ANET Rides on Solid Momentum in Data Center Vertical: Will It Persist?

Arista Networks, Inc. ANET is witnessing healthy demand across key verticals, including cloud, AI-focused data centers, and campus enterprises. The company boasts a strong presence in the hyperscale AI networking domain with its comprehensive portfolio of Etherlink switches, CloudVision. It offers one of the broadest ranges of datacenter and campus Gigabit Ethernet switches (1/2.5/5/10/25/40/50/100/400) and routers in the industry. The company’s routing and switching platforms offer industry-leading capacity, low latency, port density and power efficiency.

Per a report from Grand View Research, the AI data center market is projected to reach $60.49 billion in 2030 from $13.62 billion in 2025, exhibiting a compound annual growth rate of 28.3%. The hyperscale data center is the largest component in this sector and will continue to be a major driving factor in the upcoming years. Prominent organizations such as Google, Amazon, and Microsoft are rapidly investing in hyperscale datacenters to support complex AI tasks. Networking solutions have become a key enabler for high-performance AI applications. Arista is undertaking various initiatives to capitalize on this emerging market trend.

The company recently introduced multiple AI-powered enterprise solutions to provide next-generation switching, Wi-Fi 7 access points and WAN capabilities. Its new switching and wireless portfolio includes a compact, fanless 12-port PoE switch engineered to support remote office and branch deployments. The new durable Wi-Fi 7 access point, the O-435, is engineered to operate in hostile and outdoor environments. It has also expanded the capabilities of Arista CloudVision AGNI. It can now effectively support on-prem deployment, maintain compliance and ensure secure access for users, devices, and applications. Such a strong focus on innovation augurs well for its long-term growth.

How Are Competitors Faring?

Arista faces stiff competition in cloud networking solutions, particularly in the 10-gigabit Ethernet and above. Cisco Systems CSCO is the dominant player in the data center networking market by virtue of its diverse portfolio of IP-based networking products. Cisco Systems is expanding its AI portfolio for data centers with new solutions like the Unified Nexus Dashboard, Cisco Intelligent Packet Flow, configurable AI PODs and 400G bidirectional (BiDi) optics. Its data center switching orders jumped double digits year over year in the fiscal third quarter.

Apart from Cisco, Arista faces significant competition from Hewlett-Packard Enterprise HPE. The company recently completed the acquisition of Juniper Networks. The strategic move involves integrating Juniper's comprehensive range of cloud-based networking solutions, software and services, including Mist AI, with HPE Aruba Networking and HPE AI interconnect. It will accelerate the development of secure, unified networking solutions optimized for hybrid cloud and AI. The buyout will also better equip HPE to fend off the growing competition from other industry leaders.

ANET’s Price Performance, Valuation and Estimates

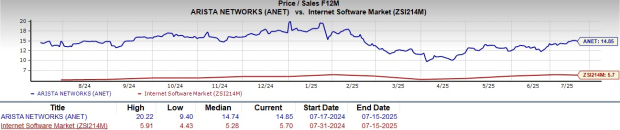

Arista has increased 19.9% over the past year compared with the industry’s growth of 37.3%.

Image Source: Zacks Investment Research

From a valuation standpoint, Arista trades at a forward price-to-sales ratio of 14.85, above the industry.

Image Source: Zacks Investment Research

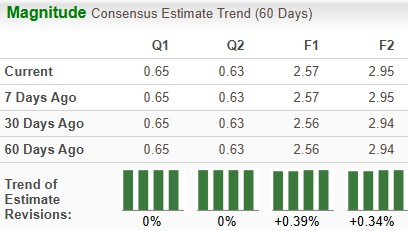

The Zacks Consensus Estimate for Arista’s earnings for 2025 has increased over the past 60 days.

Image Source: Zacks Investment Research

Arista currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English