Subdued Growth No Barrier To China HK Power Smart Energy Group Limited (HKG:931) With Shares Advancing 35%

China HK Power Smart Energy Group Limited (HKG:931) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

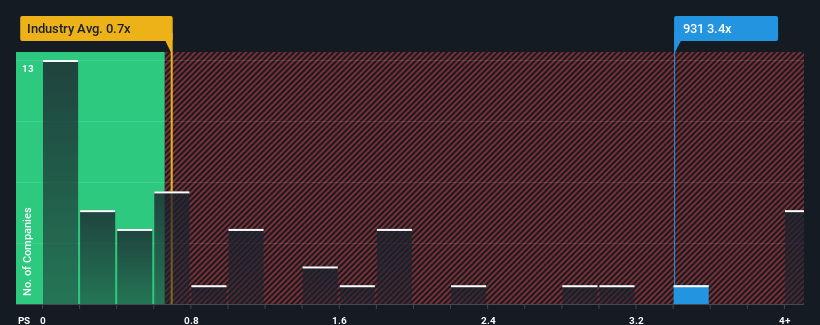

Following the firm bounce in price, you could be forgiven for thinking China HK Power Smart Energy Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.4x, considering almost half the companies in Hong Kong's Oil and Gas industry have P/S ratios below 0.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Our free stock report includes 2 warning signs investors should be aware of before investing in China HK Power Smart Energy Group. Read for free now.See our latest analysis for China HK Power Smart Energy Group

What Does China HK Power Smart Energy Group's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, China HK Power Smart Energy Group has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China HK Power Smart Energy Group will help you shine a light on its historical performance.How Is China HK Power Smart Energy Group's Revenue Growth Trending?

In order to justify its P/S ratio, China HK Power Smart Energy Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 173% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 26% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 1.7% over the next year, or less than the company's recent medium-term annualised revenue decline.

In light of this, it's odd that China HK Power Smart Energy Group's P/S sits above the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From China HK Power Smart Energy Group's P/S?

China HK Power Smart Energy Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of China HK Power Smart Energy Group revealed its sharp three-year contraction in revenue isn't impacting its high P/S anywhere near as much as we would have predicted, given the industry is set to shrink less severely. Right now we aren't comfortable with the high P/S as this revenue performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - China HK Power Smart Energy Group has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English