LiveOne Teams Up With Synervoz to Boost Voice AI and Expand B2B Deals

LiveOne, Inc. LVO has announced a strategic partnership with Synervoz Communications, Inc. The collaboration is set to accelerate the development of voice-enabled experiences integrated directly into native devices and operating systems.

With Synervoz’s powerful Switchboard platform, known for enhancing voice and audio development cycles by up to 10 times, the partnership is expected to unlock more than 70 Business-to-Business (B2B) opportunities across industries, such as automotive, retail and more.

LiveOne emphasized that the partnership marks a transformative step in how audiences engage with audio. By joining forces with Synervoz, the company gains robust tools to enrich user experiences through innovations like voice search, social listening, and collaborative podcast streaming. Additionally, it enables LiveOne to efficiently scale its engineering capabilities in line with its rapidly growing B2B pipeline.

Together, LiveOne and Synervoz are paving the way for a new era of interactive, voice-powered digital entertainment, bringing smarter, more connected audio experiences to consumers and businesses alike.

LVO Accelerates Momentum Through Strategic B2B Alliances

Headquartered in Los Angeles, CA, LiveOne is a leading music and entertainment platform that is strategically focusing on expanding its B2B deals, having established significant new agreements and identifying potential partnerships in the pipeline. In the fourth-quarter fiscal 2025, the company highlighted that it has secured two major partnerships — one with Amazon valued at over $16.5 million, and another with a Fortune 50 company worth more than $25 million. In addition, LiveOne has 75 more B2B deals currently in the pipeline.

The company is operating at nearly a $50 million annual run rate from five newly launched B2B partnerships, and it is preparing to roll out what could be the largest B2B collaboration in the company’s history, expected to bring in nearly 10 times the number of subscribers as the Tesla partnership. This major launch is scheduled for August 2025.

In February 2025, LiveOne teamed up with Telly, the world’s smartest TV available free of cost, to offer users an unmatched dual-screen audio and entertainment experience. This partnership allows Telly’s users to enjoy music or podcasts on the secondary "Smart" display while watching their favorite content on the primary "Theater" screen.

LVO’S Zacks Rank & Stock Price Performance

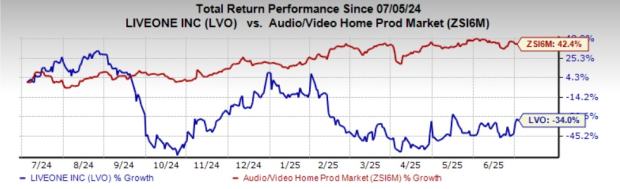

LVO currently carries a Zacks Rank #3 (Hold). Shares of the company have plunged 34% in the past year compared with the Zacks Audio Video Production industry’s growth of 42.4%.

Image Source: Zacks Investment Research

Stocks to Consider From Audio Video Production Space

Some better-ranked stocks from the broader technology space are Manchester United plc MANU, Pursuit Attractions and Hospitality, Inc. PRSU and GoPro, Inc. GPRO. MANU and PRSU sport a Zacks Rank #1 (Strong Buy) each, while GPRO carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Manchester’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 56.39%. In the last reported quarter, MANU delivered an earnings surprise of 87.88%. Its shares have jumped 7.8% in the past year.

PRSU’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 19.19%. In the last reported quarter, DLB delivered an earnings surprise of 1.03%. Its shares have decreased 6% in the past year.

GoPro’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 32.47%. In the last reported quarter, GPRO delivered an earnings surprise of 7.69%. Its shares have decreased 46.4% in the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GoPro, Inc. (GPRO): Free Stock Analysis Report

Manchester United Ltd. (MANU): Free Stock Analysis Report

LiveOne, Inc. (LVO): Free Stock Analysis Report

Pursuit Attractions and Hospitality, Inc. (PRSU): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English