Is Shenghua Lande Scitech (HKG:8106) Weighed On By Its Debt Load?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Shenghua Lande Scitech Limited (HKG:8106) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Shenghua Lande Scitech

What Is Shenghua Lande Scitech's Debt?

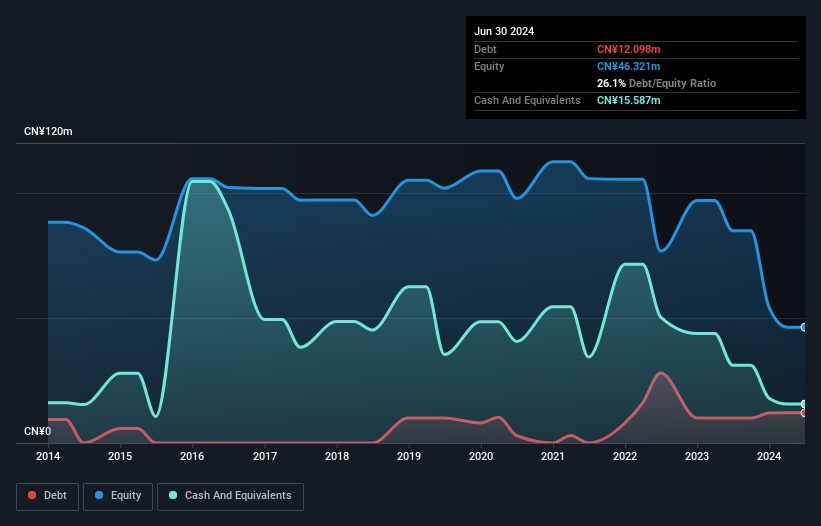

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Shenghua Lande Scitech had CN¥12.1m of debt, an increase on CN¥10.0m, over one year. However, its balance sheet shows it holds CN¥15.6m in cash, so it actually has CN¥3.49m net cash.

A Look At Shenghua Lande Scitech's Liabilities

According to the balance sheet data, Shenghua Lande Scitech had liabilities of CN¥28.2m due within 12 months, but no longer term liabilities. Offsetting these obligations, it had cash of CN¥15.6m as well as receivables valued at CN¥41.7m due within 12 months. So it actually has CN¥29.1m more liquid assets than total liabilities.

This surplus liquidity suggests that Shenghua Lande Scitech's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, Shenghua Lande Scitech boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Shenghua Lande Scitech's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Shenghua Lande Scitech wasn't profitable at an EBIT level, but managed to grow its revenue by 32%, to CN¥140m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Shenghua Lande Scitech?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Shenghua Lande Scitech had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CN¥18m and booked a CN¥39m accounting loss. With only CN¥3.49m on the balance sheet, it would appear that its going to need to raise capital again soon. Shenghua Lande Scitech's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for Shenghua Lande Scitech (3 shouldn't be ignored) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English