Trip.com Group (NasdaqGS:TCOM) Completes Repurchase Offer for US$500M Exchangeable Notes

Trip.com Group (NasdaqGS:TCOM) recently completed its repurchase right offer for Exchangeable Senior Notes without any notes being surrendered, reflecting stability in its debt management despite the absence of activity. Over the past week, the company's shares moved 1.8%, a movement in line with the general upward trend in major market indices like the S&P 500 and Nasdaq, which also saw gains. Broader market sentiment was supported by favorable developments in trade talks and financial stability projected by strong federal reserve stress test results for major U.S. banks, contributing to a positive backdrop for Trip.com's performance.

Buy, Hold or Sell Trip.com Group? View our complete analysis and fair value estimate and you decide.

Trip.com Group's recent decision not to have any notes surrendered in its repurchase right offer could initially be seen as a sign of financial stability, aligning with its robust capital management strategy discussed in its narrative. This stability supports the company's focus on leveraging AI-driven tools, market expansion, and customer acquisition to boost revenue and earnings. In the last three years, the company's total shareholder returns reached 112.08%, illustrating a substantial gain that contrasts with a shorter-term view. Over the past year, Trip.com outperformed the US Hospitality industry, which returned 21.5%, further solidifying its position as a strong market player.

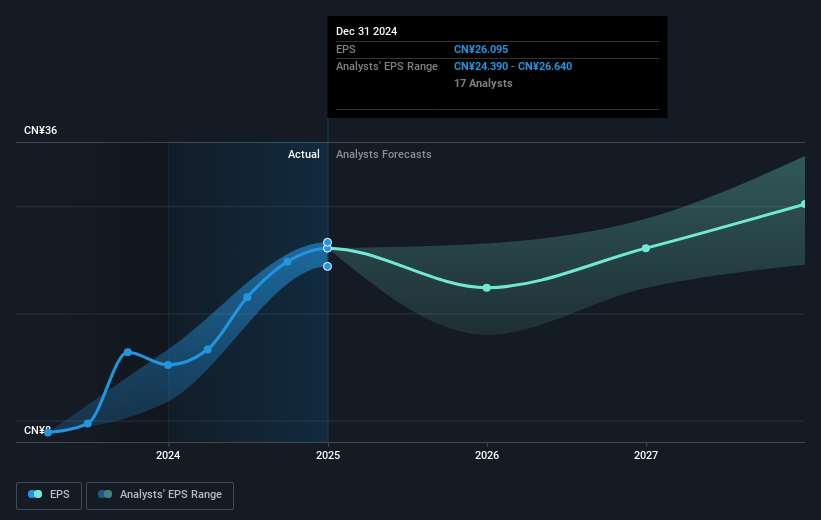

As the company focuses on AI innovation and international market penetration, the absence of significant financial restructuring following the repurchase decision may underpin analysts' revenue and earnings forecasts. These expectations include an increase in revenue by 13.7% annually and earnings reaching CN¥21.4 billion by May 2028. The current share price movement towards analysts' consensus price target of US$76.64 may reflect market confidence in Trip.com's strategic direction. With a current trading price of US$61.22, this suggests a potential 30.6% increase to reach the target, indicating market optimism about the company's long-term growth trajectory.

Understand Trip.com Group's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English