Here's Why Kimou Environmental Holding (HKG:6805) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kimou Environmental Holding (HKG:6805). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kimou Environmental Holding with the means to add long-term value to shareholders.

Kimou Environmental Holding's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Kimou Environmental Holding's EPS has grown 30% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

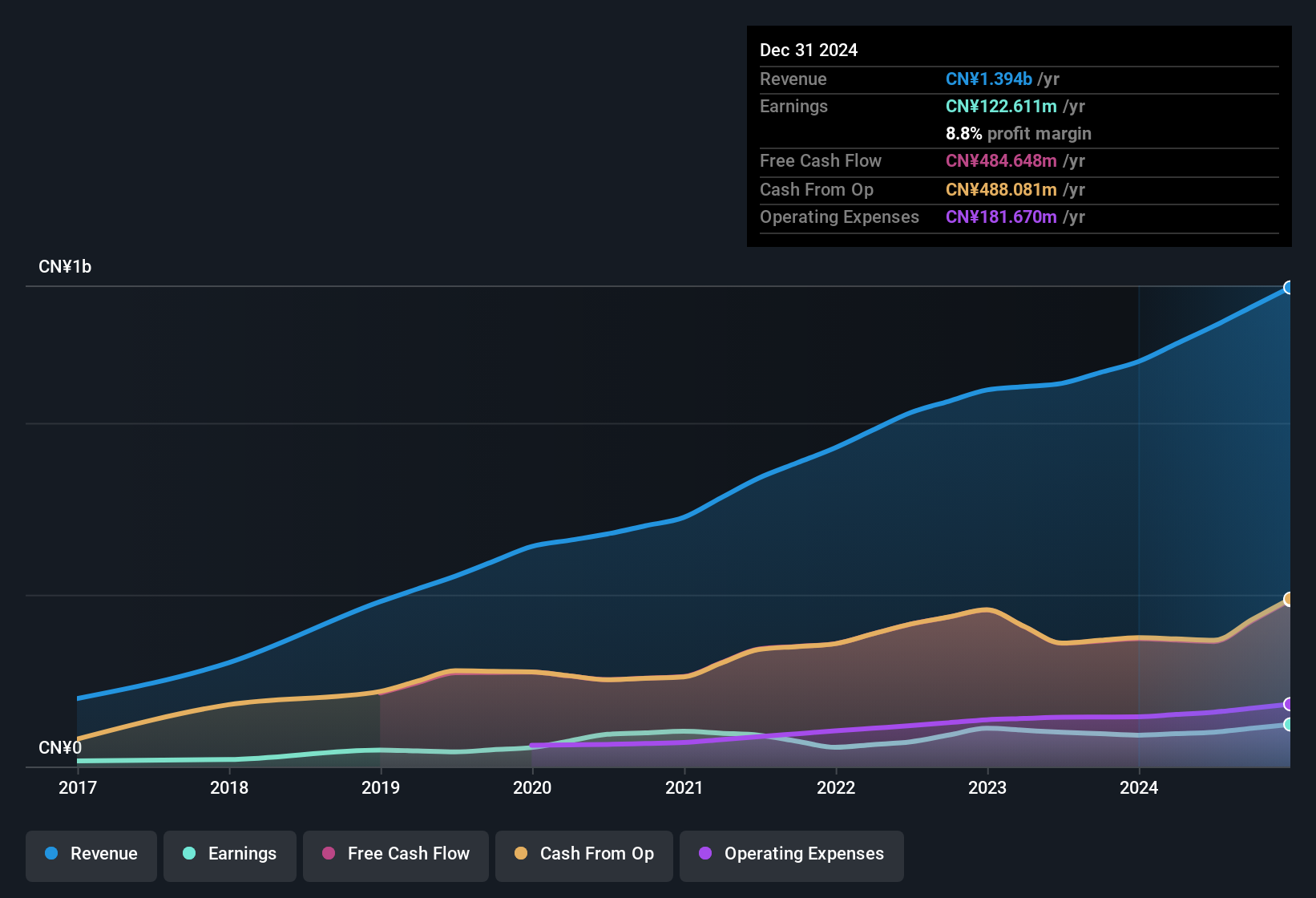

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Kimou Environmental Holding's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Kimou Environmental Holding maintained stable EBIT margins over the last year, all while growing revenue 18% to CN¥1.4b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

See our latest analysis for Kimou Environmental Holding

Kimou Environmental Holding isn't a huge company, given its market capitalisation of HK$2.1b. That makes it extra important to check on its balance sheet strength.

Are Kimou Environmental Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First and foremost; there we saw no insiders sell Kimou Environmental Holding shares in the last year. Even better, though, is that the Financial Controller & Executive Director, Shaobo Huang, bought a whopping CN¥2.1m worth of shares, paying about CN¥1.22 per share, on average. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Kimou Environmental Holding will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 72%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. To give you an idea, the value of insiders' holdings in the business are valued at CN¥1.5b at the current share price. So there's plenty there to keep them focused!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Qiyang Huang, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Kimou Environmental Holding with market caps between CN¥718m and CN¥2.9b is about CN¥2.6m.

The CEO of Kimou Environmental Holding only received CN¥1.2m in total compensation for the year ending December 2024. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Kimou Environmental Holding Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Kimou Environmental Holding's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kimou Environmental Holding (at least 1 which is a bit concerning) , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Kimou Environmental Holding, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English