Zhixin Group Holding Limited's (HKG:2187) 25% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Zhixin Group Holding Limited (HKG:2187) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

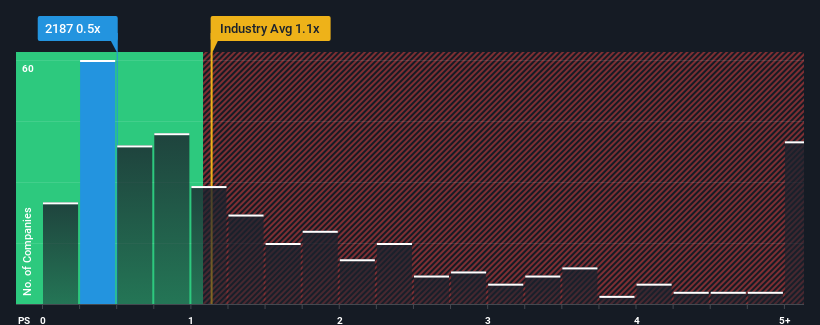

Even after such a large drop in price, there still wouldn't be many who think Zhixin Group Holding's price-to-sales (or "P/S") ratio of 0.5x is worth a mention when it essentially matches the median P/S in Hong Kong's Basic Materials industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Zhixin Group Holding

How Zhixin Group Holding Has Been Performing

The revenue growth achieved at Zhixin Group Holding over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhixin Group Holding will help you shine a light on its historical performance.How Is Zhixin Group Holding's Revenue Growth Trending?

In order to justify its P/S ratio, Zhixin Group Holding would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 24% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 5.6% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Zhixin Group Holding is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Zhixin Group Holding's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Zhixin Group Holding revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Before you settle on your opinion, we've discovered 3 warning signs for Zhixin Group Holding (1 is potentially serious!) that you should be aware of.

If these risks are making you reconsider your opinion on Zhixin Group Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English