Fameglow Holdings Limited's (HKG:8603) 48% Share Price Surge Not Quite Adding Up

Fameglow Holdings Limited (HKG:8603) shareholders have had their patience rewarded with a 48% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 90% in the last year.

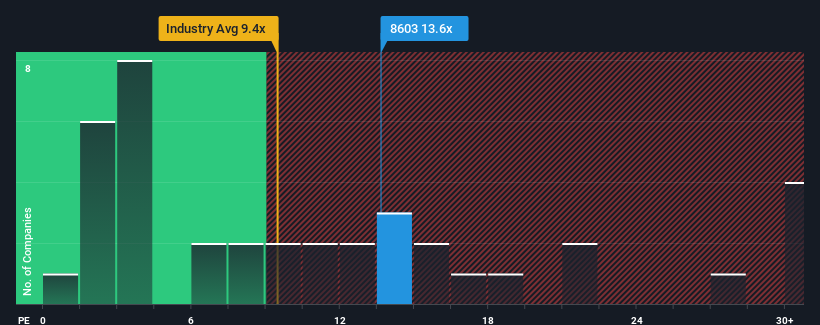

Following the firm bounce in price, Fameglow Holdings' price-to-earnings (or "P/E") ratio of 13.6x might make it look like a sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings growth that's exceedingly strong of late, Fameglow Holdings has been doing very well. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Fameglow Holdings

Is There Enough Growth For Fameglow Holdings?

Fameglow Holdings' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 251% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 20% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Fameglow Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Fameglow Holdings' P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Fameglow Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 1 warning sign for Fameglow Holdings that we have uncovered.

You might be able to find a better investment than Fameglow Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English