Hewlett Packard Enterprise (HPE) Enhances Leadership With Elliott Partnership and New Board Strategy

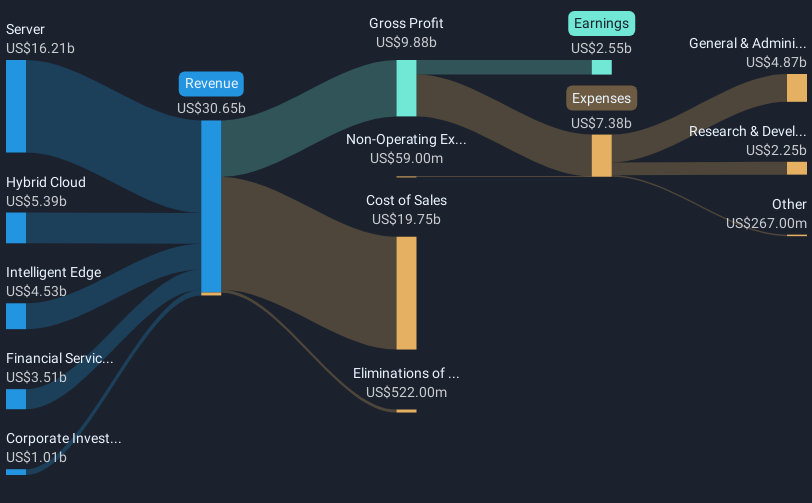

Hewlett Packard Enterprise (HPE) recently announced a cooperation agreement with Elliott Investment Management, allowing Elliott to appoint a representative to HPE's Board, and the formation of a new Strategy Committee chaired by Robert Calderoni. These initiatives are part of broader efforts to enhance shareholder value, aligning with HPE's strategic moves such as its partnership with KDDI Corporation for a data center and product expansion collaborations. While market volatility persisted due to external factors, including monetary policy uncertainties and tariff discussions, HPE's price increase of 36% significantly outpaced the broader market trend within the last quarter.

You should learn about the 4 possible red flags we've spotted with Hewlett Packard Enterprise.

The recent developments at Hewlett Packard Enterprise (HPE), particularly the cooperation with Elliott Investment Management, and the strategic alignment related to KDDI Corporation partnerships, underscore efforts to enhance shareholder value. Meanwhile, HPE's total return of 146.14% over the last five years illustrates significant capital appreciation for shareholders, providing a long-term perspective on the company's performance. However, in the past year, HPE's shares have underperformed the US market, which returned 10%, pointing to potential challenges or prevailing market conditions affecting short-term investor sentiment.

The introduction of a Strategy Committee could further hone HPE's focus on AI and cloud strategies, potentially positively impacting projected revenue and earnings. Despite regulatory and competitive challenges mentioned in the narrative, these measures might streamline operations and improve margins. Analysts have set a consensus price target of US$22.07, slightly above the current share price of US$20.28, indicating a possible appreciation potential. However, realizing this target is contingent upon successful execution of strategic initiatives and overcoming regulatory hurdles related to the Juniper acquisition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English