Oil-Dri Corporation of America (NYSE:ODC) Stock Rockets 30% But Many Are Still Ignoring The Company

Oil-Dri Corporation of America (NYSE:ODC) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 68%.

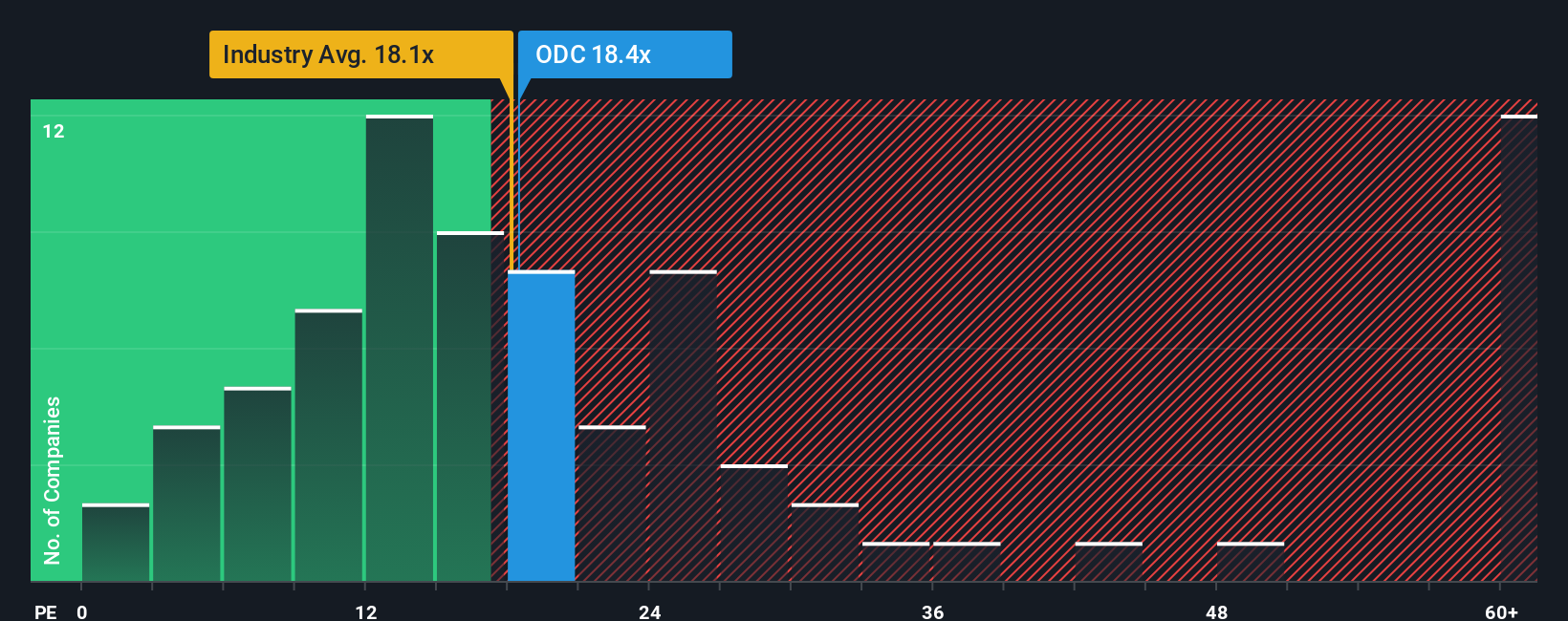

In spite of the firm bounce in price, there still wouldn't be many who think Oil-Dri Corporation of America's price-to-earnings (or "P/E") ratio of 18.4x is worth a mention when the median P/E in the United States is similar at about 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen firmly for Oil-Dri Corporation of America recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Oil-Dri Corporation of America

Is There Some Growth For Oil-Dri Corporation of America?

There's an inherent assumption that a company should be matching the market for P/E ratios like Oil-Dri Corporation of America's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 17%. Pleasingly, EPS has also lifted 2,756% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Oil-Dri Corporation of America's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Oil-Dri Corporation of America's P/E?

Oil-Dri Corporation of America's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Oil-Dri Corporation of America revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 1 warning sign for Oil-Dri Corporation of America that we have uncovered.

If you're unsure about the strength of Oil-Dri Corporation of America's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English