CANbridge Pharmaceuticals Inc. (HKG:1228) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the CANbridge Pharmaceuticals Inc. (HKG:1228) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 87% share price decline.

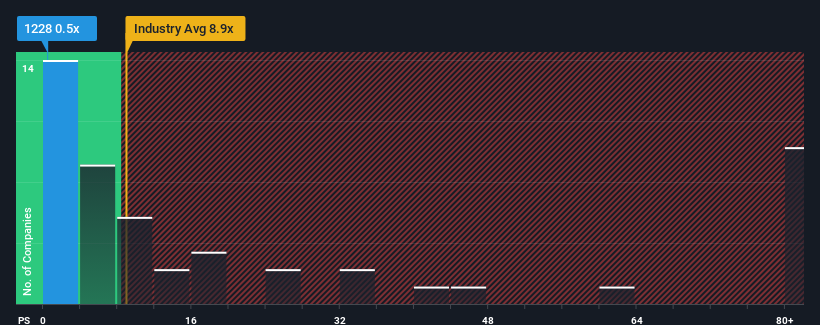

Since its price has dipped substantially, CANbridge Pharmaceuticals' price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 8.9x and even P/S above 43x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for CANbridge Pharmaceuticals

How CANbridge Pharmaceuticals Has Been Performing

Revenue has risen firmly for CANbridge Pharmaceuticals recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for CANbridge Pharmaceuticals, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is CANbridge Pharmaceuticals' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as CANbridge Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 144% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why CANbridge Pharmaceuticals is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

CANbridge Pharmaceuticals' P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, CANbridge Pharmaceuticals maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

You always need to take note of risks, for example - CANbridge Pharmaceuticals has 4 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on CANbridge Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English