Asian Growth Leaders With Strong Insider Ownership July 2025

As global markets experience a rally driven by easing geopolitical tensions and new trade agreements, Asia's economic landscape remains vibrant with significant opportunities for growth. In this context, companies with high insider ownership are particularly noteworthy as they often signal strong confidence from those closest to the business, aligning well with current investor sentiment seeking stability and commitment in an evolving market environment.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's explore several standout options from the results in the screener.

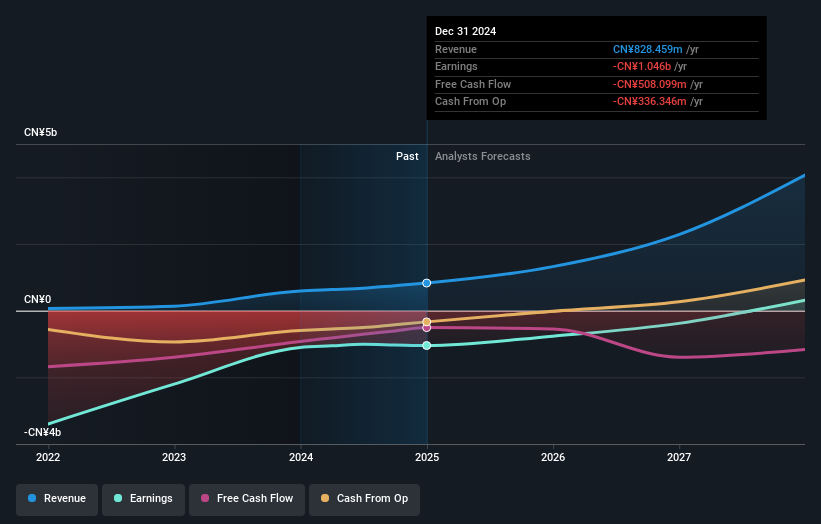

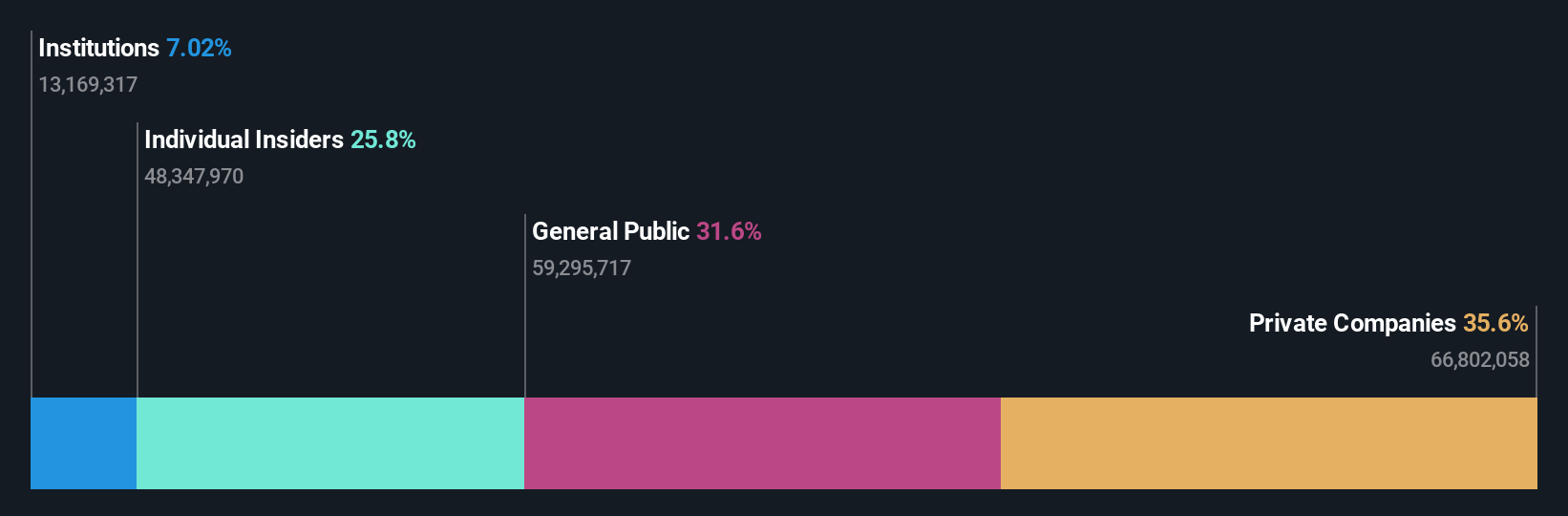

InnoScience (Suzhou) Technology Holding (SEHK:2577)

Simply Wall St Growth Rating: ★★★★★☆

Overview: InnoScience (Suzhou) Technology Holding Co., Ltd. operates in the technology sector and has a market capitalization of approximately HK$32.81 billion.

Operations: The company's revenue primarily comes from the sales of GaN power semiconductor products, totaling CN¥828.46 million.

Insider Ownership: 12.9%

InnoScience (Suzhou) Technology Holding is poised for significant growth with its revenue projected to increase at 37.4% annually, surpassing the Hong Kong market average. The company is expected to become profitable within three years, indicating robust expansion potential. Recent strategic alliances with Midea Group aim to advance gallium nitride applications in home appliances, enhancing technological innovation and market reach. Despite low forecasted return on equity, insider ownership remains stable without significant recent trading activities.

- Unlock comprehensive insights into our analysis of InnoScience (Suzhou) Technology Holding stock in this growth report.

- Upon reviewing our latest valuation report, InnoScience (Suzhou) Technology Holding's share price might be too optimistic.

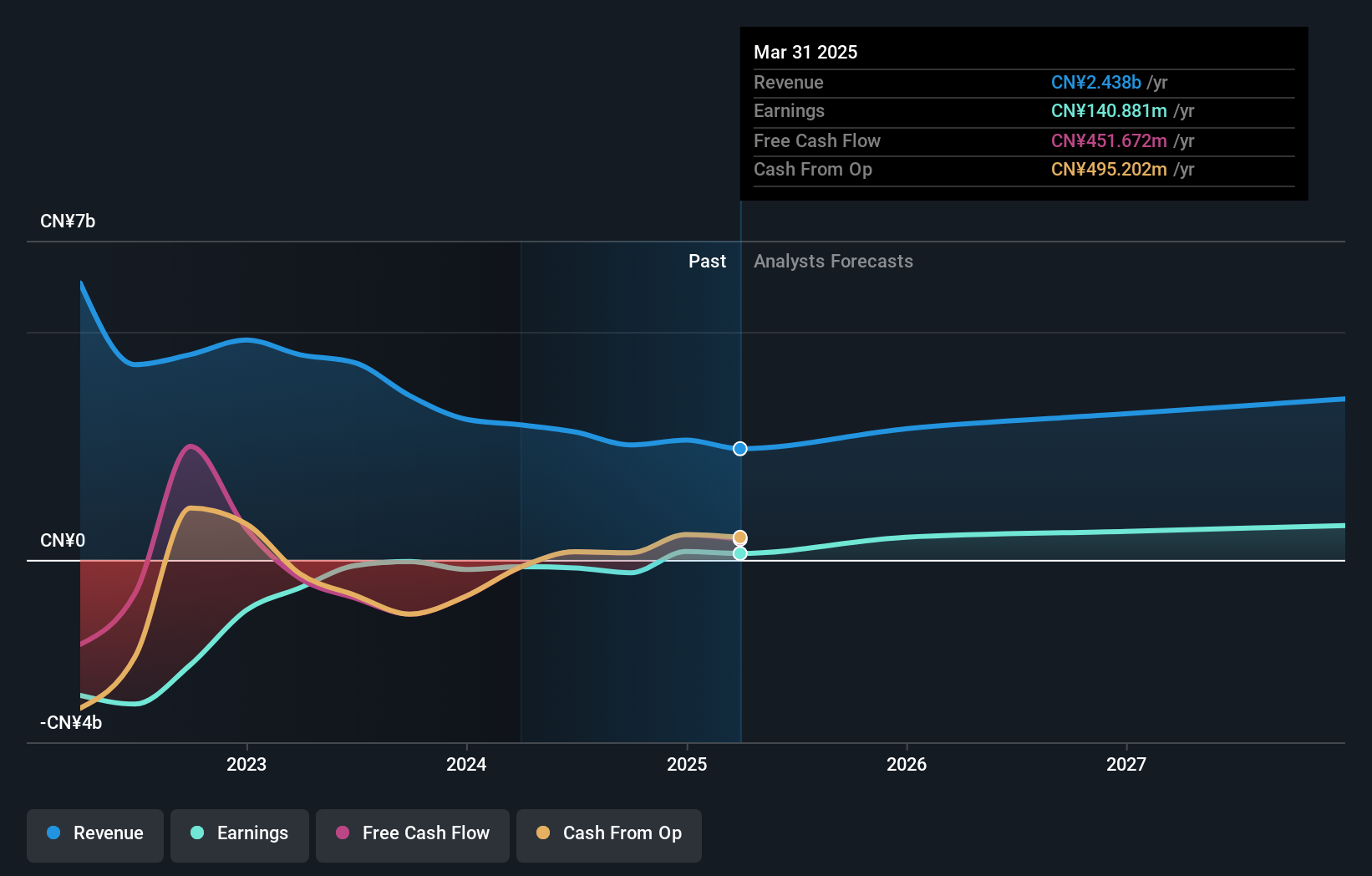

Offcn Education Technology (SZSE:002607)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Offcn Education Technology Co., Ltd. operates as a multi-category vocational education institution in China with a market cap of CN¥18.87 billion.

Operations: The company generates revenue primarily from its Education and Training segment, which amounts to CN¥2.38 billion.

Insider Ownership: 24.3%

Offcn Education Technology shows promising growth potential, with earnings forecast to grow significantly at 41.1% annually, outpacing the broader Chinese market. Despite trading at a substantial discount to its estimated fair value, revenue growth is modest but above market average. Recent financials show a decline in sales and net income compared to last year, highlighting challenges. The company's high return on equity forecast of 40.1% suggests strong future profitability despite current financial pressures.

- Click here to discover the nuances of Offcn Education Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Offcn Education Technology's current price could be inflated.

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Co., Ltd focuses on the research, development, cultivation, production, and sale of edible fungi in China with a market capitalization of CN¥32.44 billion.

Operations: The company generates revenue primarily from the research, development, cultivation, production, and sale of edible fungi within China.

Insider Ownership: 15%

Fujian Wanchen Biotechnology Group's earnings are expected to grow significantly at 34.3% annually, surpassing the Chinese market average. The company recently became profitable, with a substantial increase in revenue and net income in the first quarter of 2025 compared to the previous year. While its share price has been volatile, insider ownership remains high following Peng Dejian's acquisition of a significant stake, indicating strong internal confidence in future growth prospects.

- Get an in-depth perspective on Fujian Wanchen Biotechnology Group's performance by reading our analyst estimates report here.

- The analysis detailed in our Fujian Wanchen Biotechnology Group valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 603 more companies for you to explore.Click here to unveil our expertly curated list of 606 Fast Growing Asian Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English