Central New Energy Holding Group (HKG:1735) shareholder returns have been massive, earning 842% in 5 years

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. To wit, the Central New Energy Holding Group Limited (HKG:1735) share price has soared 842% over five years. This just goes to show the value creation that some businesses can achieve. In the last week the share price is up 3.2%. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since it's been a strong week for Central New Energy Holding Group shareholders, let's have a look at trend of the longer term fundamentals.

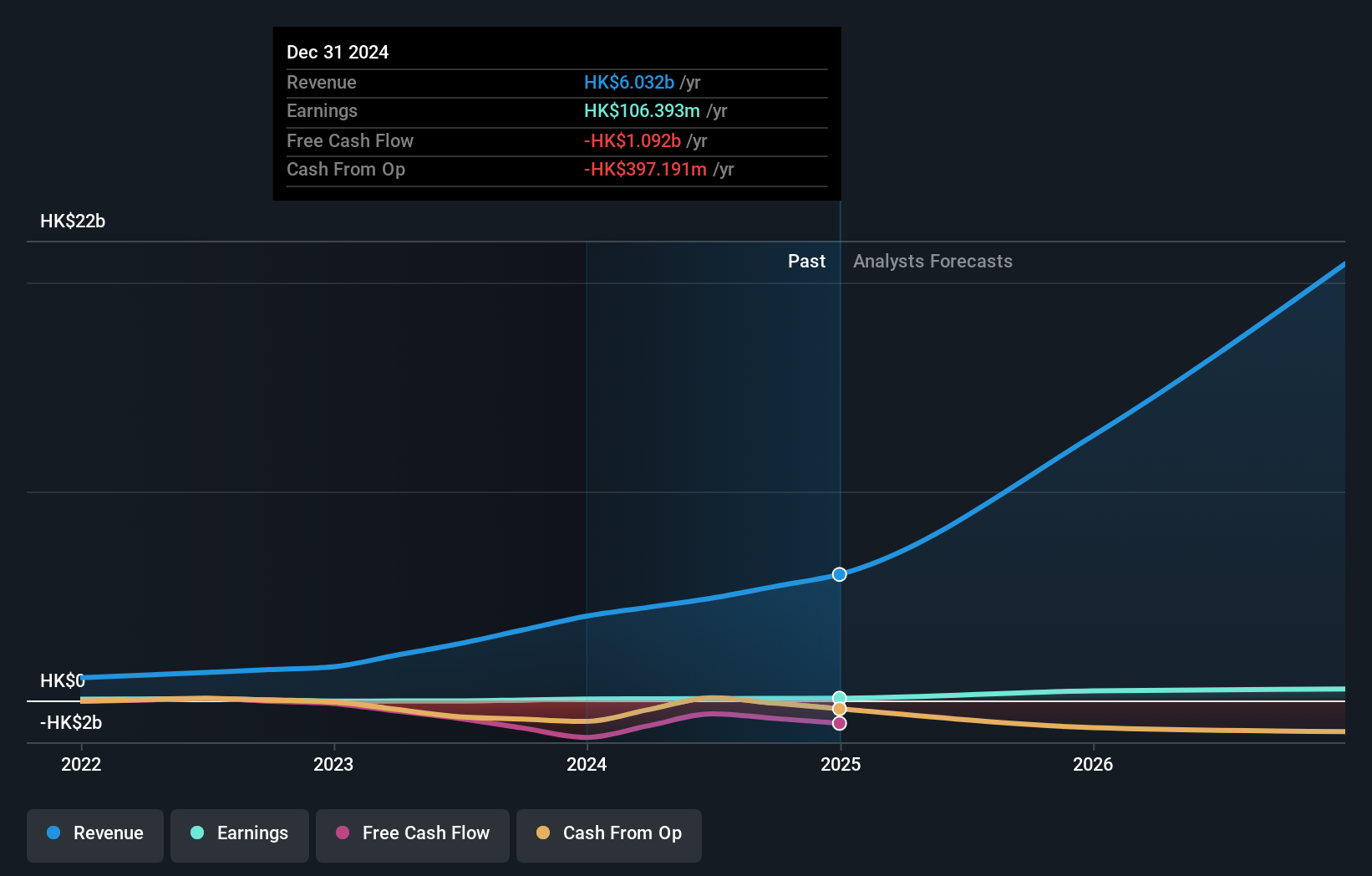

Given that Central New Energy Holding Group only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Central New Energy Holding Group can boast revenue growth at a rate of 52% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 57% per year in that time. It's never too late to start following a top notch stock like Central New Energy Holding Group, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Central New Energy Holding Group shareholders are up 3.8% for the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 57% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Central New Energy Holding Group that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English