Modern Healthcare Technology Holdings (HKG:919) Has Some Way To Go To Become A Multi-Bagger

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Modern Healthcare Technology Holdings (HKG:919) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Modern Healthcare Technology Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.16 = HK$34m ÷ (HK$586m - HK$367m) (Based on the trailing twelve months to September 2024).

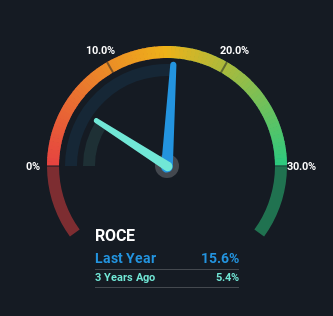

Thus, Modern Healthcare Technology Holdings has an ROCE of 16%. In absolute terms, that's a satisfactory return, but compared to the Consumer Services industry average of 9.1% it's much better.

Check out our latest analysis for Modern Healthcare Technology Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Modern Healthcare Technology Holdings' ROCE against it's prior returns. If you want to delve into the historical earnings , check out these free graphs detailing revenue and cash flow performance of Modern Healthcare Technology Holdings.

How Are Returns Trending?

Things have been pretty stable at Modern Healthcare Technology Holdings, with its capital employed and returns on that capital staying somewhat the same for the last five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if Modern Healthcare Technology Holdings doesn't end up being a multi-bagger in a few years time.

On a separate but related note, it's important to know that Modern Healthcare Technology Holdings has a current liabilities to total assets ratio of 63%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

What We Can Learn From Modern Healthcare Technology Holdings' ROCE

We can conclude that in regards to Modern Healthcare Technology Holdings' returns on capital employed and the trends, there isn't much change to report on. Since the stock has declined 30% over the last five years, investors may not be too optimistic on this trend improving either. Therefore based on the analysis done in this article, we don't think Modern Healthcare Technology Holdings has the makings of a multi-bagger.

On a final note, we found 4 warning signs for Modern Healthcare Technology Holdings (1 shouldn't be ignored) you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English