3 Asian Growth Stocks With High Insider Ownership Expecting 64% Profit Growth

As global markets respond positively to the recent U.S.-China tariff suspension, Asian stocks have shown resilience, with many indices experiencing gains amid easing trade tensions. In this environment, growth companies with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the business and potential for robust profit growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Schooinc (TSE:264A) | 27.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| giftee (TSE:4449) | 34.5% | 63.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

We're going to check out a few of the best picks from our screener tool.

InnoScience (Suzhou) Technology Holding (SEHK:2577)

Simply Wall St Growth Rating: ★★★★★☆

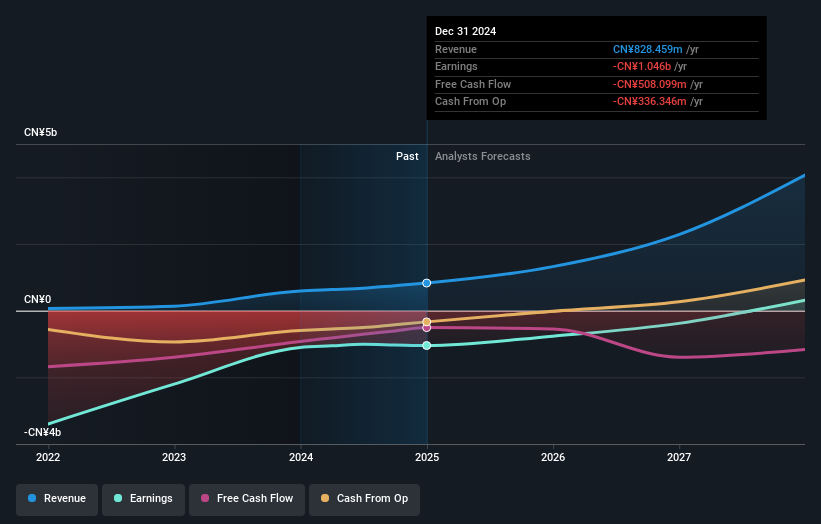

Overview: InnoScience (Suzhou) Technology Holding Co., Ltd. operates in the semiconductor industry with a focus on power electronics, and has a market cap of approximately HK$34.53 billion.

Operations: The company's revenue primarily comes from the sales of GaN power semiconductor products, amounting to CN¥828.46 million.

Insider Ownership: 12.9%

Earnings Growth Forecast: 64% p.a.

InnoScience (Suzhou) Technology Holding is poised for significant growth, with revenue expected to increase by 37.4% annually, surpassing the Hong Kong market average. The company recently entered a strategic alliance with Midea to expand GaN applications in home appliances, enhancing its market presence. Despite high volatility in share price and previous net losses, InnoScience's focus on innovative GaN technology and recent legal victories position it well for future profitability and expansion across sectors like electric vehicles and data centers.

- Click here to discover the nuances of InnoScience (Suzhou) Technology Holding with our detailed analytical future growth report.

- Our valuation report here indicates InnoScience (Suzhou) Technology Holding may be overvalued.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

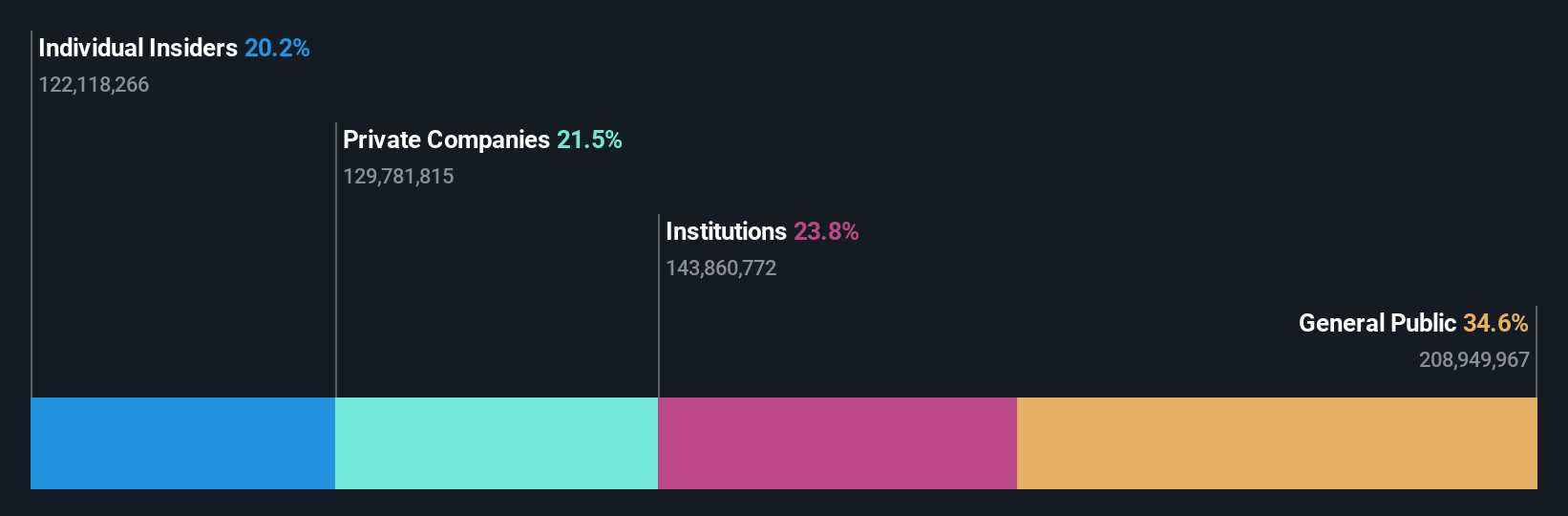

Overview: Bethel Automotive Safety Systems Co., Ltd develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China, with a market cap of CN¥34.95 billion.

Operations: The company's revenue primarily comes from the manufacturing and selling of automobile and related accessories, totaling CN¥10.71 billion.

Insider Ownership: 20.2%

Earnings Growth Forecast: 22.9% p.a.

Bethel Automotive Safety Systems demonstrates strong growth potential, with revenue and earnings expected to grow significantly above 20% annually. Recent financial results show a substantial increase in sales and net income, indicating robust performance. The company's stock is trading at a significant discount to its estimated fair value, suggesting potential upside. While insider trading data over the past three months is unavailable, the high insider ownership aligns interests with shareholders, supporting confidence in long-term strategic decisions.

- Take a closer look at Bethel Automotive Safety Systems' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Bethel Automotive Safety Systems is trading behind its estimated value.

KEBODA TECHNOLOGY (SHSE:603786)

Simply Wall St Growth Rating: ★★★★★☆

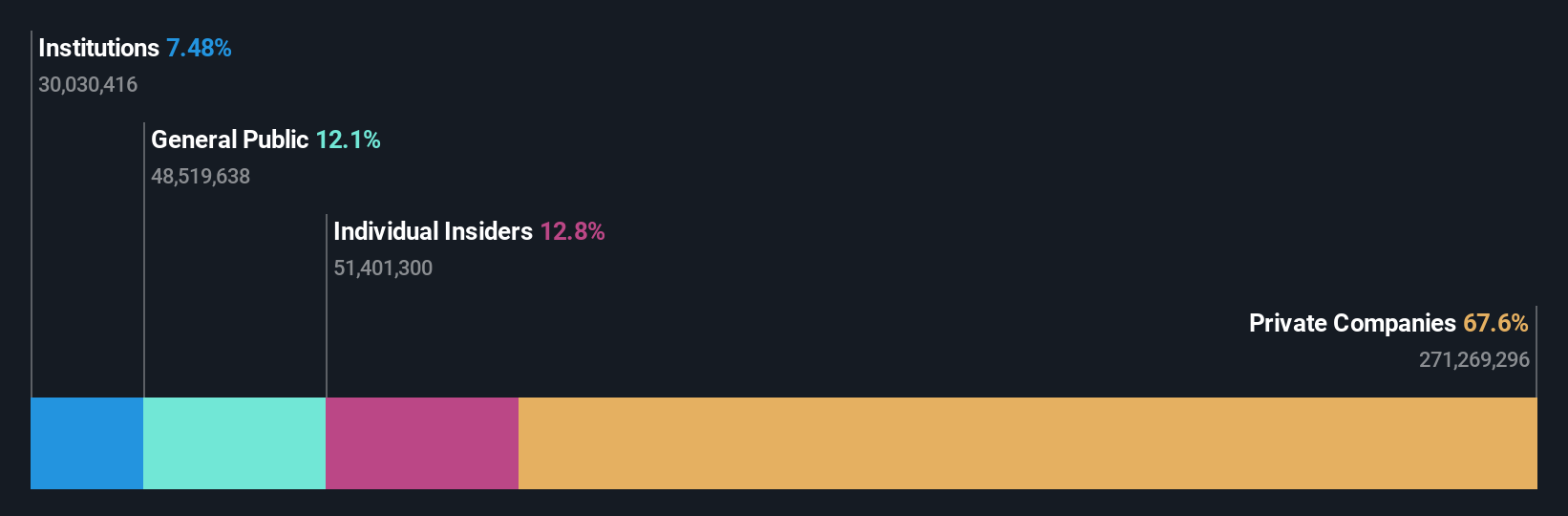

Overview: KEBODA TECHNOLOGY Co., Ltd. manufactures and sells automotive electronics and related products for the automotive industry in China, with a market cap of CN¥22.16 billion.

Operations: KEBODA TECHNOLOGY Co., Ltd. generates revenue through the production and distribution of automotive electronics and related products within China's automotive sector.

Insider Ownership: 12.8%

Earnings Growth Forecast: 25.6% p.a.

KEBODA TECHNOLOGY is positioned for strong growth, with revenue and earnings forecasted to increase significantly above 20% annually, outperforming the market. The stock trades below analyst price targets, indicating potential upside due to its attractive valuation with a P/E ratio of 29.2x against the CN market's 38.5x. Despite recent declines in quarterly sales and net income, high insider ownership aligns management interests with shareholders, fostering confidence in strategic execution.

- Unlock comprehensive insights into our analysis of KEBODA TECHNOLOGY stock in this growth report.

- Our valuation report unveils the possibility KEBODA TECHNOLOGY's shares may be trading at a premium.

Turning Ideas Into Actions

- Discover the full array of 622 Fast Growing Asian Companies With High Insider Ownership right here.

- Curious About Other Options? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English