Worthington Steel, Inc. Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

Shareholders will be ecstatic, with their stake up 31% over the past week following Worthington Steel, Inc.'s (NYSE:WS) latest full-year results. It looks like a credible result overall - although revenues of US$3.1b were in line with what the analysts predicted, Worthington Steel surprised by delivering a statutory profit of US$2.19 per share, a notable 19% above expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

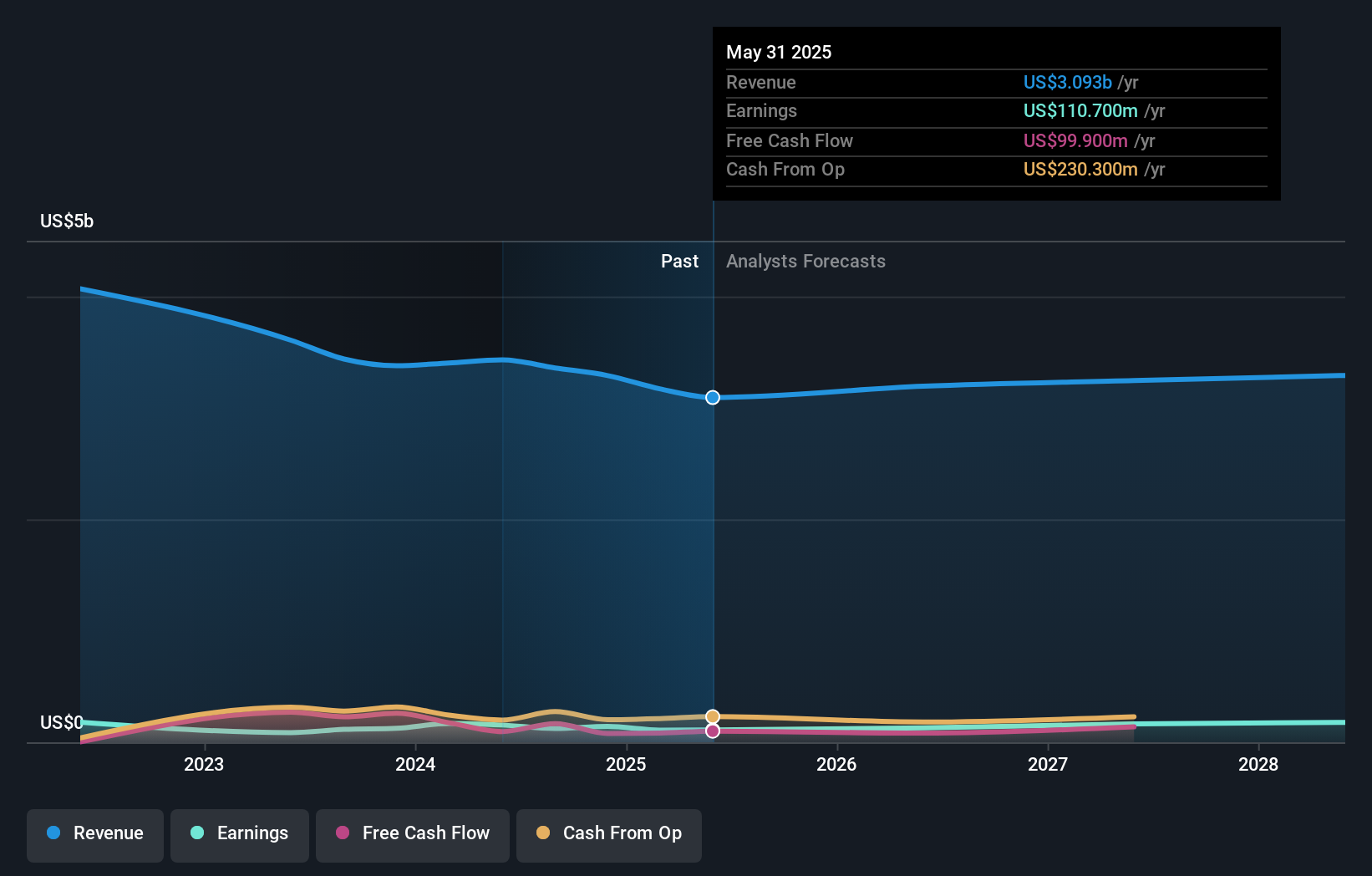

Taking into account the latest results, the most recent consensus for Worthington Steel from two analysts is for revenues of US$3.19b in 2026. If met, it would imply an okay 3.3% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to expand 14% to US$2.55. Before this earnings report, the analysts had been forecasting revenues of US$3.03b and earnings per share (EPS) of US$3.18 in 2026. While next year's revenue estimates increased, there was also a real cut to EPS expectations, suggesting the consensus has a bit of a mixed view of these results.

Check out our latest analysis for Worthington Steel

Curiously, the consensus price target rose 6.3% to US$34.00. We can only conclude that the forecast revenue growth is expected to offset the impact of the expected fall in earnings.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Worthington Steel is forecast to grow faster in the future than it has in the past, with revenues expected to display 3.3% annualised growth until the end of 2026. If achieved, this would be a much better result than the 8.2% annual decline over the past three years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 4.7% annually for the foreseeable future. Although Worthington Steel's revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Worthington Steel. Fortunately, they also upgraded their revenue estimates, although our data indicates it is expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2028, which can be seen for free on our platform here.

It might also be worth considering whether Worthington Steel's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English