Vision Values Holdings Limited (HKG:862) Stock Rockets 31% But Many Are Still Ignoring The Company

Vision Values Holdings Limited (HKG:862) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

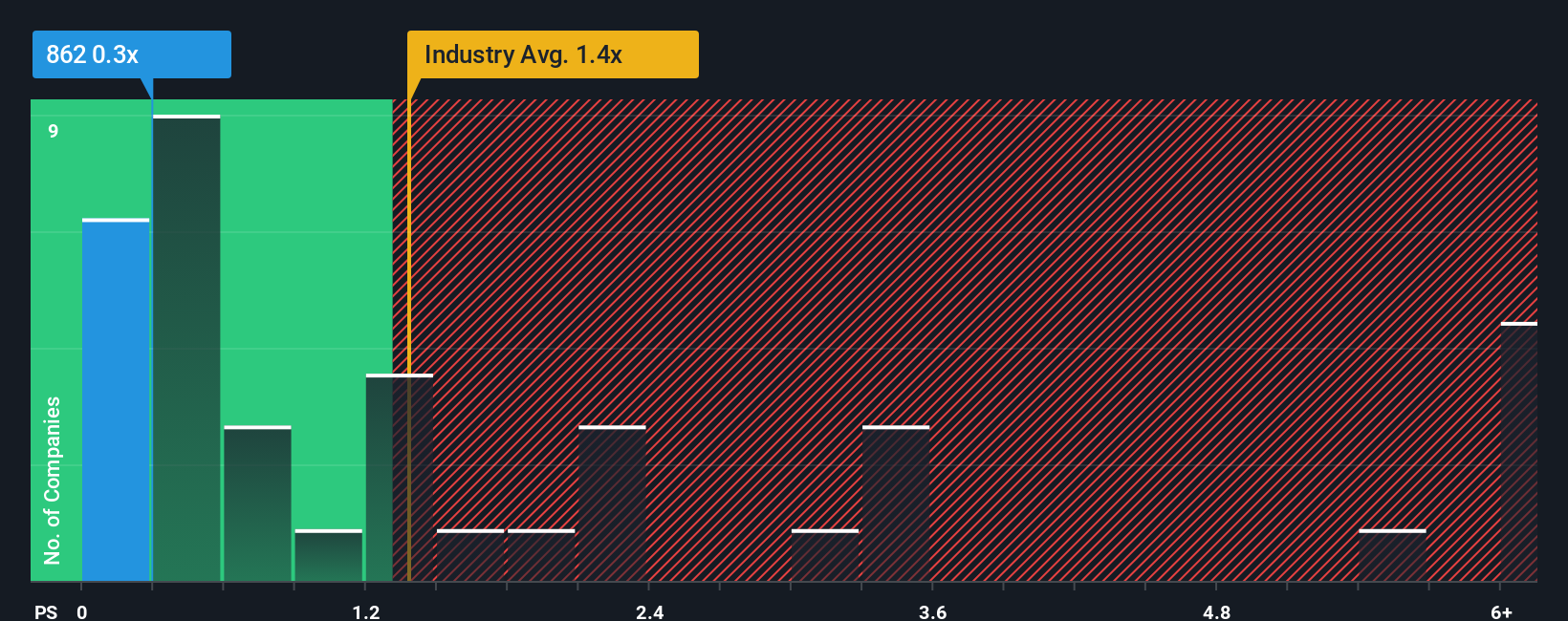

In spite of the firm bounce in price, Vision Values Holdings' price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the IT industry in Hong Kong, where around half of the companies have P/S ratios above 1.4x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Vision Values Holdings

What Does Vision Values Holdings' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Vision Values Holdings, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Vision Values Holdings' earnings, revenue and cash flow.How Is Vision Values Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Vision Values Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 7.4% gain to the company's revenues. While this performance is only fair, the company was still able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.6% shows it's noticeably more attractive.

With this information, we find it odd that Vision Values Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Vision Values Holdings' P/S?

Vision Values Holdings' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Vision Values Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Vision Values Holdings has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English