Slammed 34% Kaisun Holdings Limited (HKG:8203) Screens Well Here But There Might Be A Catch

Kaisun Holdings Limited (HKG:8203) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

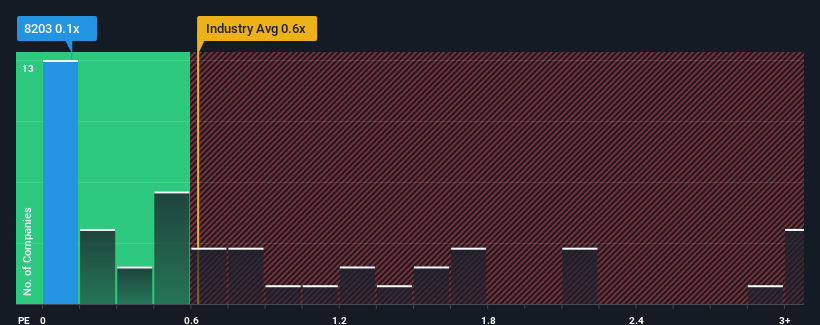

In spite of the heavy fall in price, given about half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") above 0.6x, you may still consider Kaisun Holdings as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Kaisun Holdings

What Does Kaisun Holdings' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Kaisun Holdings has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Kaisun Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Kaisun Holdings?

In order to justify its P/S ratio, Kaisun Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to shrink 1.1% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Kaisun Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Kaisun Holdings' P/S Mean For Investors?

Kaisun Holdings' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Kaisun Holdings revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

Having said that, be aware Kaisun Holdings is showing 4 warning signs in our investment analysis, and 2 of those are a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English