Why JFrog (FROG) Is Up 6.1% After Launching New AI Model Context Protocol Server and What's Next

- Earlier this week, JFrog unveiled its new Model Context Protocol (MCP) Server, an open framework designed to securely connect large language models and AI agents with the JFrog Platform through trusted methods like HTTPS, offering tools for software package insights, monitoring, and OAuth 2.1 authentication.

- This launch highlights JFrog's efforts to integrate AI-driven development and automation capabilities directly into developer workflows, aiming to enhance productivity and secure software delivery at scale.

- Now, let's examine how the MCP Server launch could impact JFrog's investment narrative, with a focus on expanded AI integration capabilities.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

JFrog Investment Narrative Recap

To be a JFrog shareholder right now, you need to believe in its vision for leading the software supply chain and AI integration market, betting on continued enterprise cloud adoption and durable, multi-year customer contracts. The MCP Server launch adds a clear AI integration toolset, but it does not materially shift the short-term catalyst, which remains centered on further cloud expansion and enterprise customer wins, nor does it address the key risk of volatile revenue if large enterprise deal flow slows.

The most relevant recent announcement is JFrog’s collaboration with NVIDIA, which brings JFrog’s DevSecOps tools to NVIDIA’s AI Factory. Both moves reinforce the theme that AI and machine learning capabilities are increasingly vital across JFrog’s offering, providing additional proof points to the business catalysts of deeper enterprise and developer engagement. On the other hand, investors should be aware of...

Read the full narrative on JFrog (it's free!)

JFrog's narrative projects $681.1 million revenue and $82.0 million earnings by 2028. This requires 16.7% yearly revenue growth and a $151.2 million increase in earnings from -$69.2 million today.

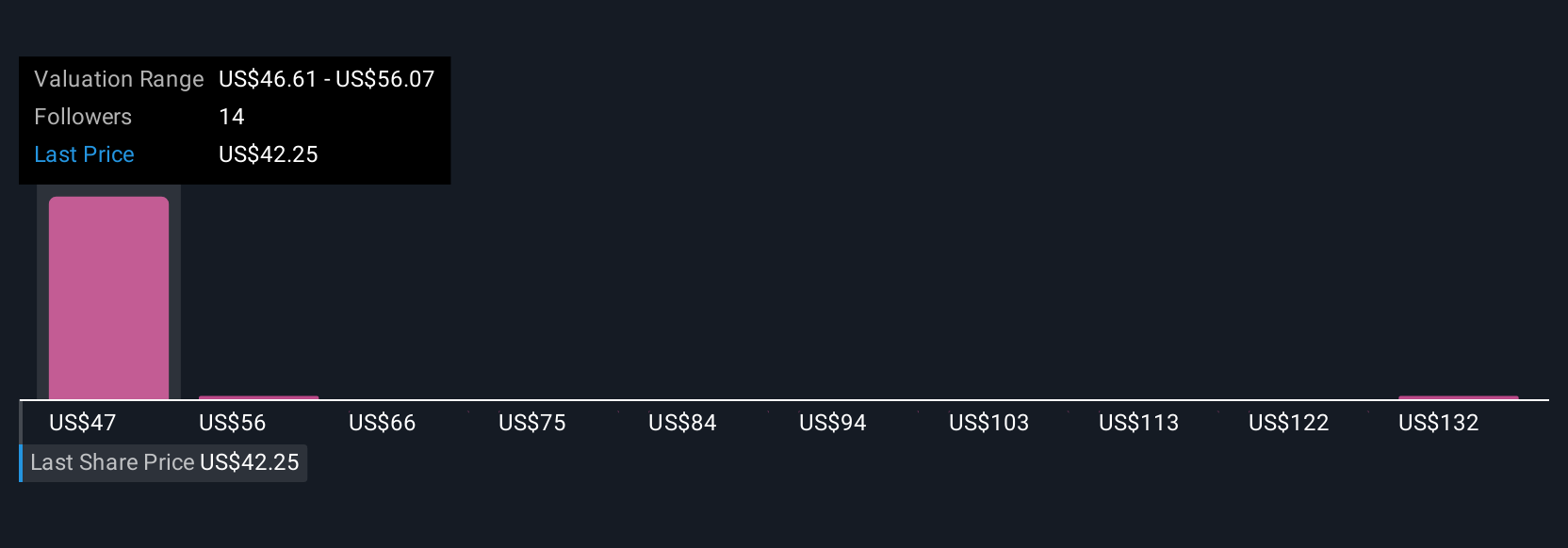

Uncover how JFrog's forecasts yield a $46.63 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put JFrog’s fair value anywhere from US$46.52 to US$141.21, based on 4 independent perspectives. With such wide-ranging estimates, keep in mind that future revenue growth still depends on maintaining momentum with large enterprise cloud commitments, which has broad implications for both optimism and caution among shareholders.

Explore 4 other fair value estimates on JFrog - why the stock might be worth just $46.52!

Build Your Own JFrog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JFrog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free JFrog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JFrog's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English