ImmuneOnco Biopharmaceuticals (Shanghai) Inc.'s (HKG:1541) 77% Share Price Surge Not Quite Adding Up

ImmuneOnco Biopharmaceuticals (Shanghai) Inc. (HKG:1541) shares have had a really impressive month, gaining 77% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

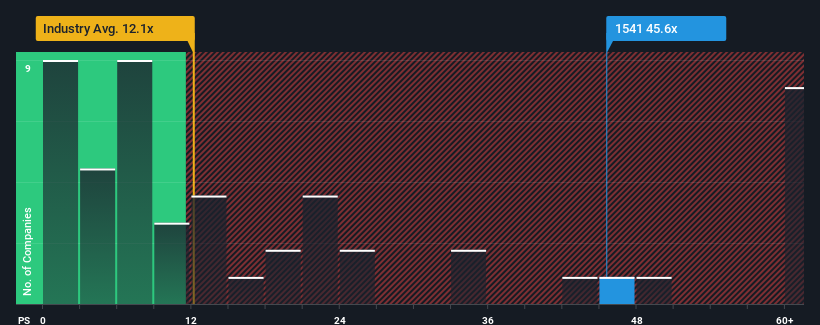

Following the firm bounce in price, ImmuneOnco Biopharmaceuticals (Shanghai) may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 45.6x, when you consider almost half of the companies in the Biotechs industry in Hong Kong have P/S ratios under 12.1x and even P/S lower than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for ImmuneOnco Biopharmaceuticals (Shanghai)

How ImmuneOnco Biopharmaceuticals (Shanghai) Has Been Performing

With revenue growth that's superior to most other companies of late, ImmuneOnco Biopharmaceuticals (Shanghai) has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think ImmuneOnco Biopharmaceuticals (Shanghai)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, ImmuneOnco Biopharmaceuticals (Shanghai) would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 58% per year as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 414% per year growth forecast for the broader industry.

With this information, we find it concerning that ImmuneOnco Biopharmaceuticals (Shanghai) is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From ImmuneOnco Biopharmaceuticals (Shanghai)'s P/S?

Shares in ImmuneOnco Biopharmaceuticals (Shanghai) have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for ImmuneOnco Biopharmaceuticals (Shanghai), this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for ImmuneOnco Biopharmaceuticals (Shanghai) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English