It's Down 26% But Bar Pacific Group Holdings Limited (HKG:8432) Could Be Riskier Than It Looks

To the annoyance of some shareholders, Bar Pacific Group Holdings Limited (HKG:8432) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

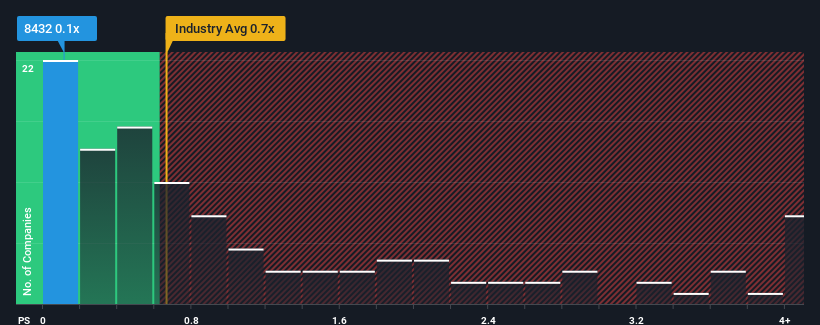

Following the heavy fall in price, Bar Pacific Group Holdings may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Hospitality industry in Hong Kong have P/S ratios greater than 0.7x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Our free stock report includes 1 warning sign investors should be aware of before investing in Bar Pacific Group Holdings. Read for free now.View our latest analysis for Bar Pacific Group Holdings

How Has Bar Pacific Group Holdings Performed Recently?

For example, consider that Bar Pacific Group Holdings' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bar Pacific Group Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Bar Pacific Group Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.3%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 202% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 15% shows it's noticeably more attractive.

In light of this, it's peculiar that Bar Pacific Group Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Bar Pacific Group Holdings' P/S Mean For Investors?

Bar Pacific Group Holdings' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Bar Pacific Group Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 1 warning sign for Bar Pacific Group Holdings you should be aware of.

If these risks are making you reconsider your opinion on Bar Pacific Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English