Ingersoll Rand (IR) Appoints Experienced Leader Aurobind Satpathy to Board of Directors

Ingersoll Rand (IR) recently appointed Aurobind Satpathy to its Board of Directors, a move reflecting its focus on enhancing innovation and sustainable growth. The company's stock price rose by 20% over the last quarter, aligning with broader market trends, where major indices recorded mixed performances amid inflation data and tech rallies. Despite a slight decline in first-quarter net income, the company continued to engage shareholders with a dividend payout and an augmented buyback plan. As financial institutions faced mixed earnings results, Ingersoll Rand's strategic board enhancement seemingly added weight to its robust stock performance.

We've identified 1 weakness for Ingersoll Rand that you should be aware of.

The recent appointment of Aurobind Satpathy to Ingersoll Rand's Board highlights the company's focus on innovation and growth, aligning with its narrative of leveraging strategic acquisitions and cost efficiencies. Over the past five years, the company's total shareholder return, including share price and dividends, was 181.29%, indicating strong long-term performance. However, over the past year, Ingersoll Rand underperformed both the US Machinery industry and the overall US market in terms of return.

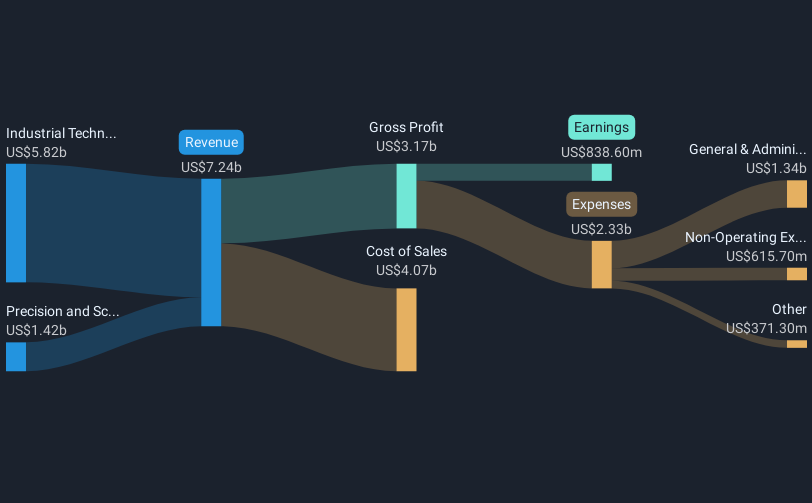

The inclusion of new board talents could influence the projected revenue and earnings growth forecasted by analysts, who anticipate annual growth rates of 5.3% and potential earnings reaching US$1.3 billion by 2028. This ambition aligns with ongoing efforts to bolster earnings per share through a US$2 billion share repurchase strategy, aiming to sustain shareholder value amid a challenging economic landscape.

Despite the recent 20% rise in the company's stock price over the past quarter, the current share price of US$87.64 remains slightly below the consensus analyst price target of US$91.48. This price target implies a moderate potential for appreciation, taking into account Ingersoll Rand's projected earnings growth and PE ratio estimates. Investors may consider this alignment as an indication of confidence in the company’s forward strategy, although potential risks in pricing approaches and integration of acquisitions remain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English