Insider Buying Highlights 3 Undervalued Small Caps In Hong Kong

As global markets navigate through heightened geopolitical tensions and fluctuating economic indicators, Hong Kong's Hang Seng Index has shown resilience with a notable climb of 10.2% amidst broader market volatility. In this dynamic environment, small-cap stocks in Hong Kong present intriguing opportunities, particularly when insider buying suggests potential undervaluation. Identifying such stocks often involves considering factors like company fundamentals and market sentiment which can be pivotal in determining their future performance potential.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.7x | 30.60% | ★★★★★☆ |

| Vesync | 7.6x | 1.1x | -9.06% | ★★★★☆☆ |

| Lion Rock Group | 5.5x | 0.4x | 49.76% | ★★★★☆☆ |

| Ferretti | 10.7x | 0.7x | 48.05% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.3x | 37.61% | ★★★★☆☆ |

| Beijing Chunlizhengda Medical Instruments | 15.3x | 3.4x | 44.77% | ★★★☆☆☆ |

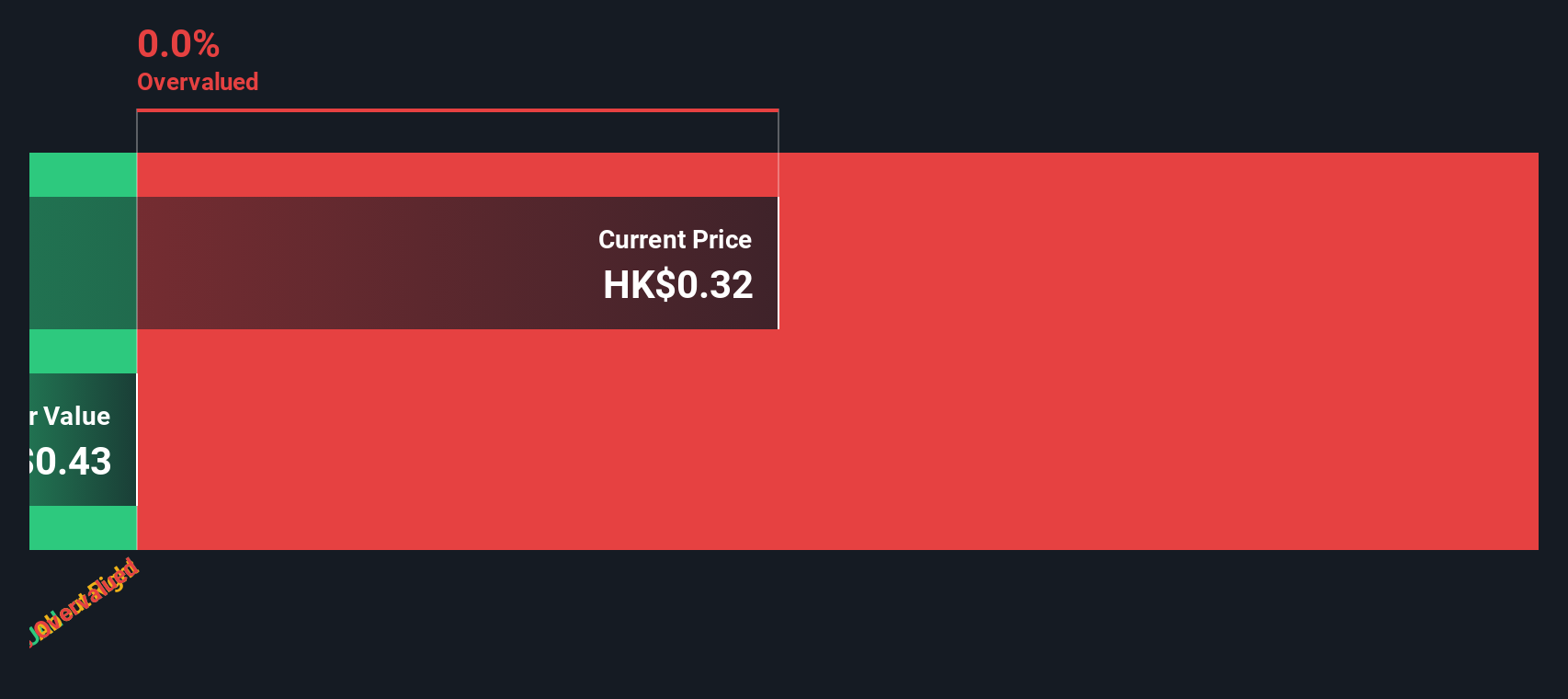

| China Lesso Group Holdings | 6.4x | 0.4x | -566.70% | ★★★☆☆☆ |

| Skyworth Group | 6.3x | 0.1x | -341.60% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 8.1x | 0.5x | -66.22% | ★★★☆☆☆ |

| Guangdong Kanghua Healthcare Group | 13.7x | 0.3x | 5.41% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer and distributor of building materials, primarily focusing on plastics and rubber products, with a market capitalization of CN¥21.84 billion.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with a recent figure of CN¥29.13 billion. The cost of goods sold (COGS) has been recorded at CN¥21.55 billion, impacting the gross profit margin which stands at 26.04%. Operating expenses include significant allocations to sales and marketing as well as general and administrative costs, contributing to the net income margin of 6.58%.

PE: 6.4x

China Lesso Group Holdings, a smaller player in Hong Kong's market, has recently caught attention due to insider confidence. In early 2024, an insider purchased 4 million shares for approximately CNY 10.05 million, reflecting belief in the company's potential despite challenges. The company faces high debt levels and relies on external borrowing but anticipates earnings growth of 10.65% annually. Recent earnings showed decreased sales and net income compared to last year, yet future prospects remain cautiously optimistic given projected growth rates.

- Click to explore a detailed breakdown of our findings in China Lesso Group Holdings' valuation report.

Learn about China Lesso Group Holdings' historical performance.

Lee & Man Paper Manufacturing (SEHK:2314)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lee & Man Paper Manufacturing is a company engaged in the production of pulp, tissue paper, and packaging paper with a market capitalization of HK$9.81 billion.

Operations: The company's revenue is primarily derived from packaging paper and tissue paper, with packaging paper contributing significantly more. The cost of goods sold (COGS) has a substantial impact on the gross profit, which shows fluctuations over time. Notably, the gross profit margin peaked at 29.08% in December 2017 but has seen a decline to 12.49% by October 2024. Operating expenses are consistently significant, with general and administrative expenses being a major component.

PE: 8.1x

Lee & Man Paper Manufacturing, a smaller player in Hong Kong's market landscape, has caught attention with its recent financial performance and insider confidence. They reported a significant increase in net income to HK$805.69 million for the first half of 2024, up from HK$359.9 million the previous year. Insider confidence is evident as Ho Chung Lee purchased 483,000 shares valued at approximately HK$1.1 million between January and October 2024, signaling potential optimism about future growth prospects despite reliance on external borrowing for funding needs.

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment is engaged in property development and property investment and management, with a focus on the real estate sector, and has a market capitalization of approximately CN¥6.98 billion.

Operations: The company's revenue primarily stems from its Property Development and Property Investment and Management segments. Over time, the gross profit margin has shown fluctuations, reaching a peak of 41.63% in December 2018 before experiencing declines to -2.60% by June 2023, with a slight recovery to 10.57% by December 2023.

PE: -2.0x

Gemdale Properties and Investment has seen insider confidence with Lian Huat Loh purchasing 10 million shares recently, indicating potential value recognition despite a volatile share price over the past three months. The company reported a net loss of CNY 2,179 million for the first half of 2024, contrasting last year's profit due to increased impairment losses. Sales figures show growth with RMB 12.43 billion in contracted sales from January to August 2024, reflecting ongoing market activity amidst financial challenges.

Taking Advantage

- Access the full spectrum of 10 Undervalued SEHK Small Caps With Insider Buying by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English