Subdued Growth No Barrier To China Rare Earth Holdings Limited (HKG:769) With Shares Advancing 73%

China Rare Earth Holdings Limited (HKG:769) shareholders have had their patience rewarded with a 73% share price jump in the last month. The last month tops off a massive increase of 115% in the last year.

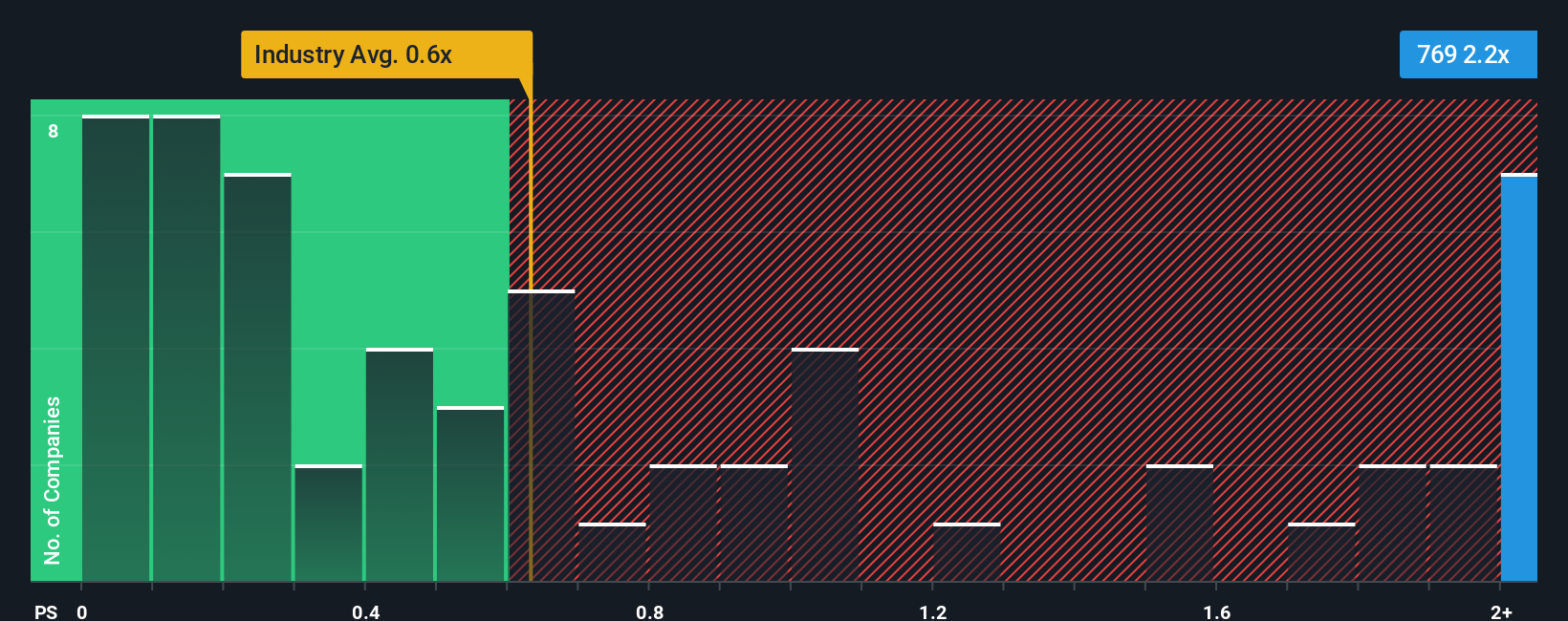

Since its price has surged higher, you could be forgiven for thinking China Rare Earth Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Hong Kong's Metals and Mining industry have P/S ratios below 0.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for China Rare Earth Holdings

How Has China Rare Earth Holdings Performed Recently?

The revenue growth achieved at China Rare Earth Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Rare Earth Holdings' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For China Rare Earth Holdings?

The only time you'd be truly comfortable seeing a P/S as high as China Rare Earth Holdings' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Still, lamentably revenue has fallen 38% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that China Rare Earth Holdings' P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

The large bounce in China Rare Earth Holdings' shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of China Rare Earth Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You should always think about risks. Case in point, we've spotted 2 warning signs for China Rare Earth Holdings you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English