3 Stocks Estimated To Be 34.4% To 46% Below Intrinsic Value

In the last week, the United States market has remained flat, but it has risen by 10.0% over the past year with earnings projected to grow by 15% annually. In this context of steady growth and positive forecasts, identifying stocks trading significantly below their intrinsic value can offer potential opportunities for investors looking to capitalize on undervaluation in a thriving market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.17 | $48.02 | 49.7% |

| Valley National Bancorp (VLY) | $8.67 | $17.22 | 49.7% |

| TransMedics Group (TMDX) | $123.56 | $246.12 | 49.8% |

| StoneCo (STNE) | $14.52 | $29.00 | 49.9% |

| Roku (ROKU) | $80.99 | $160.61 | 49.6% |

| Peoples Financial Services (PFIS) | $46.96 | $93.66 | 49.9% |

| Horizon Bancorp (HBNC) | $14.60 | $29.08 | 49.8% |

| First Internet Bancorp (INBK) | $23.32 | $46.30 | 49.6% |

| Central Pacific Financial (CPF) | $26.09 | $51.99 | 49.8% |

| Arrow Financial (AROW) | $25.09 | $49.68 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Freshpet (FRPT)

Overview: Freshpet, Inc. manufactures, distributes, and markets natural fresh meals and treats for dogs and cats across the United States, Canada, and Europe with a market cap of $3.62 billion.

Operations: The company's revenue primarily comes from its pet food and pet treats segment, generating $1.01 billion.

Estimated Discount To Fair Value: 46%

Freshpet is trading at US$74.13, significantly below its estimated fair value of US$137.32, suggesting it may be undervalued based on cash flows. Despite a reported Q1 net loss of US$12.7 million, earnings are forecast to grow significantly at 37.8% per year, outpacing the broader market's growth rate of 14.6%. Revenue is projected to increase by 15-18% in 2025, reflecting strong demand despite recent financial challenges.

- Upon reviewing our latest growth report, Freshpet's projected financial performance appears quite optimistic.

- Dive into the specifics of Freshpet here with our thorough financial health report.

Banc of California (BANC)

Overview: Banc of California, Inc. is a bank holding company for Banc of California, offering a range of banking products and services, with a market cap of $2.17 billion.

Operations: The company generates revenue through its Commercial Banking segment, which accounted for $964.19 million.

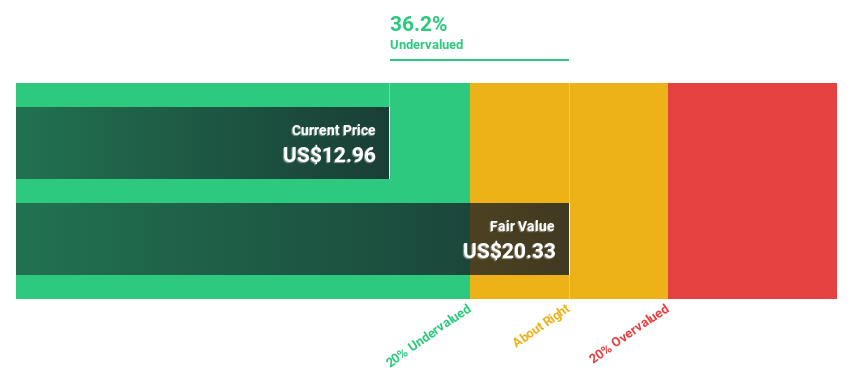

Estimated Discount To Fair Value: 34.4%

Banc of California, trading at $13.80, is substantially below its fair value estimate of $21.03, reflecting potential undervaluation based on cash flows. Despite significant insider selling recently, the company's earnings are projected to grow at 36.6% annually over the next three years—outpacing the US market's growth rate—and revenue growth is expected to exceed market averages as well. Recent buybacks and dividend affirmations further enhance shareholder value prospects.

- Our expertly prepared growth report on Banc of California implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Banc of California.

Granite Ridge Resources (GRNT)

Overview: Granite Ridge Resources, Inc. is a non-operated oil and natural gas exploration and production company with a market cap of $840.43 million.

Operations: The company generates revenue of $390.67 million from its activities in oil and natural gas development, exploration, and production.

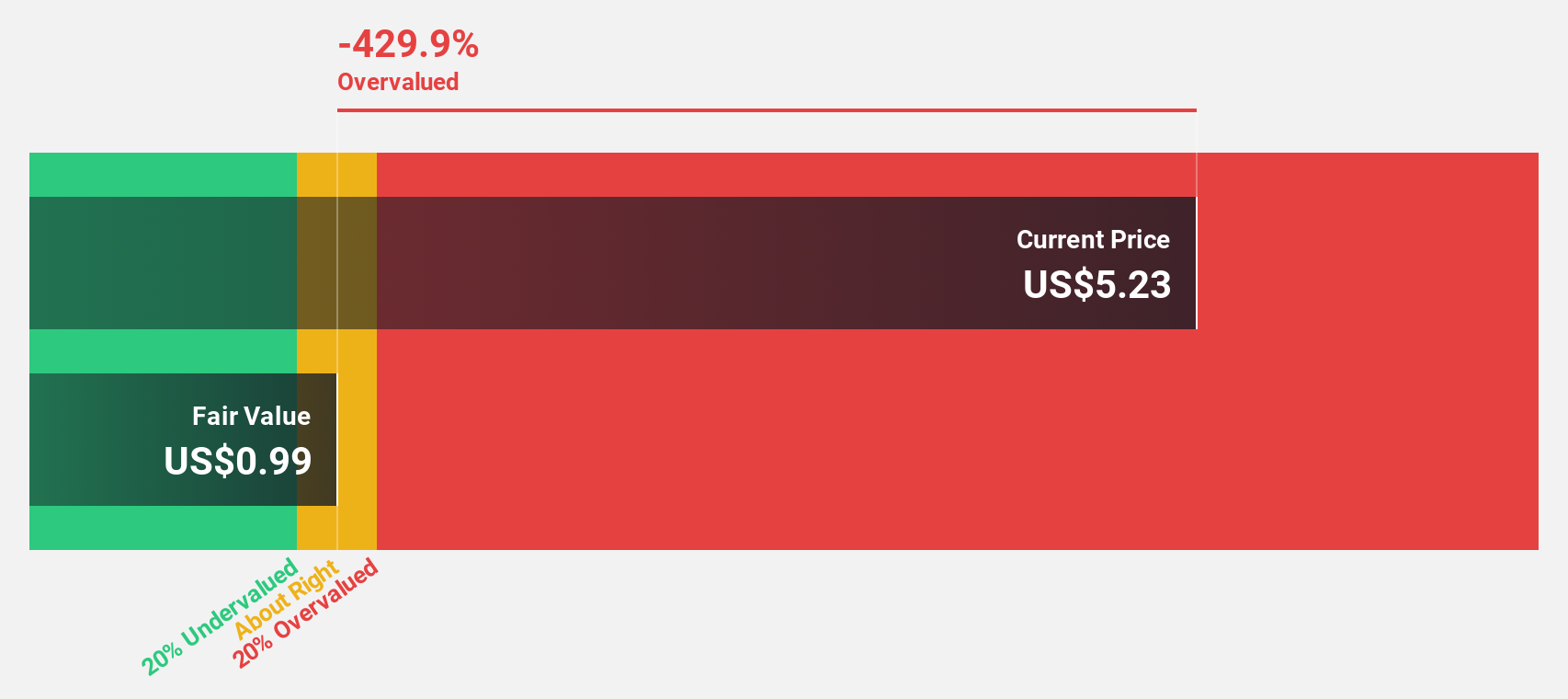

Estimated Discount To Fair Value: 44.2%

Granite Ridge Resources, priced at US$6.41, is significantly undervalued compared to its fair value estimate of US$11.48, based on discounted cash flow analysis. Despite a recent decline in profit margins and earnings per share, the company's earnings are expected to grow substantially at 49.7% annually, surpassing market averages. However, the dividend yield of 6.86% isn't well covered by current earnings or free cash flows, posing potential risks for income-focused investors amidst executive leadership changes.

- The analysis detailed in our Granite Ridge Resources growth report hints at robust future financial performance.

- Navigate through the intricacies of Granite Ridge Resources with our comprehensive financial health report here.

Turning Ideas Into Actions

- Get an in-depth perspective on all 171 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English