Datadog Stock Surges 11% After Hours After Making S&P 500 Debut

Datadog Inc. (NASDAQ:DDOG) saw a surge of nearly 11% in its stock value during after-hours trading on Wednesday.

What Happened: Datadog’s stock price experienced a 10.88% increase after the market closed on Wednesday, reaching $149.70. This surge followed the company’s announcement of its inclusion in the S&P 500 index. The stock’s closing price was $135.01, reflecting a 2.03% increase during regular trading hours.

S&P Dow Jones announced on July 2, 2025, Datadog is set to join the S&P 500. Datadog will officially replace Juniper Networks (NYSE:JNPR), acquired by Hewlett-Packard Enterprise (NYSE:HPE), in the index. This change will be effective before the market opens on July 9, 2025.

Datadog’s market cap is currently at $46.63 billion, with an average trading volume of 4.36 million. The company’s price-to-earnings ratio stands at 267.48.

Why It Matters: Datadog’s stock surge comes on the heels of a strong performance in the first quarter of 2025. The company’s first-quarter revenue exceeded expectations, increasing by 25% year-over-year to $761.55 million. This performance led to a rise in the company’s revenue outlook, despite concerns about margin pressure.

Furthermore, a report by BofA Securities suggests that AI and analytics budgets are on the rise, which could potentially benefit companies like Datadog. The report indicates that while software spending growth intentions have slightly decreased, they are still expected to increase by 9.9% for 2025 and 10.8% for 2026.

Price Action: DDOG stock is closed up at 2.03% at $135.01 during regular trading hours on July 3, 2025.

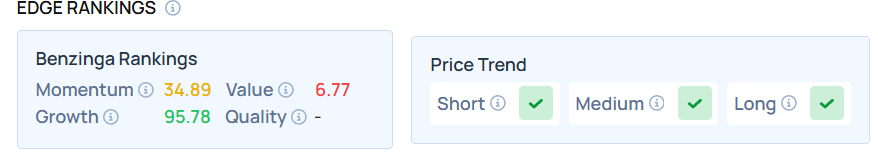

Benzinga's Edge Stock Rankings indicate a high growth score of 95.78 and bullish trends across all timeframes. Know the other parameters on which the stock fares.

Photo Courtesy: MacroEcon on Shutterstock.com

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English