Construction Partners Insiders Sell US$28m Of Stock, Possibly Signalling Caution

The fact that multiple Construction Partners, Inc. (NASDAQ:ROAD) insiders offloaded a considerable amount of shares over the past year could have raised some eyebrows amongst investors. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

Construction Partners Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Vice Chairman of the Board, Charles Owens, for US$12m worth of shares, at about US$102 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of US$109. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. It is worth noting that this sale was only 48% of Charles Owens's holding.

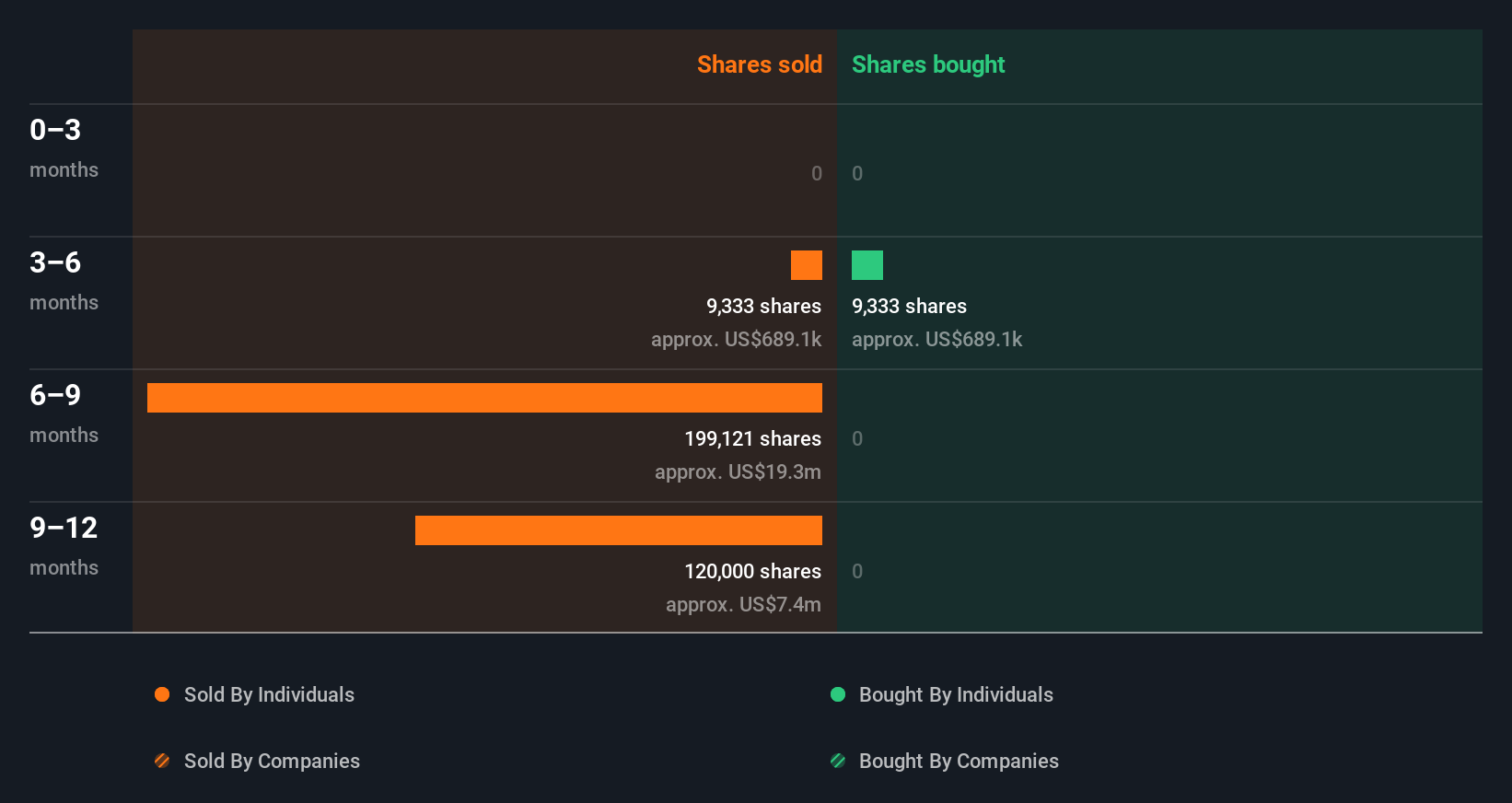

Over the last year we saw more insider selling of Construction Partners shares, than buying. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Construction Partners

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Construction Partners insiders own about US$578m worth of shares (which is 9.7% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Construction Partners Insider Transactions Indicate?

The fact that there have been no Construction Partners insider transactions recently certainly doesn't bother us. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Construction Partners insiders selling. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Construction Partners. While conducting our analysis, we found that Construction Partners has 1 warning sign and it would be unwise to ignore it.

Of course Construction Partners may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English