China Dredging Environment Protection Holdings Limited (HKG:871) Might Not Be As Mispriced As It Looks After Plunging 36%

The China Dredging Environment Protection Holdings Limited (HKG:871) share price has fared very poorly over the last month, falling by a substantial 36%. Still, a bad month hasn't completely ruined the past year with the stock gaining 25%, which is great even in a bull market.

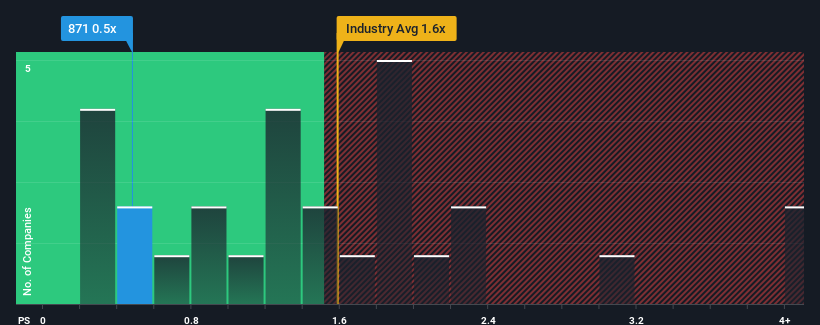

After such a large drop in price, considering around half the companies operating in Hong Kong's Infrastructure industry have price-to-sales ratios (or "P/S") above 1.6x, you may consider China Dredging Environment Protection Holdings as an solid investment opportunity with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for China Dredging Environment Protection Holdings

What Does China Dredging Environment Protection Holdings' P/S Mean For Shareholders?

For instance, China Dredging Environment Protection Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for China Dredging Environment Protection Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For China Dredging Environment Protection Holdings?

In order to justify its P/S ratio, China Dredging Environment Protection Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 27%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 1.7% shows it's about the same on an annualised basis.

With this information, we find it odd that China Dredging Environment Protection Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

China Dredging Environment Protection Holdings' recently weak share price has pulled its P/S back below other Infrastructure companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that China Dredging Environment Protection Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with China Dredging Environment Protection Holdings (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If you're unsure about the strength of China Dredging Environment Protection Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English