Winson Holdings Hong Kong Limited's (HKG:6812) Shares Climb 26% But Its Business Is Yet to Catch Up

Those holding Winson Holdings Hong Kong Limited (HKG:6812) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

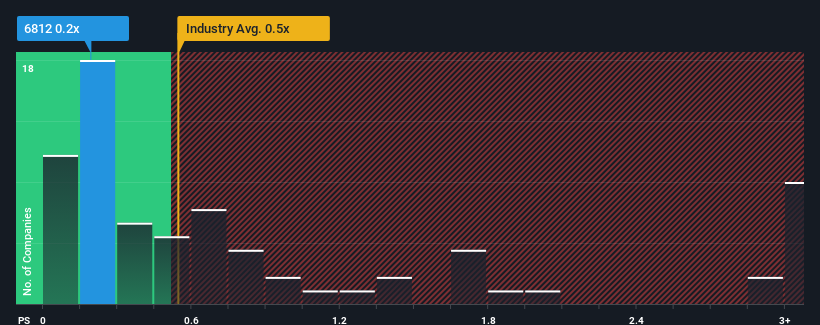

Even after such a large jump in price, there still wouldn't be many who think Winson Holdings Hong Kong's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Commercial Services industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

We've discovered 4 warning signs about Winson Holdings Hong Kong. View them for free.Check out our latest analysis for Winson Holdings Hong Kong

How Winson Holdings Hong Kong Has Been Performing

The recent revenue growth at Winson Holdings Hong Kong would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Winson Holdings Hong Kong's earnings, revenue and cash flow.How Is Winson Holdings Hong Kong's Revenue Growth Trending?

In order to justify its P/S ratio, Winson Holdings Hong Kong would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.3% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 5.7% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 5.3% shows it's an unpleasant look.

With this in mind, we find it worrying that Winson Holdings Hong Kong's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Winson Holdings Hong Kong's P/S Mean For Investors?

Winson Holdings Hong Kong appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We find it unexpected that Winson Holdings Hong Kong trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You need to take note of risks, for example - Winson Holdings Hong Kong has 4 warning signs (and 3 which are potentially serious) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English