Is MTT Group Holdings (HKG:2350) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that MTT Group Holdings Limited (HKG:2350) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for MTT Group Holdings

How Much Debt Does MTT Group Holdings Carry?

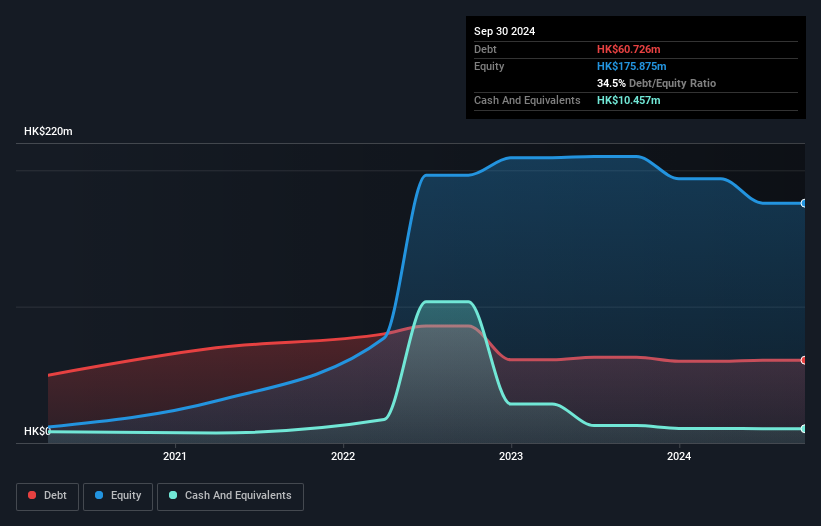

As you can see below, MTT Group Holdings had HK$60.7m of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. However, it also had HK$10.5m in cash, and so its net debt is HK$50.3m.

A Look At MTT Group Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that MTT Group Holdings had liabilities of HK$264.4m due within 12 months and liabilities of HK$5.24m due beyond that. Offsetting these obligations, it had cash of HK$10.5m as well as receivables valued at HK$355.5m due within 12 months. So it actually has HK$96.3m more liquid assets than total liabilities.

This surplus strongly suggests that MTT Group Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. The balance sheet is clearly the area to focus on when you are analysing debt. But it is MTT Group Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year MTT Group Holdings had a loss before interest and tax, and actually shrunk its revenue by 31%, to HK$488m. To be frank that doesn't bode well.

Caveat Emptor

While MTT Group Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping HK$34m. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. Still, we'd be more encouraged to study the business in depth if it already had some free cash flow. This one is a bit too risky for our liking. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for MTT Group Holdings (1 is significant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English