Volcano Spring International Holdings Limited's (HKG:1715) Shares Climb 30% But Its Business Is Yet to Catch Up

Volcano Spring International Holdings Limited (HKG:1715) shares have had a really impressive month, gaining 30% after a shaky period beforehand. But the last month did very little to improve the 67% share price decline over the last year.

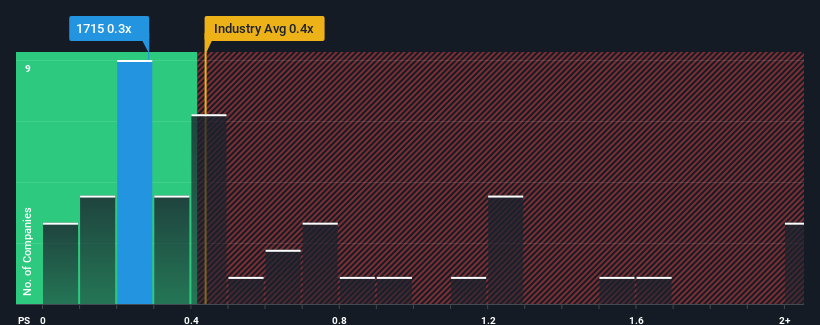

In spite of the firm bounce in price, there still wouldn't be many who think Volcano Spring International Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Consumer Durables industry is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Volcano Spring International Holdings

How Volcano Spring International Holdings Has Been Performing

Revenue has risen firmly for Volcano Spring International Holdings recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Volcano Spring International Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Volcano Spring International Holdings will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Volcano Spring International Holdings?

In order to justify its P/S ratio, Volcano Spring International Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.9% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 36% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.9% shows it's an unpleasant look.

With this information, we find it concerning that Volcano Spring International Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Volcano Spring International Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Volcano Spring International Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you take the next step, you should know about the 3 warning signs for Volcano Spring International Holdings that we have uncovered.

If these risks are making you reconsider your opinion on Volcano Spring International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English