Exploring Three Undiscovered Gems in Global Markets

In the current climate of economic uncertainty and inflation concerns, global markets have seen a decline in major indices, with U.S. stocks particularly impacted by trade policy uncertainties and growth concerns. Amidst this backdrop, small-cap stocks can often present unique opportunities for investors seeking undiscovered gems that may offer resilience or potential growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

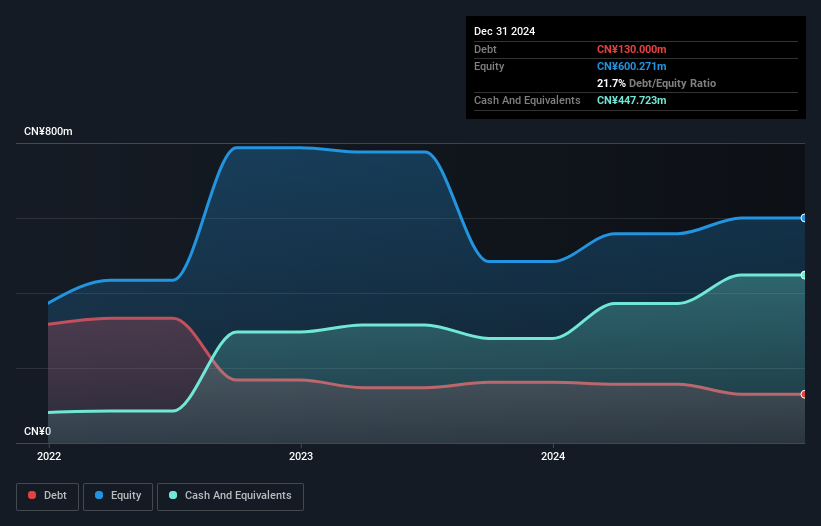

Zibuyu Group (SEHK:2420)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zibuyu Group Limited is an investment holding company that functions as a cross-border e-commerce enterprise in China, with a market cap of HK$2.75 billion.

Operations: The company generates revenue primarily from online retailing, amounting to CN¥3.33 billion. Gross profit margin is reported at 44.5%.

Zibuyu Group, a small player in the market, has turned heads with its recent financial performance. The company's sales rose to CNY 3.33 billion from CNY 3 billion, and it swung to a net income of CNY 150.78 million from a previous loss of CNY 265.79 million. Basic earnings per share improved to CNY 0.31 from a loss per share of CNY 0.53 last year, indicating strong operational recovery and profitability growth this year compared to the specialty retail industry average decline of -26%. Trading at about 80% below estimated fair value suggests potential for future appreciation despite past challenges.

- Take a closer look at Zibuyu Group's potential here in our health report.

Assess Zibuyu Group's past performance with our detailed historical performance reports.

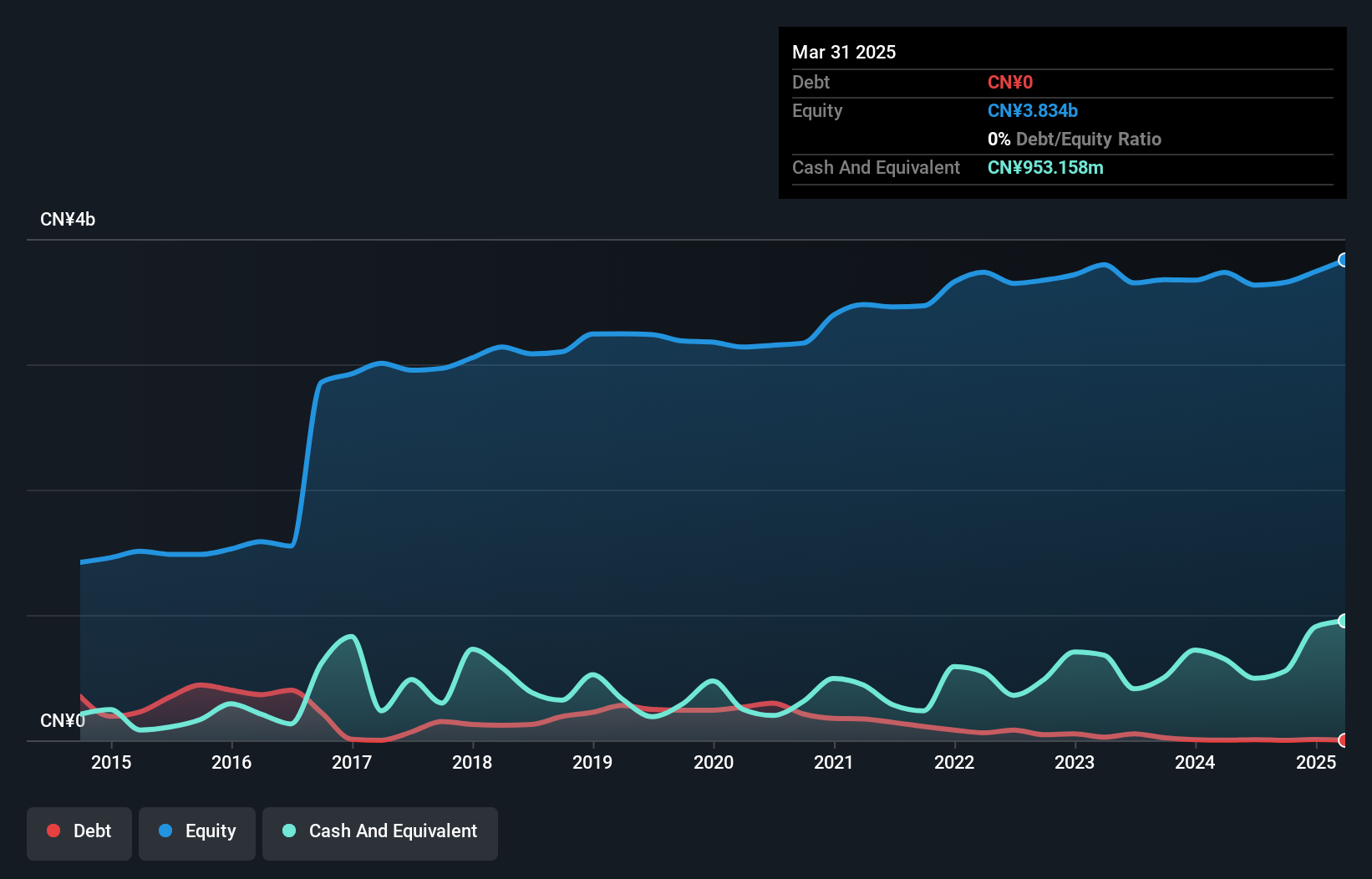

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. is engaged in the production, processing, and sale of rice wine both domestically and internationally, with a market capitalization of approximately CN¥5.21 billion.

Operations: The company generates revenue primarily through the production and sale of rice wine in domestic and international markets. It has a market capitalization of approximately CN¥5.21 billion.

Kuaijishan Shaoxing Rice Wine, a smaller player in the beverage industry, has shown promising financial health with its debt-to-equity ratio dropping from 7.6 to 0.04 over five years, indicating prudent debt management. The company reported sales of CNY 1.63 billion and a net income of CNY 196 million for the year ending December 2024, reflecting strong earnings growth of 17.7%, outpacing industry averages. With a price-to-earnings ratio of 29x below the CN market average, it seems an attractive proposition amidst its high-quality earnings and positive free cash flow position, suggesting robust operational efficiency and potential for sustained performance.

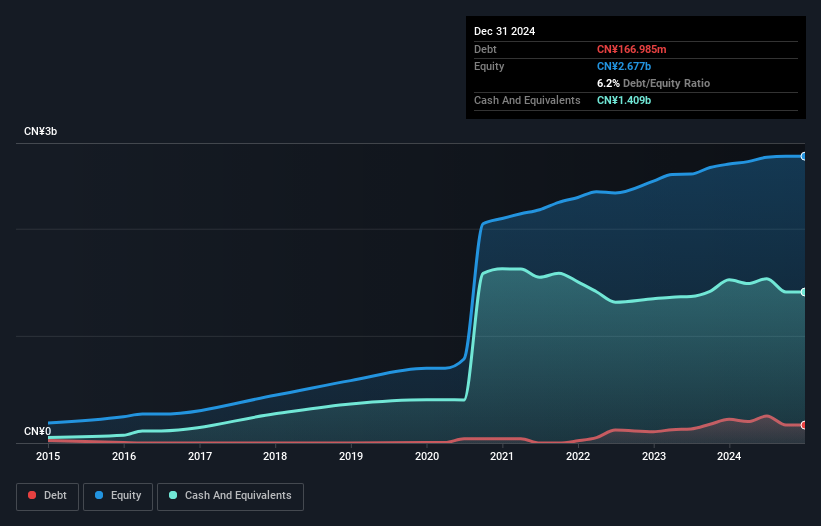

Chengdu Easton Biopharmaceuticals (SHSE:688513)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chengdu Easton Biopharmaceuticals Co., Ltd. is a company focused on the development and production of pharmaceutical products, with a market cap of CN¥5.84 billion.

Operations: Chengdu Easton Biopharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to CN¥1.35 billion.

Chengdu Easton Biopharmaceuticals, a nimble player in the pharmaceutical sector, has shown promising growth with sales reaching CNY 1.35 billion for 2024, up from CNY 1.12 billion the previous year. Net income also saw an uptick to CNY 236.57 million from CNY 226.57 million, reflecting solid performance despite industry challenges. The company completed a share buyback program worth CNY 134.91 million, repurchasing over two percent of its shares since August 2023, which could signal confidence in its market position and future prospects. With a P/E ratio of 26x below the CN market average of 37.7x, it offers potential value to investors seeking growth at reasonable valuations within this dynamic industry landscape.

Where To Now?

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3227 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English