Dowway Holdings Limited's (HKG:8403) Shares Climb 29% But Its Business Is Yet to Catch Up

Dowway Holdings Limited (HKG:8403) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 84%.

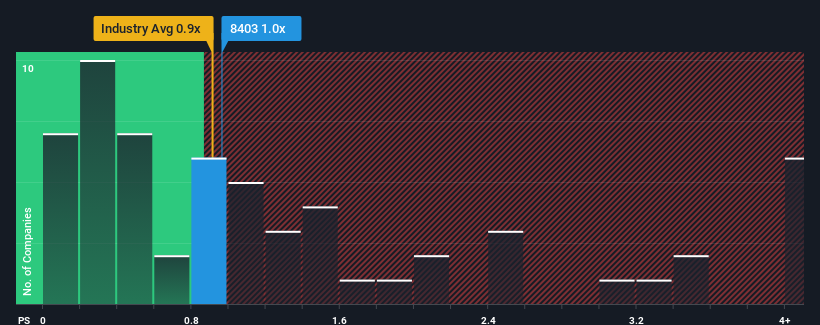

Although its price has surged higher, it's still not a stretch to say that Dowway Holdings' price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Media industry in Hong Kong, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Dowway Holdings

How Has Dowway Holdings Performed Recently?

For example, consider that Dowway Holdings' financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dowway Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

Dowway Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. As a result, revenue from three years ago have also fallen 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 7.8% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Dowway Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Dowway Holdings' P/S

Dowway Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Dowway Holdings currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Dowway Holdings (1 is a bit concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English