Hantech And 2 Emerging Asian Small Caps With Promising Potential

As the global markets navigate a landscape of heightened uncertainty, with central banks holding rates steady and mixed economic indicators emerging, investors are increasingly looking towards small-cap stocks in Asia for potential opportunities. In this context, identifying promising small-cap companies like Hantech requires a keen understanding of market dynamics and the ability to spot businesses that can thrive amidst both local and international economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 11.09% | 63.42% | ★★★★★★ |

| Kondotec | 11.26% | 7.01% | 7.06% | ★★★★★☆ |

| Shenzhen Keanda Electronic Technology | 5.01% | -5.04% | -11.56% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Bank of Iwate | 119.19% | 1.75% | 7.64% | ★★★★☆☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| GENOVA | 0.46% | 25.48% | 27.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hantech (KOSDAQ:A098070)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hantech Co., Ltd. is a South Korean company that manufactures and sells chemical process equipment, storage tanks, and cryogenic containers, with a market cap of ₩369.22 billion.

Operations: Hantech generates revenue primarily from the sale of chemical process equipment, storage tanks, and cryogenic containers. The company's market cap stands at ₩369.22 billion.

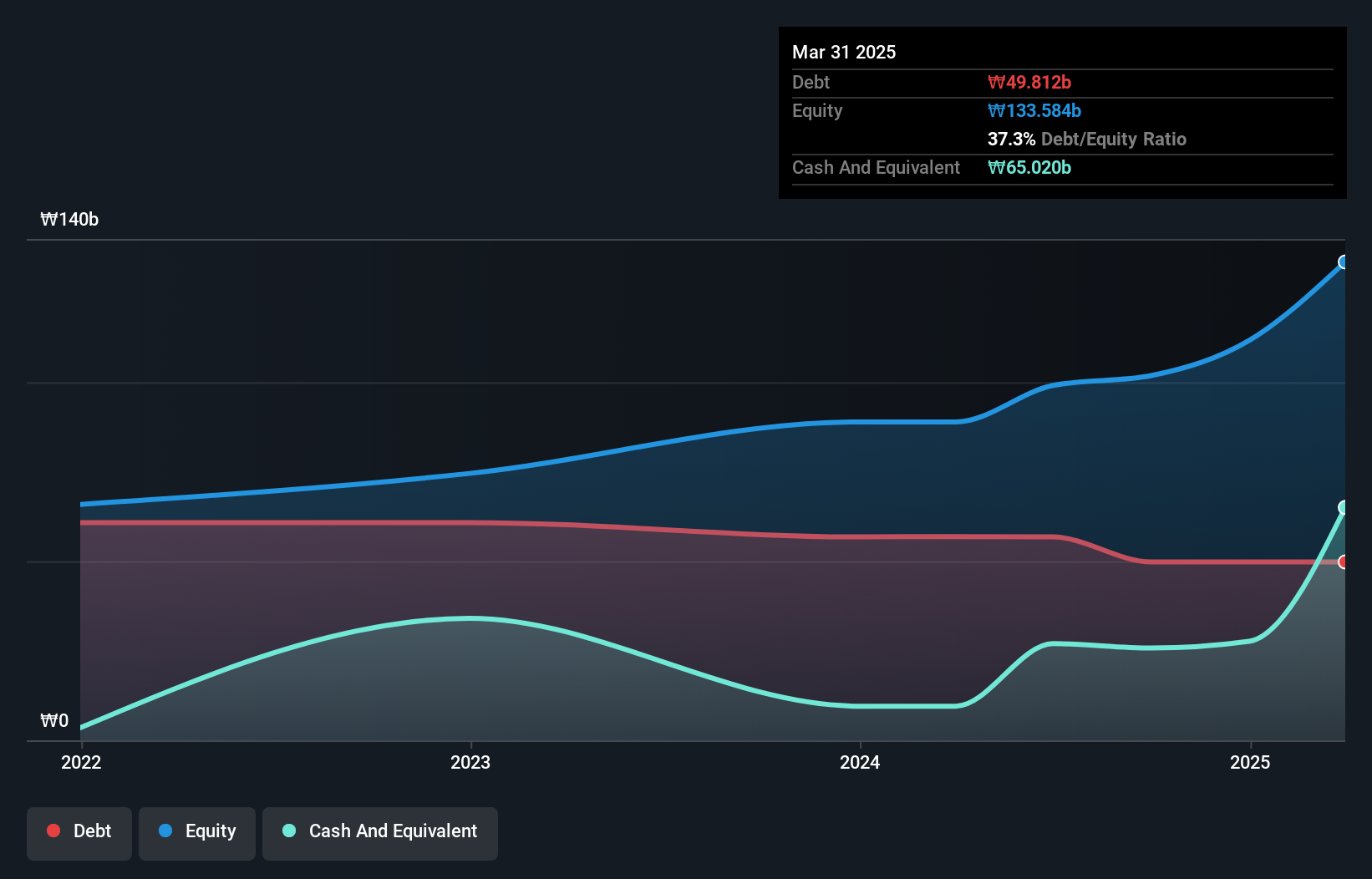

Hantech recently completed an IPO, raising KRW 35.74 billion by offering common stock at a price of KRW 10,800 per share with a discount of KRW 324. Despite revenue slipping by 12.7% over the past year, earnings surged by 76.9%, outpacing the Machinery industry average of 12%. The company's net debt to equity ratio stands at a satisfactory level of 19.8%, reflecting prudent financial management. With interest payments well-covered at 7.9 times EBIT and high-quality past earnings, Hantech presents an intriguing prospect in the Asian market despite its highly illiquid shares.

- Take a closer look at Hantech's potential here in our health report.

Gain insights into Hantech's historical performance by reviewing our past performance report.

Nanshan Aluminium International Holdings (SEHK:2610)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanshan Aluminium International Holdings Limited, a subsidiary of Nanshan Aluminium Investment Holding Limited, focuses on metal processing and fabrication operations with a market capitalization of approximately HK$11.43 billion.

Operations: The company generates revenue of $878.09 million from its metal processing and fabrication segment.

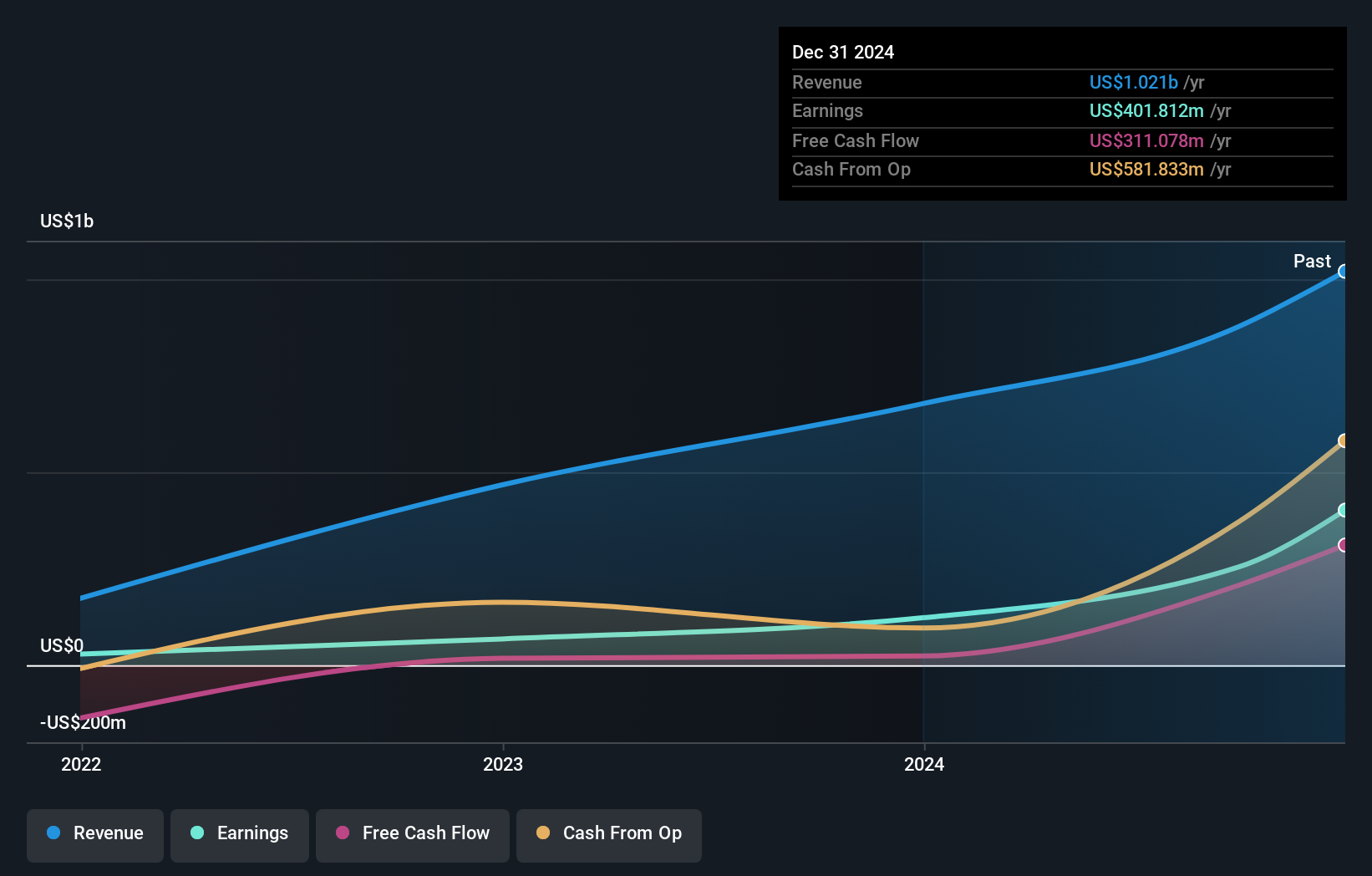

Nanshan Aluminium International Holdings recently completed an IPO raising HKD 2.35 billion, offering shares at HKD 26.6 each with a slight discount of HKD 0.48 per share. The company boasts high-quality earnings and has more cash than its total debt, ensuring financial stability despite the illiquid nature of its shares. Over the past year, revenue surged by 41%, indicating robust growth potential in the competitive aluminium sector. With positive free cash flow reaching US$207 million as of late 2024, Nanshan seems well-positioned to leverage its capital for future expansion opportunities in Asia's dynamic market landscape.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited, an investment holding company, offers software development and cloud services in China with a market capitalization of HK$7.61 billion.

Operations: Inspur Digital Enterprise Technology generates revenue primarily from its Internet of Things (IoT) solutions, management software, and cloud services, with IoT solutions contributing CN¥3.53 billion. The company focuses on these three segments to drive its financial performance.

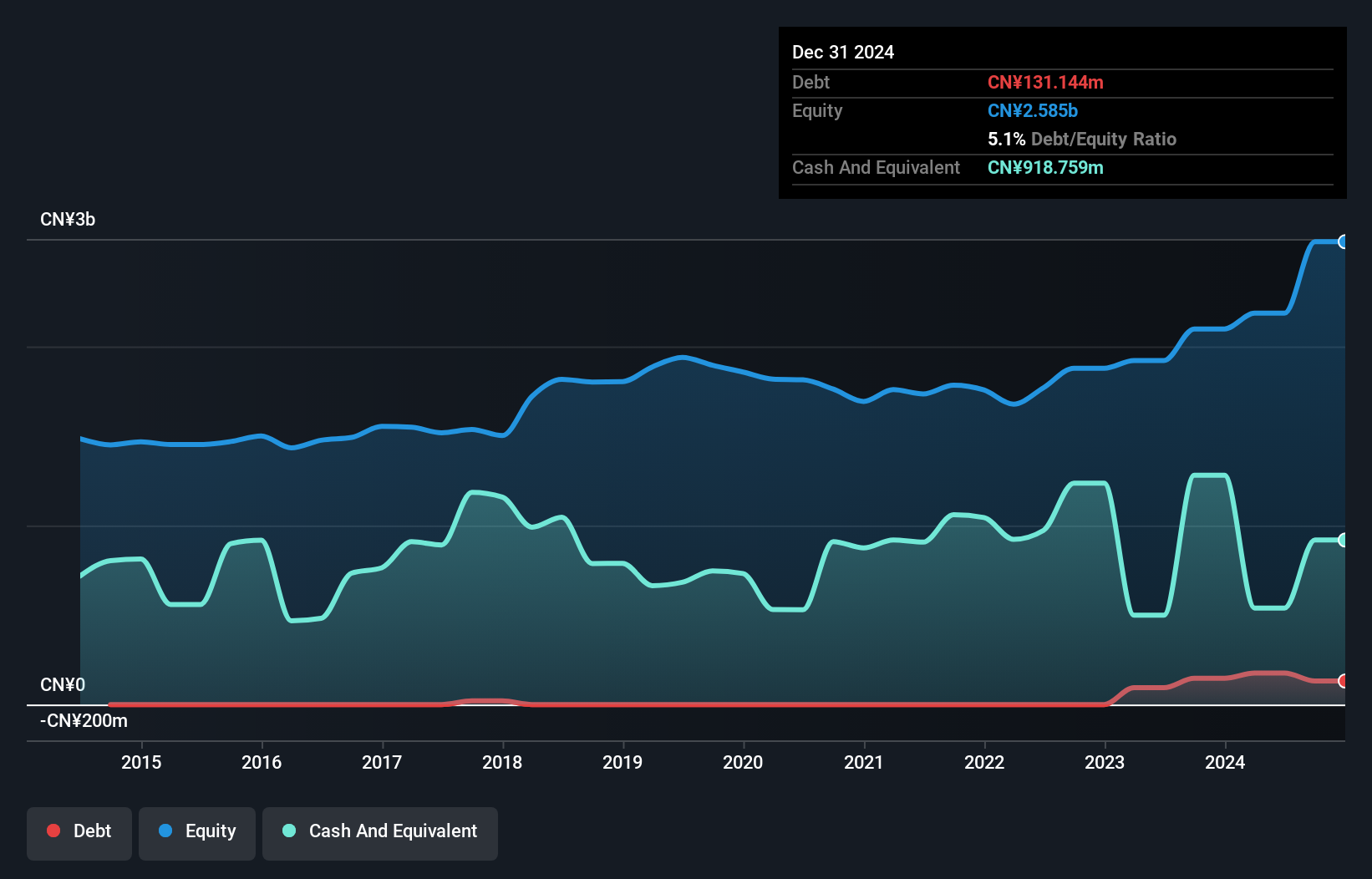

Inspur Digital Enterprise Technology, with its nimble market presence, has shown impressive earnings growth of 84.5% over the past year, outpacing the Software industry average of 14.7%. The company is trading at a significant discount of 61.5% below its estimated fair value, suggesting potential upside for investors. Its debt to equity ratio has increased to 8% over five years; however, it maintains robust interest coverage with EBIT covering interest payments by a factor of 251.2 times. Recent guidance indicates net profit could rise by up to 93%, driven by cloud services transformation and revenue growth in RMB terms (RMB350 million–RMB390 million).

Next Steps

- Click this link to deep-dive into the 2647 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English