Eli Lilly (LLY) Collaborates With Gate Bioscience For Innovative Molecular Gate Therapeutics

Eli Lilly (LLY) recently entered a collaboration with Gate Bioscience to develop molecular gate therapeutics, a move that potentially strengthens its innovative pipeline. During the same period, the FDA approved a label update for the company's Alzheimer's treatment, Kisunla, optimizing its dosing schedule and potentially enhancing its market appeal. These developments coincided with a 3.67% rise in the company's share price over the past month. Although the market itself experienced an upward trend of 1.7% in the last seven days, Eli Lilly's advancements likely reinforced its alignment with these broader market movements.

The recent collaboration between Eli Lilly and Gate Bioscience, along with the FDA's label update for Kisunla, aligns well with the company's narrative of enhancing its innovative pipeline. This can potentially boost its revenue and earnings forecasts as new product approvals and optimized dosing schedules may increase market adoption, especially in the Alzheimer's treatment space. Over the past five years, Eli Lilly's total shareholder returns have been very large, highlighting its consistent growth trajectory. This robust performance must be considered in light of the recent one-year return, where Eli Lilly matched the US Pharmaceuticals industry, but fell short of the broader US market, which returned 17.7%.

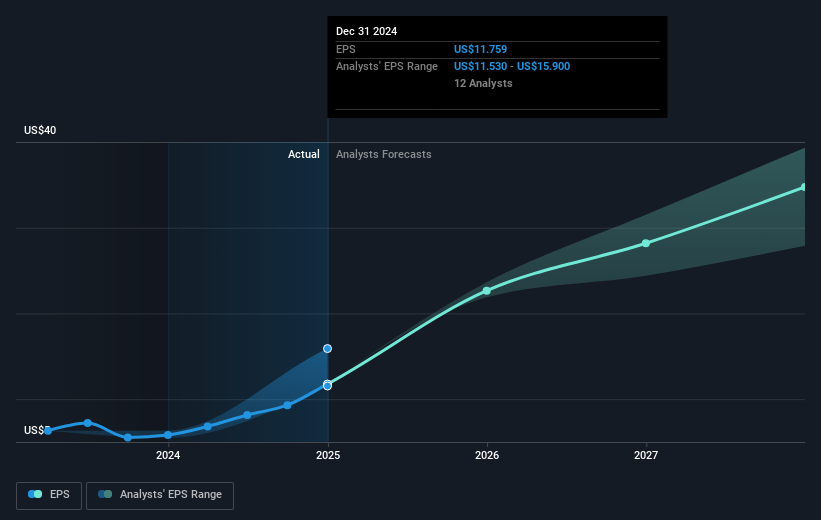

With current shares trading at US$798.89, the market values Eli Lilly below the consensus target of US$952.27, suggesting a possible upside if projected growth is realized. The anticipated revenue growth from advancements in oncology and immunology further contributes to this outlook, potentially supporting the favorable long-term earnings estimates. As analysts forecast substantial annual earnings growth, the recent developments could reinforce these projections, provided external economic and competitive challenges are managed effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

① During the campaign period, US stocks, US stocks short selling, US stock options, Hong Kong stocks, and A-shares trading will maintain at $0 commission, and no subscription/redemption fees for mutual fund transactions. $0 fee offer has a time limit, until further notice. For more information, please visit: https://www.webull.hk/pricing

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English