3 Asian Penny Stocks With Market Caps Under US$200M To Consider

As geopolitical tensions rise and trade-related concerns continue to impact global markets, investors are increasingly seeking opportunities in less conventional areas. Penny stocks, although an older term, remain a significant segment for those interested in smaller or emerging companies with potential for growth. By focusing on penny stocks with strong financial health and clear growth trajectories, investors might uncover valuable opportunities amidst the market's complexities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.104 | SGD44.2M | ✅ 2 ⚠️ 3 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.77 | HK$2.25B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.21 | HK$763.45M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.19 | HK$1.82B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.21 | HK$2.02B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.27 | SGD8.93B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.182 | SGD36.26M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.66 | HK$53.38B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,154 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Venus Medtech (Hangzhou) (SEHK:2500)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Venus Medtech (Hangzhou) Inc. focuses on the research, development, manufacturing, and sale of bioprosthetic heart valves in Mainland China and internationally, with a market cap of approximately HK$1.31 billion.

Operations: The company generates revenue primarily from its medical products segment, totaling CN¥470.83 million.

Market Cap: HK$1.31B

Venus Medtech (Hangzhou) Inc. presents a mixed picture for investors interested in penny stocks. The company, with a market cap of HK$1.31 billion, reported revenues of CN¥470.83 million but remains unprofitable, with increasing losses over the past five years at an annual rate of 24.8%. Despite its financial challenges, Venus Medtech has sufficient cash to cover liabilities and maintain operations for over three years at current free cash flow levels. Recent activities include a private placement of convertible bonds worth CN¥200 million to bolster its financial position amidst declining sales and rising net losses from the previous year.

- Dive into the specifics of Venus Medtech (Hangzhou) here with our thorough balance sheet health report.

- Examine Venus Medtech (Hangzhou)'s past performance report to understand how it has performed in prior years.

Sino ICT Holdings (SEHK:365)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino ICT Holdings Limited is an investment holding company that manufactures and sells surface mount technology and semiconductor equipment in the People’s Republic of China and Hong Kong, with a market cap of HK$0.52 billion.

Operations: The company's revenue is derived from two main segments: Energy Business, contributing HK$17.26 million, and Production and Sales of Industrial Products, generating HK$229.78 million.

Market Cap: HK$516.52M

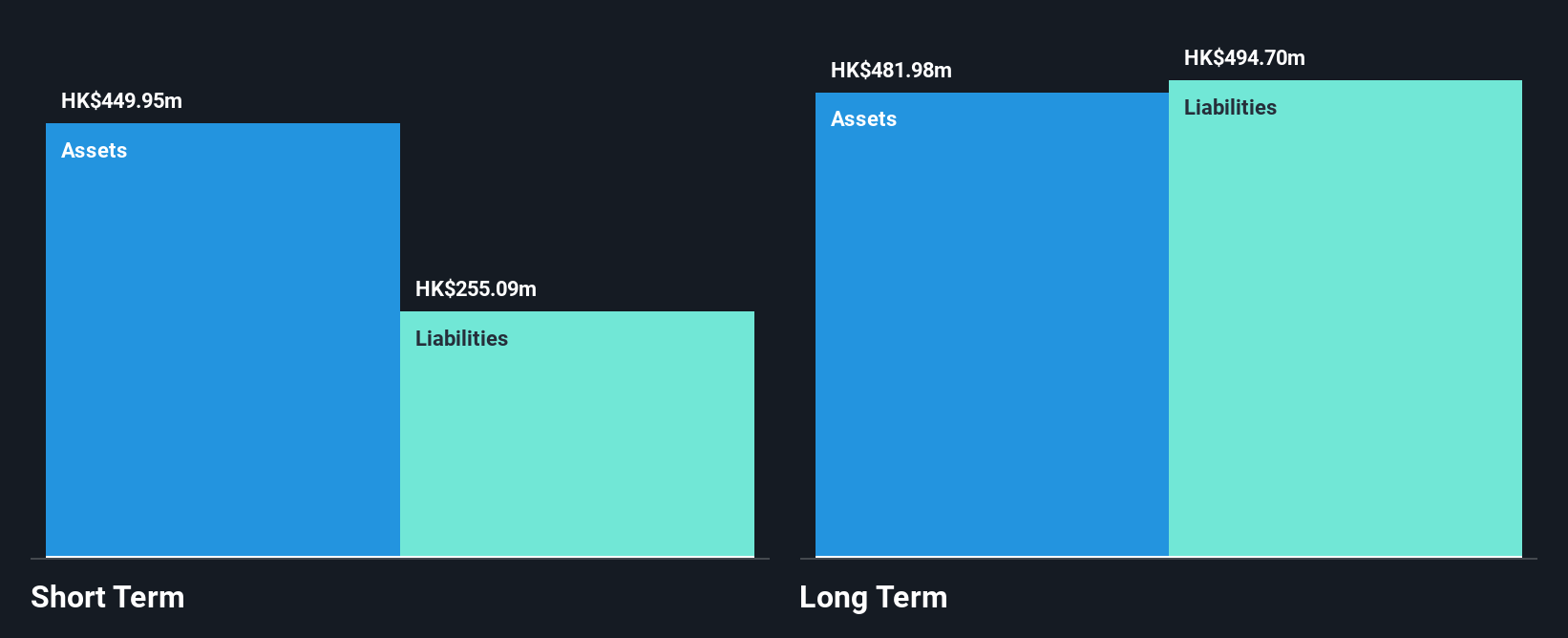

Sino ICT Holdings Limited, with a market cap of HK$0.52 billion, operates in the semiconductor equipment sector and faces financial challenges typical of penny stocks. The company reported 2024 revenues of HK$247.04 million, an increase from the previous year, yet it remains unprofitable with a net loss of HK$29.72 million. Despite high debt levels and volatile share prices, Sino ICT has sufficient cash to cover liabilities and sustain operations for over three years under current conditions. Recent earnings announcements indicate efforts to stabilize financial performance amidst ongoing losses and strategic board decisions at its upcoming AGM may impact future direction.

- Jump into the full analysis health report here for a deeper understanding of Sino ICT Holdings.

- Explore historical data to track Sino ICT Holdings' performance over time in our past results report.

7Road Holdings (SEHK:797)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 7Road Holdings Limited is an investment holding company that develops and distributes web and mobile games in the People’s Republic of China and internationally, with a market cap of HK$1.38 billion.

Operations: The company generates revenue primarily from its Computer Graphics segment, amounting to CN¥306.40 million.

Market Cap: HK$1.38B

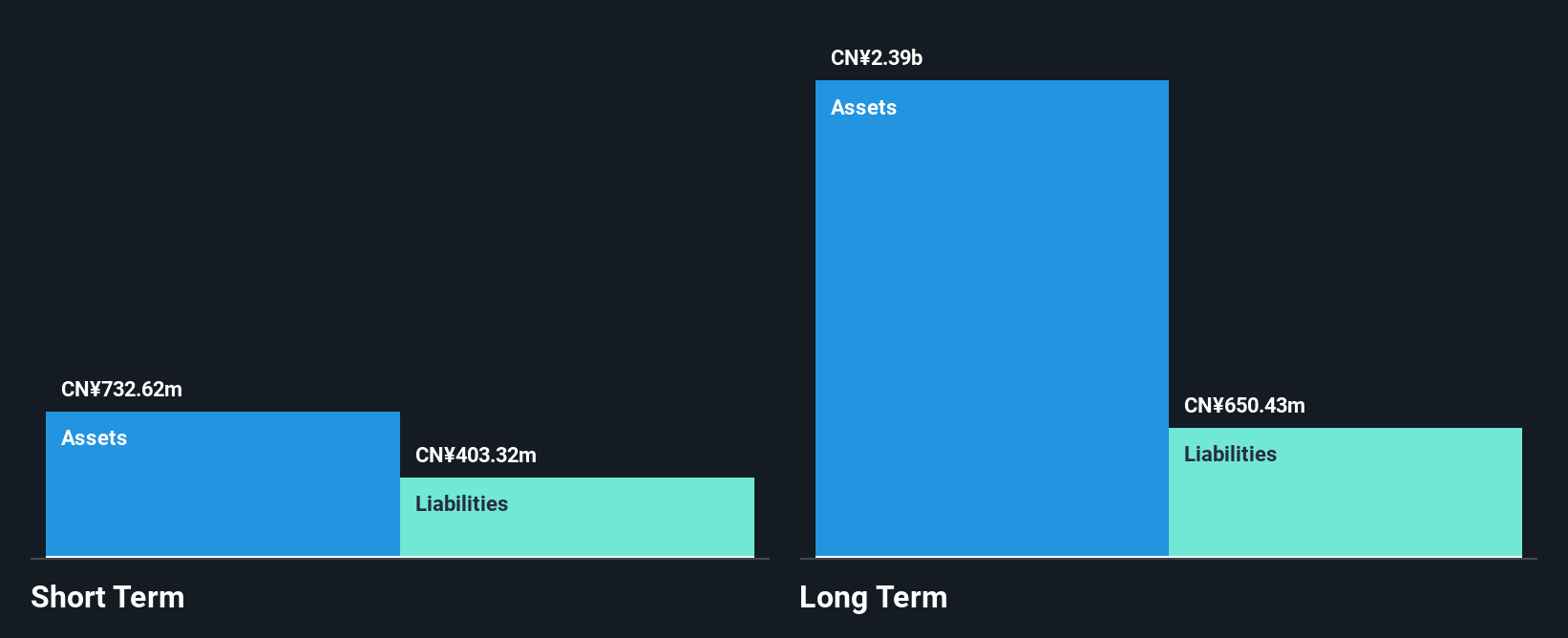

7Road Holdings, with a market cap of HK$1.38 billion, operates in the gaming sector and is currently unprofitable. The company reported a decline in 2024 revenue to CN¥306.40 million from the previous year, alongside a reduced net loss of CN¥73.45 million. Despite financial challenges typical of penny stocks, it maintains more cash than debt and covers both short- and long-term liabilities with its assets. However, its share price remains highly volatile compared to other Hong Kong stocks. Recent board meetings focused on financial statements and director re-elections may influence future strategic decisions amidst ongoing losses.

- Click here to discover the nuances of 7Road Holdings with our detailed analytical financial health report.

- Gain insights into 7Road Holdings' past trends and performance with our report on the company's historical track record.

Next Steps

- Unlock our comprehensive list of 1,154 Asian Penny Stocks by clicking here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English