Further Upside For scPharmaceuticals Inc. (NASDAQ:SCPH) Shares Could Introduce Price Risks After 40% Bounce

scPharmaceuticals Inc. (NASDAQ:SCPH) shares have had a really impressive month, gaining 40% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.8% in the last twelve months.

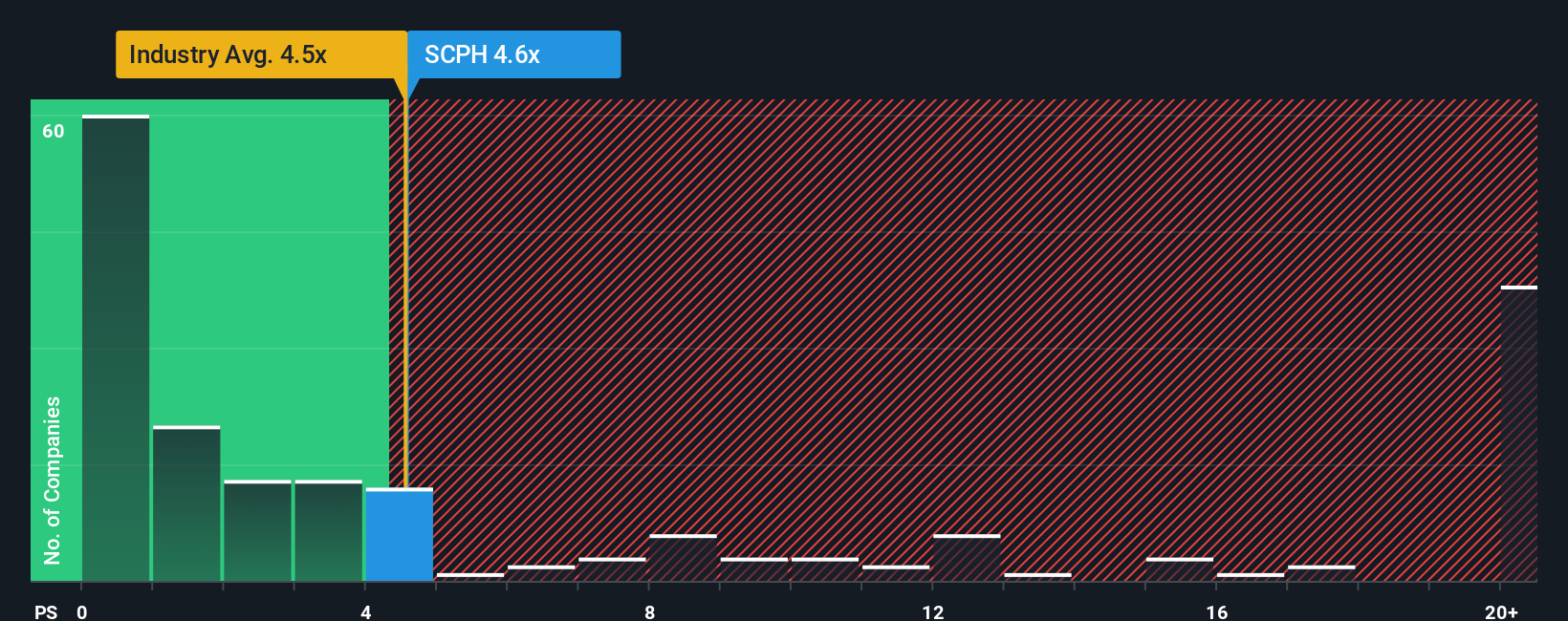

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about scPharmaceuticals' P/S ratio of 4.6x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in the United States is also close to 4.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for scPharmaceuticals

What Does scPharmaceuticals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, scPharmaceuticals has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on scPharmaceuticals will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, scPharmaceuticals would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 138%. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 72% per annum as estimated by the six analysts watching the company. That's shaping up to be materially higher than the 18% each year growth forecast for the broader industry.

In light of this, it's curious that scPharmaceuticals' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From scPharmaceuticals' P/S?

scPharmaceuticals appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at scPharmaceuticals' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 4 warning signs for scPharmaceuticals (2 are a bit concerning!) that you need to take into consideration.

If you're unsure about the strength of scPharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English