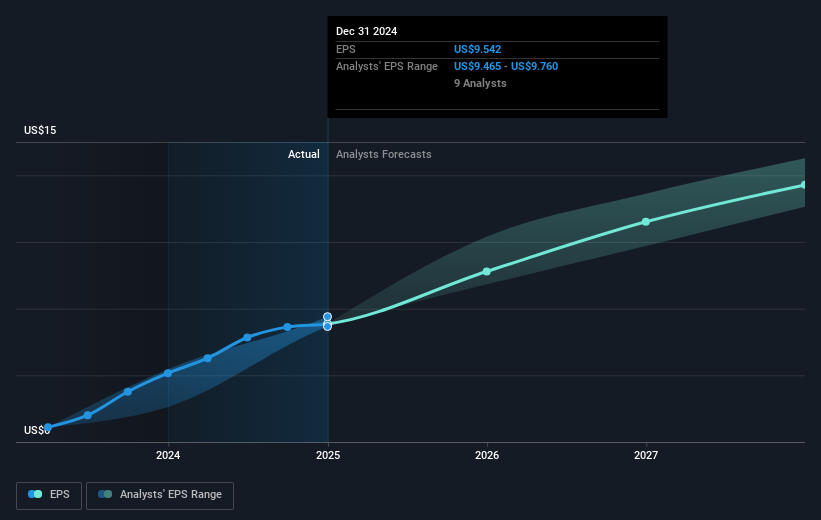

The Eaton-NVIDIA partnership might provide impetus for future revenue and earnings forecasts, as analysts currently project an annual revenue growth of 8.4% over the next three years. With earnings expected to grow to $5.6 billion by 2028, this partnership could aid in reaching these ambitious targets. As of now, Eaton's share price sits at US$360.29, slightly below the price target of US$362.99, suggesting limited immediate upside. This modest discount to the target signifies market expectations aligned with current valuations but highlights the potential for growth contingent on successful execution of strategic initiatives.

Evaluate Eaton's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English