Top Growth Companies With Insider Stake In February 2025

As global markets experience a surge, with U.S. stock indexes nearing record highs and growth stocks outperforming value shares, investors are keeping a keen eye on inflation data and its potential impact on interest rates. In this environment of heightened economic activity and cautious optimism, growth companies with substantial insider ownership often attract attention due to the confidence their stakeholders demonstrate in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.1% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's uncover some gems from our specialized screener.

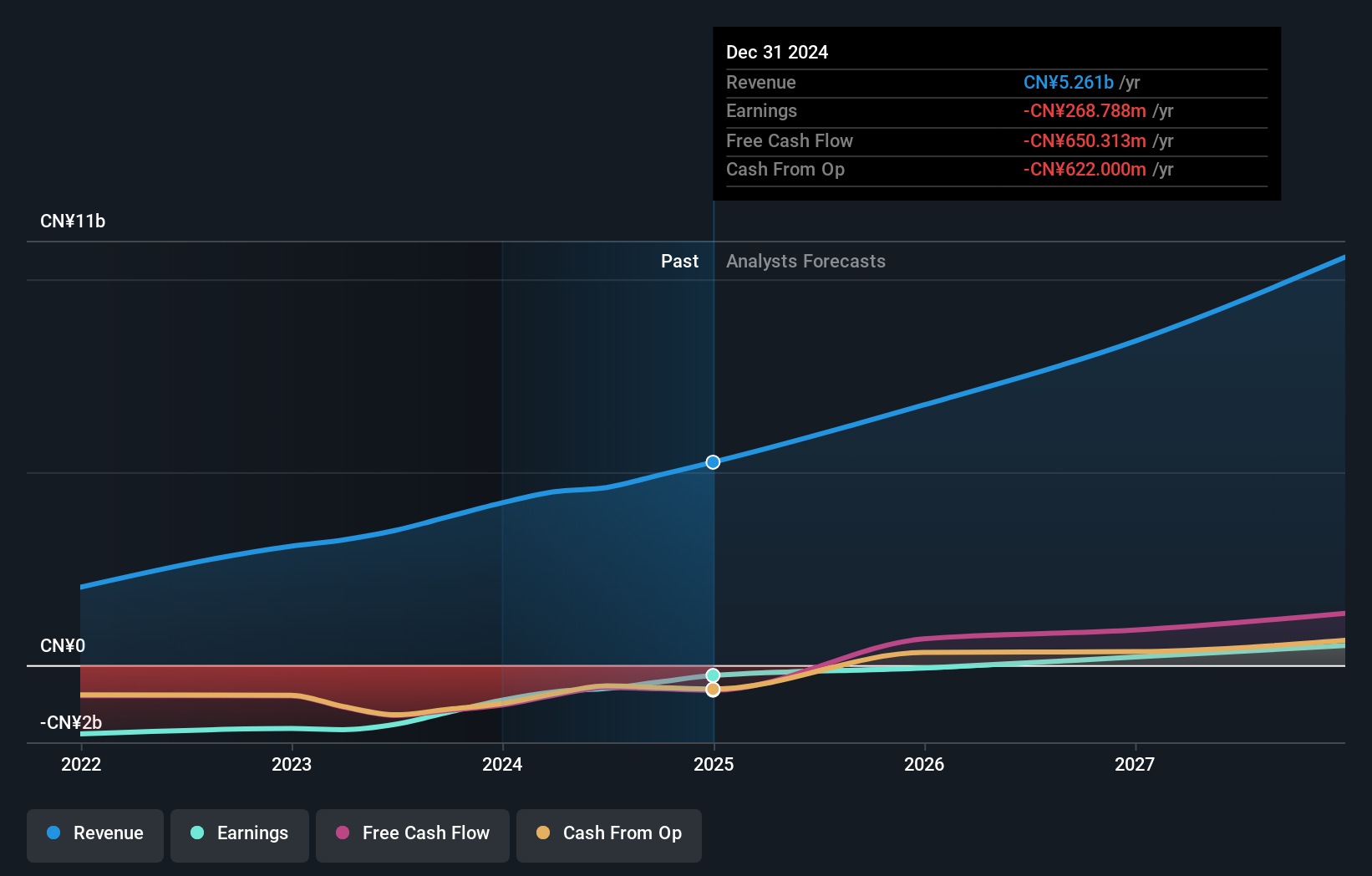

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company offering platform-centric artificial intelligence solutions in China, with a market cap of HK$25.30 billion.

Operations: The company's revenue segments include the Sage AI Platform generating CN¥3 billion, Sagegpt Aigs Services contributing CN¥448.10 million, and Shift Intelligent Solutions accounting for CN¥1.15 billion.

Insider Ownership: 22.8%

Revenue Growth Forecast: 19.3% p.a.

Beijing Fourth Paradigm Technology is poised for growth with expected earnings to increase by over 113% annually and revenue growth projected at 19.3%, outpacing the Hong Kong market. Despite a volatile share price, the company's path to profitability within three years signals robust potential. Recent executive changes, including Mr. Peng Jun's appointment as joint company secretary, reflect strategic internal alignment amid ongoing business reorganization efforts in Hong Kong.

- Click here to discover the nuances of Beijing Fourth Paradigm Technology with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Beijing Fourth Paradigm Technology shares in the market.

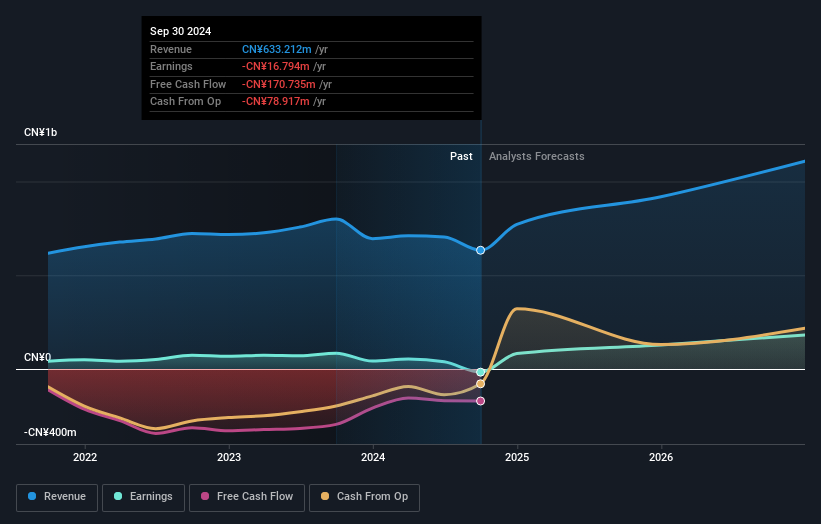

Goodwill E-Health Info (SHSE:688246)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Goodwill E-Health Info Co., Ltd. focuses on the research and development of medical information software in China, with a market cap of CN¥5.54 billion.

Operations: Goodwill E-Health Info Co., Ltd. generates its revenue primarily from the development and innovation of medical information software within China.

Insider Ownership: 20.3%

Revenue Growth Forecast: 22.7% p.a.

Goodwill E-Health Info is projected to achieve profitability within three years, with earnings expected to grow by 73.2% annually and revenue increasing at 22.7% per year, surpassing the Chinese market average. Despite recent share price volatility, no substantial insider trading has been reported in the past three months. The company held a Special/Extraordinary Shareholders Meeting on February 13, 2025, indicating active shareholder engagement and potential strategic developments.

- Navigate through the intricacies of Goodwill E-Health Info with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Goodwill E-Health Info's share price might be on the expensive side.

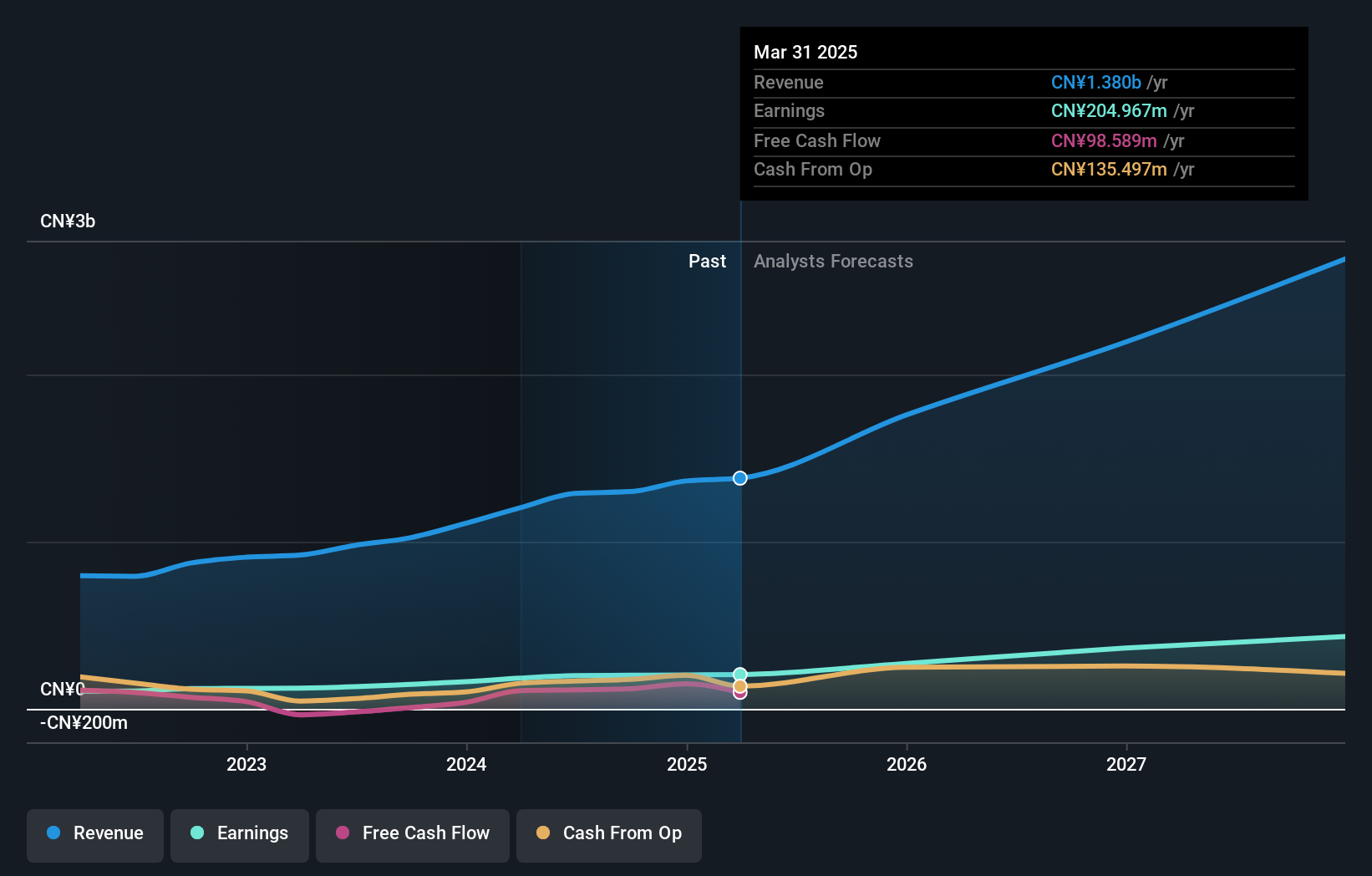

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Chuanhuan Technology Co., Ltd. focuses on the research, development, production, and sale of automotive rubber hose series products in China with a market cap of CN¥8.26 billion.

Operations: The company generates revenue from its Non-Tire Rubber Products segment, amounting to CN¥1.30 billion.

Insider Ownership: 24.5%

Revenue Growth Forecast: 21% p.a.

Sichuan Chuanhuan Technology Ltd is poised for substantial growth, with revenue expected to increase by 21% annually, outpacing the broader Chinese market. Earnings are projected to grow significantly at 21.45% per year, despite being below the market's average growth rate. The company's share price has been highly volatile recently, and it lacks a stable dividend history. No significant insider trading activity has been reported in the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Sichuan Chuanhuan TechnologyLtd.

- Our expertly prepared valuation report Sichuan Chuanhuan TechnologyLtd implies its share price may be too high.

Turning Ideas Into Actions

- Gain an insight into the universe of 1458 Fast Growing Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English