SFK Construction Holdings Limited's (HKG:1447) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

- SFK Construction Holdings' Annual General Meeting to take place on 22nd of May

- CEO Ki Chun Chan's total compensation includes salary of HK$1.59m

- The total compensation is similar to the average for the industry

- SFK Construction Holdings' EPS grew by 17% over the past three years while total shareholder return over the past three years was 8.0%

Under the guidance of CEO Ki Chun Chan, SFK Construction Holdings Limited (HKG:1447) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 22nd of May. We present our case of why we think CEO compensation looks fair.

See our latest analysis for SFK Construction Holdings

Comparing SFK Construction Holdings Limited's CEO Compensation With The Industry

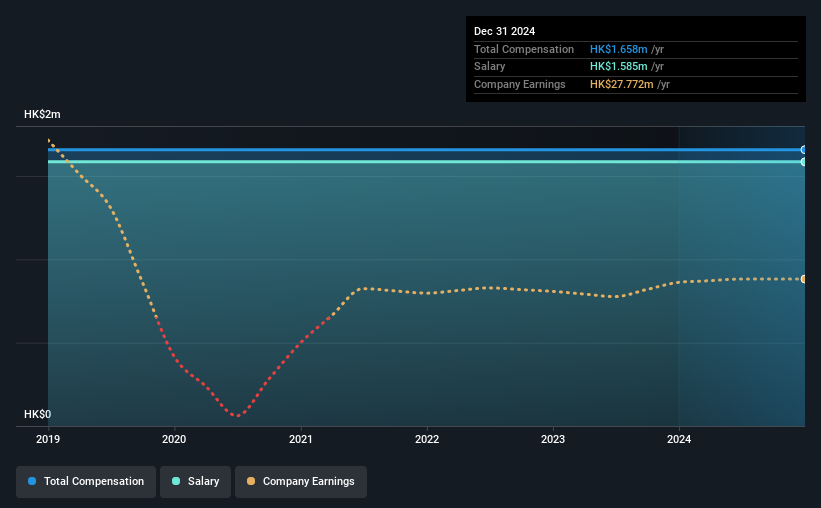

At the time of writing, our data shows that SFK Construction Holdings Limited has a market capitalization of HK$224m, and reported total annual CEO compensation of HK$1.7m for the year to December 2024. This was the same as last year. In particular, the salary of HK$1.59m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Construction industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.2m. So it looks like SFK Construction Holdings compensates Ki Chun Chan in line with the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$1.6m | HK$1.6m | 96% |

| Other | HK$73k | HK$73k | 4% |

| Total Compensation | HK$1.7m | HK$1.7m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Investors will find it interesting that SFK Construction Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

SFK Construction Holdings Limited's Growth

Over the past three years, SFK Construction Holdings Limited has seen its earnings per share (EPS) grow by 17% per year. It achieved revenue growth of 20% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has SFK Construction Holdings Limited Been A Good Investment?

With a total shareholder return of 8.0% over three years, SFK Construction Holdings Limited has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

SFK Construction Holdings pays its CEO a majority of compensation through a salary. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 3 warning signs (and 2 which shouldn't be ignored) in SFK Construction Holdings we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English