Shareholders Will Likely Find scPharmaceuticals Inc.'s (NASDAQ:SCPH) CEO Compensation Acceptable

Key Insights

- scPharmaceuticals will host its Annual General Meeting on 3rd of June

- Salary of US$663.8k is part of CEO John Tucker's total remuneration

- The overall pay is 39% below the industry average

- scPharmaceuticals' three-year loss to shareholders was 31% while its EPS was down 19% over the past three years

Shareholders may be wondering what CEO John Tucker plans to do to improve the less than great performance at scPharmaceuticals Inc. (NASDAQ:SCPH) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 3rd of June. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for scPharmaceuticals

Comparing scPharmaceuticals Inc.'s CEO Compensation With The Industry

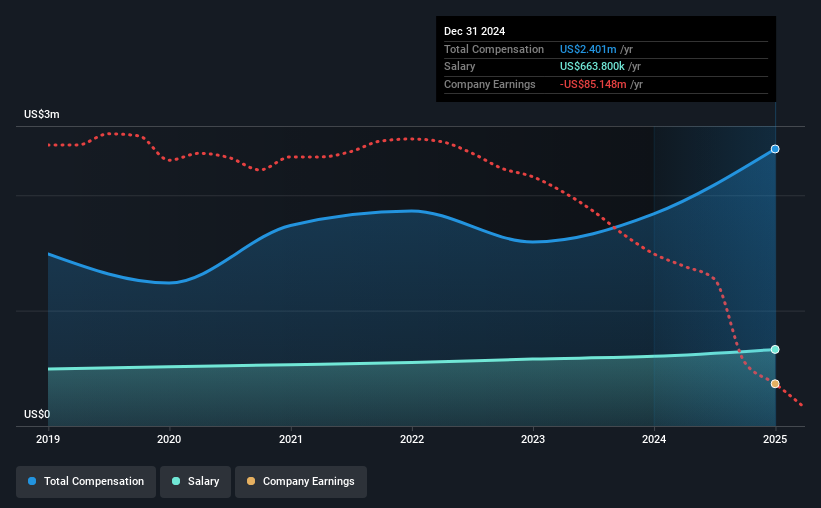

Our data indicates that scPharmaceuticals Inc. has a market capitalization of US$175m, and total annual CEO compensation was reported as US$2.4m for the year to December 2024. We note that's an increase of 31% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$664k.

For comparison, other companies in the American Pharmaceuticals industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$4.0m. This suggests that John Tucker is paid below the industry median. What's more, John Tucker holds US$405k worth of shares in the company in their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$664k | US$604k | 28% |

| Other | US$1.7m | US$1.2m | 72% |

| Total Compensation | US$2.4m | US$1.8m | 100% |

Talking in terms of the industry, salary represented approximately 26% of total compensation out of all the companies we analyzed, while other remuneration made up 74% of the pie. Our data reveals that scPharmaceuticals allocates salary more or less in line with the wider market. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at scPharmaceuticals Inc.'s Growth Numbers

Over the last three years, scPharmaceuticals Inc. has shrunk its earnings per share by 19% per year. Its revenue is up 138% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has scPharmaceuticals Inc. Been A Good Investment?

The return of -31% over three years would not have pleased scPharmaceuticals Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning. The fact that earnings growth has gone backwards could be a factor for the downward trend in the share price. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for scPharmaceuticals you should be aware of, and 2 of them shouldn't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English