Investors Still Aren't Entirely Convinced By Kinetix Systems Holdings Limited's (HKG:8606) Revenues Despite 35% Price Jump

Kinetix Systems Holdings Limited (HKG:8606) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 68%.

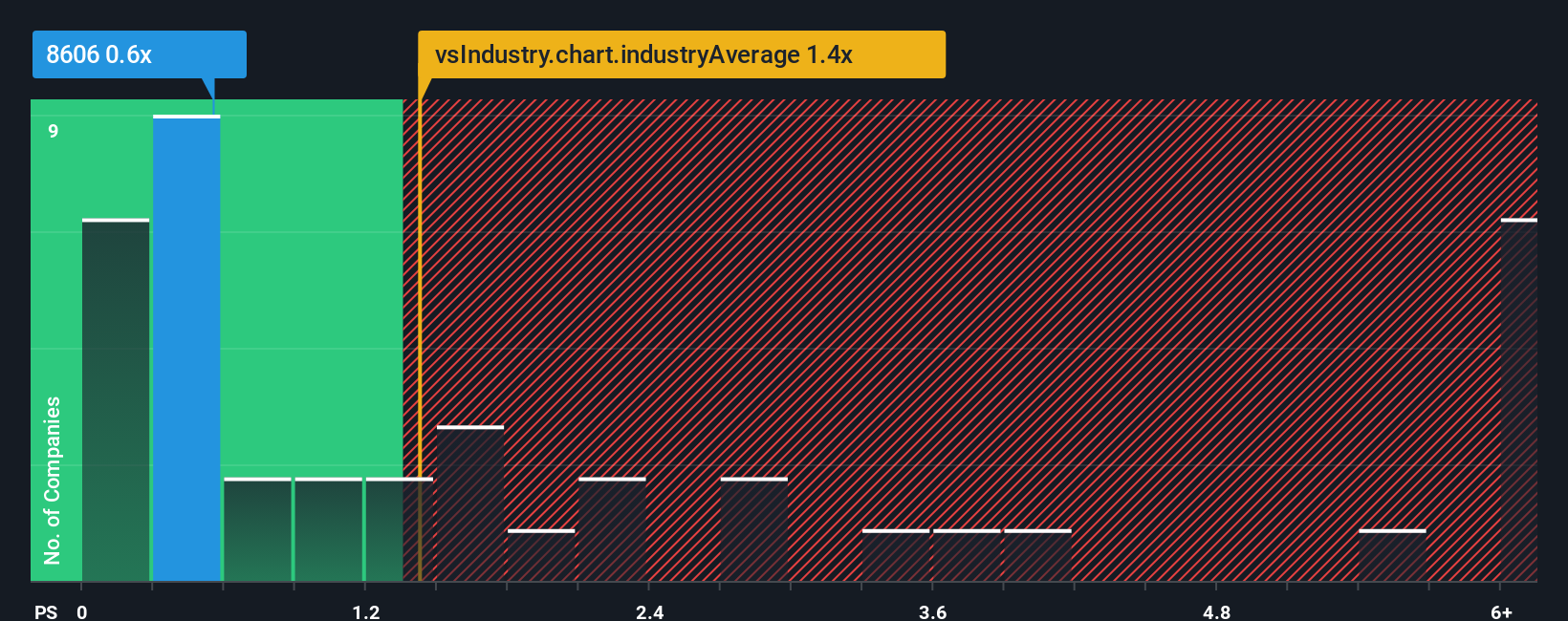

Although its price has surged higher, when close to half the companies operating in Hong Kong's IT industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Kinetix Systems Holdings as an enticing stock to check out with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kinetix Systems Holdings

How Has Kinetix Systems Holdings Performed Recently?

The revenue growth achieved at Kinetix Systems Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Kinetix Systems Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Kinetix Systems Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Kinetix Systems Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.5% last year. The latest three year period has also seen an excellent 32% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 8.8% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Kinetix Systems Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

Kinetix Systems Holdings' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Kinetix Systems Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 3 warning signs for Kinetix Systems Holdings (2 are concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Kinetix Systems Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English