SIGN UP

LOG IN

Top 3 Financial Stocks That May Collapse In June

Benzinga·06/09/2025 13:06:02

Listen to the news

As of June 9, 2025, three stocks in the financial sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Shinhan Financial Group Co Ltd (NYSE:SHG)

- On April 23, Shinhan Financial Group filed its FY2024 Form 20-F to the SEC. The company's stock jumped around 19% over the past month and has a 52-week high of $46.05.

- RSI Value: 79.6

- SHG Price Action: Shares of Shinhan Financial closed at $42.90 on Friday.

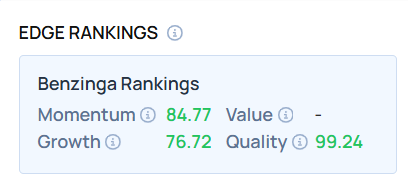

- Edge Stock Ratings: 84.77 Momentum score.

mF International Limited (NASDAQ:MFI)

- On June 4, mF International named Haoyu Wang as CEO, replacing Chi Weng Tam. The company's stock gained around 214% over the past month and has a 52-week high of $3.13.

- RSI Value: 72

- MFI Price Action: Shares of mF International closed at $2.17 on Friday.

Great Elm Group Inc (NASDAQ:GEG)

- On May 7, Great Elm Group reported a third-quarter loss of 17 cents per share, versus a year-ago loss of 10 cents per share. Jason Reese, Chief Executive Officer of the Company stated, “We achieved a solid fiscal third quarter 2025, continuing our positive momentum by expanding our assets under management and maintaining performance across our credit and real estate businesses. Notably, GECC delivered record total investment income in the first calendar quarter of 2025 and continues to drive significant growth in our fee-paying assets under management. GECC is also well positioned to pay meaningful incentive fees to GEG in the coming quarters.” The company's stock gained around 15% over the past month and has a 52-week high of $2.20.

- RSI Value: 78.9

- GEG Price Action: Shares of Great Elm Group closed at $2.18 on Friday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.